Why clean energy transition presents a major opportunity for power utilities.

Power utilities attract controversy for their outsized impact on climate change.

Not only is the sector responsible for a third of global carbon emissions, but it has also drawn criticism after several power companies restarted coal-fired plants as a consequence of the war in Ukraine.

Presented with this, climate-conscious investors might be tempted to remove power utilities from portfolios.

However, by doing so, they may be missing out on a sector that is vital to the net-zero transition of the economy as a whole.

This is because utilities, in eliminating their own emissions, can also play a crucial role in the decarbonisation of other sectors such as transport, manufacturing or buildings, via the electrification of the economy.

While not all power utilities are fully committed to the transition, we see evidence that many are taking this responsibility seriously.

Some of the progressive power companies are ramping up their investments into renewables, electricity grids and cleaning up their operations.

The prospect of higher profitability from wind or solar compared with traditional power production will incentivise utility companies to grow renewables in the power generation mix.

With the greater scale, renewable prices are likely to fall further, which will accelerate the electrification of the economy.

This should help attract more investment into renewables and electricity grids. Utilities that fully embrace decarbonisation would benefit from a boost to earnings.

What is more, switching to renewables helps reduce the financial risk of utilities as they phase out traditional thermal power plants – assets that are under threat of becoming stranded.

All of this means utilities stocks could become a rich source of “transition alpha”, offering an attractive opportunity for investors.

Green journey

The world has a lot riding on the decarbonisation of the global power system as this, combined with the electrification of road transport and buildings, has the potential to halve global greenhouse gas emissions.1

The sector’s Scope 1 emissions – or those that stem from their operations and the resource they own or control, such as carbon dioxide produced by a coal power plant – represents Scope 2 emissions for other industries, or those that result from purchased energy.2

For example, when a car manufacturer purchases electricity from a power utility, its Scope 2 emissions are effectively the utility’s Scope 1 emissions.

This means if utilities cleanse their Scope 1 emissions of fossil fuel, they are effectively cleaning up Scope 2 emissions of other sectors at the same time.

It is therefore encouraging to find that power utilities are meeting, or sometimes exceeding, expectations on their transition plans.

Specifically, this means that they are eliminating emissions from their direct and indirect operations by for example shutting down coal-fired power plants and building new solar and wind generation capacity.

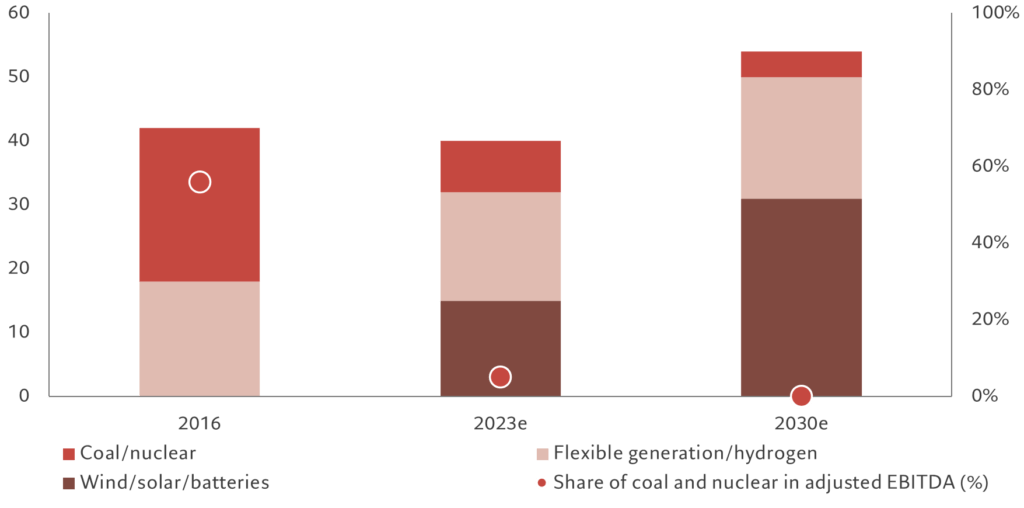

Take for instance one European utility firm (Fig 1). The share of renewables has risen to 80 per cent of its installed net capacity, or 32 gigawatts (GW), in 2023, compared with 42 per cent in 2016. It also plans to phase down coal and nuclear activities in the coming years. By 2030, all of its earnings are expected to come from non-fossil sources.

Fig.1 – Case study, company A

Installed net capacity (GW) pro rata

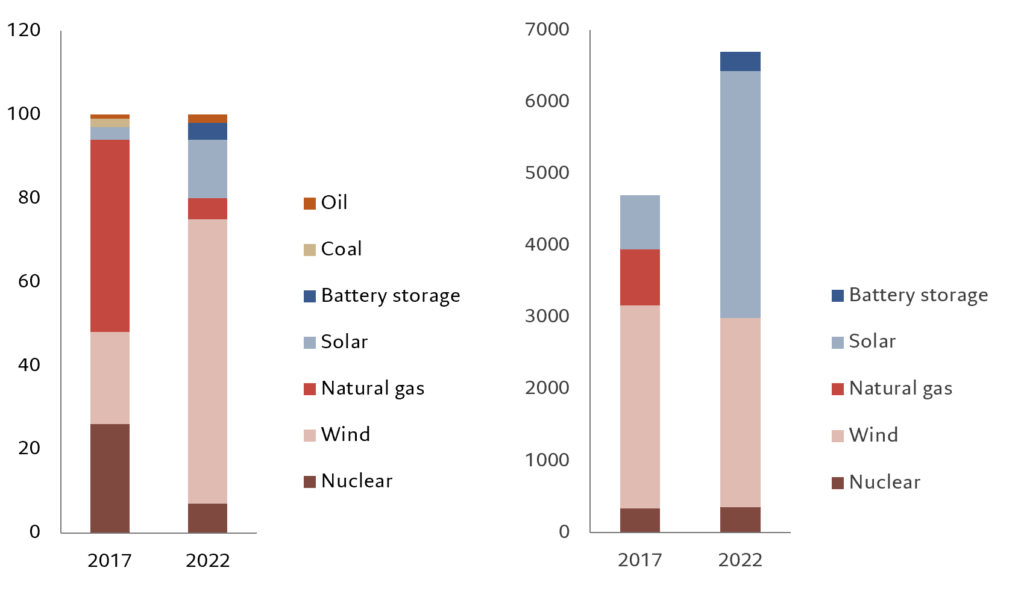

A US-based utility giant, meanwhile, has more than tripled its generation capacity of renewables such as wind and solar in the five years to 2022 (Fig.2).

It has a weighted average of 93 per cent of planned growth (as opposed to operational) capital spending, or USD78 billion, committed to green projects in the four years to 2025 which also includes battery and hydrogen storage. What is more, the firm plans to eliminate all Scope 1 and 2 carbon emissions across its operations by 2045 at no incremental cost to customers as it aims to benefit from the decarbonisation of the US economy, which it says represents a USD4 trillion market opportunity.

Fig. 2 – Case study, company B

Generation (MWh) and capital expenditures (USD mln)

These three firms are not isolated examples.

Improving economics and increased focus on sustainability from consumers and investors are pushing utilities towards shifting power generation away from fossil fuel sources.

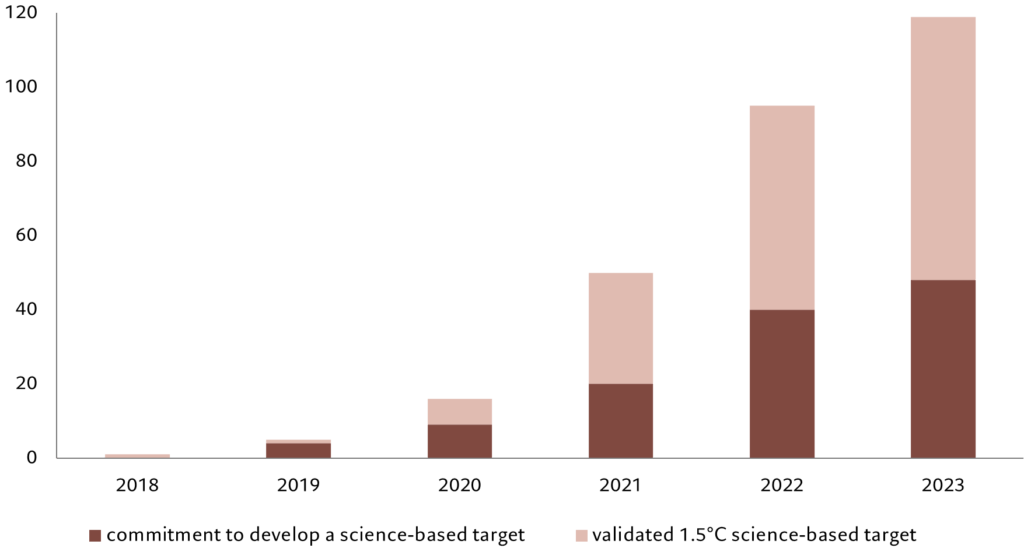

The number of utilities and independent power producers committed to the Science Based Targets initiative (SBTi) – an organisation validating corporate net-zero targets – has grown six-fold in the past three years alone.

Fig. 3 – Clean commitment

Cumulative number of electric utilities and independent power producers committed to SBTi

Transition alpha

The changing dynamics of the utilities industry have important implications for investors.

As their business becomes “cleaner”, companies will be able to profit from higher growth and reduce transition risks, which can lead to outperformance.

A recent study shows utilities that generated less carbon power and spent more on low-carbon investments outperformed an equal-weighted portfolio of US sector peer stocks by 32 per cent over the past five years.3

The widening divergence in performance within the sector also highlights the rapidly changing nature of utility stocks.

A highly regulated sector with long-term contracts, utilities have traditionally been associated with stable, defensive and bond-like returns. But they are now increasingly offering an element of growth, driven by the acceleration in renewables and grid investments.

What is more, their strategies are often in line with government priorities, allowing them to tap into additional financing incentives and invest even more in the long term.

In other words, certain utilities allow investors to capitalise on the growth of the renewable energy sector while securing stable cash flows and long-term visibility on earnings.

“As their business becomes ‘cleaner’, power utilities will be able to profit from higher growth and reduce transition risks, which can lead to outperformance. “

Investors, too, can help accelerate utilities’ decarbonisation efforts.

At Pictet Asset Management, through active ownership and engagement, our investment managers:

- ask the companies to have their decarbonisation targets validated by the Science Based Targets initiative (or similar third-party verifiers), which develops guidance on transition best practices

- encourage companies to incorporate mid-/long-term emission reduction targets in the remuneration of management with penalties/incentives

- engage with companies to target an orderly shift in the generation mix, for example by retraining workers in the fossil fuel industry towards clean energy skills and avoiding a simple disposal of dirty assets.

Utilities are powerful contributors to a shift towards a decarbonised economy.

Leaders of decarbonisation should reap rewards from their investment to phase out fossil fuel sources and also offer investors attractive long-term opportunities.

[1] https://www.wri.org/insights/4-charts-explain-greenhouse-gas-emissions-countries-and-sectors

[2] For more details, click on https://am.pictet/en/globalwebsite/global-articles/2022/expertise/thematic-equities/understand-emissions-for-climate-risk#overview

[3] Based on CO2 intensity of power generation and clean capex (the share of clean energy investments in current-year capital spending) Bloomberg, 27.03.2023

Appendix: Pictet Asset Management Clean Energy Transition strategy

- Pictet AM Clean Energy Transition strategy invests in companies leading the clean energy transition, which we believe will deliver a persistent return premium over the long term.

- The strategy invests in renewables through fast-growing and high-quality utilities. We invest in utilities that demonstrate a clear commitment to the energy transition via their investment allocation, such as deploying at least 80 per cent of the growth capex in renewables and technologies such as electric grid, e-mobility, or energy storage.

- The clean energy purity of the company (i.e. the weight of renewables and electricity networks as a percentage of the enterprise value of the company) needs to be greater than 33 per cent and should be increasing. This shows the utility has already created a meaningful renewables or electricity networks business and intends to expand this part of the businesses.

- The exposure to any coal, oil and nuclear combined must be less than 20 per cent of the enterprise value of the company and should be decreasing. This reduces the financial risk of stranded assets while showing active plans to phase out legacy “dirty” assets.