Minneapolis – The COVID-19 pandemic brought the U.S. Economy to its knees, with lockdowns, work-from-home mandates and travel restrictions wreaking havoc across the economic landscape. However, recent news shows the U.S. Economy is bouncing back. The development and roll-out of effective vaccines has allowed a return to some semblance of normalcy.

Metropolitan areas are seeing traffic levels pick up, and air travel is returning to pre-pandemic levels.1 By July, 75% of executives expect at least half of their office workforce to be onsite.2 The June employment report revealed that unemployment had dropped to 5.8% — a notable recovery from a peak rate of 14.8% in April 2020.3

These are all positive signs that in 2021, the U.S. Economy has regained a material part of its previous state. However, financial markets are perpetually looking to the future. As this recovery continues, investors’ anxieties have transitioned from the impact of COVID-19 on economic activity to concerns about how asset prices will react when policymakers begin to reduce accommodative monetary and fiscal policies. Put simply, will the removal of stimulus measures trigger a new, and potentially very different, market cycle?

How will Markets Change as COVID-19 Subsides?

The pandemic presented a unique challenge to politicians in Washington. On the one hand, they were forced to shutter the economy to slow the spread of the virus. On the other hand, they also had to stave off permanent economic scarring and prevent the temporary impact of the pandemic from developing into a major recession or depression.

Adapted from the playbook of the 2008 financial crisis, the fiscal response was, in a word, massive. In less than a year, Congress passed five separate stimulus packages equating to nearly $5.6 trillion, or roughly 27% of GDP. To put that figure in perspective, it is approximately equal to the GDP of Japan, the third-largest economy in the world. Measured as a percentage of GDP, the U.S. had the second-largest fiscal response to the pandemic of any nation.4

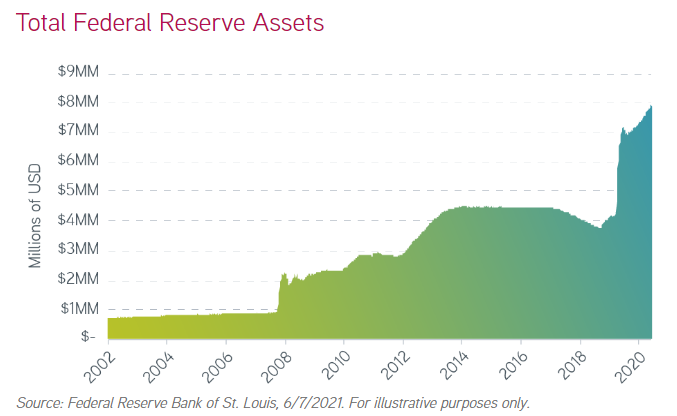

Simultaneously, the Federal Reserve stepped in with a stunning array of monetary stimulus programs. Since the onset of the pandemic, the Fed has cut the short-term borrowing rate to 0%, implemented numerous lending programs to enhance market liquidity5 and launched an asset purchase program that continues to buy $120 billion of mortgage-backed and Treasury securities each month. The asset purchase program has inflated the Fed’s balance sheet, which had just started to recover from the 2008 crisis when the pandemic hit.

This combination of massive fiscal stimulus with aggressive monetary stimulus can best be described as an extraordinary experiment. There’s no historical precedent for coordinated monetary and fiscal policy on this scale, with current stimulus measures outpacing even those in place during World War II.

Now that the economy has entered recovery mode, financial markets are starting to focus their attention on how this conjoined monetary and fiscal stimulus experiment ends. Continued stimulus and increased liquidity could ignite long-dormant inflation, causing rates to rise, the dollar to weaken and assets to reprice. At the same time, premature tightening of monetary and fiscal conditions could slow the economy, renew concerns about deflation and impair assets like equities, real estate and commodities.

Policymakers will need to walk a fine line to avoid these outcomes. As they do so, investors can expect periods of policy uncertainty and increased market volatility. Who can forget 2013, when Fed chair Ben Bernanke tipped the market off to the Fed’s intention to wind down its bond-buying program and the taper tantrum ensued?6 Heightened volatility will put a premium on investors’ ability to manage the risks inherent in their portfolios more intentionally to avoid potential pitfalls.

How Should Investors Manage Risk as the Economy Recovers?

Investors have been rewarded for maximizing their risk exposure in the current market cycle. Growth assets like equities, credit, real estate and commodities have all produced exceptional performance. There has been less reward in risk management in an environment where all assets have performed well. However, we’re transitioning to a new market cycle where fiscal and monetary stimulus are withdrawn, and uncertainty and volatility are likely to increase.

In our view, investors who may have let their risk management muscles atrophy as markets rallied over the past 15 months will need to get back in shape for what could be a more challenging environment in the future. Here are three examples of steps that investors can consider to manage risk more intentionally:

Think about instituting a disciplined rebalancing process. Given the current market environment, many investors may have an overweight to equities and an underweight to fixed income relative to their policy benchmark. We think now may be the time to rebalance portfolios back to policy targets — and to consider how to rebalance in the future if liquidity becomes challenging in certain asset classes. Don’t forget that in Spring 2020, we saw market liquidity disappear in both sub-investment-grade and investment-grade credit.

Look to manage foreign exchange (FX) exposure. The pandemic has accelerated the pace of De-Globalization as nations seek to repatriate critical global supply lines that failed in 2020. Additionally, varying fiscal stimulus and vaccine distribution levels have left national economies at radically different stages of recovery. These changes are expected to lead to increased cross-currency volatility, especially compared to the subdued levels of the 2010s. Investors may want to monitor their FX exposure carefully and hedge away risks they deem undesirable or unnecessary.

Try to take advantage of dislocations. Market volatility can lead to price dislocations and short-term funding opportunities. Before the 2008 crisis, banks had well-funded trading desks that provided liquidity to the markets and made trading more continuous. In reaction to the crisis, regulations made it increasingly expensive for banks to play this role. As a result, market dislocations associated with high-volatility and low-liquidity events are becoming more prevalent. A recent example was the nearly 200-basis-point jump in AAA municipal bond yields in March 2020. Bond dealers couldn’t absorb the large flows coming out of bond funds, making rates skyrocket. We think long-term investors should have an established framework available to take advantage of these opportunities when they arise.