Embedded emissions within the supply chains of low-carbon technologies are growing in prominance with broader adoption. Today, manufacturing electric vehicles (EVs) has a much higher carbon footprint than traditional internal combustion engine vehicles. But automakers are working with their suppliers to reduce their products’ carbon footprint through the raw materials they consume – particularly in the battery. One such raw material is nickel sulphate. Nickel sulphate has experienced the highest absolute demand growth of the battery raw materials in recent years and has a variety of production routes, with vastly different environmental impacts.

In the face of fears over nickel sulphate supply, Tsingshan has planned to produce nickel sulphate via NPI (Nickel Pig Iron) at its planned Morowali plant in Indonesia. This route would require the conversion of NPI (produced from a nickel laterite ore) to a nickel matte, which would then be made available for nickel sulphate conversion. Previously, this had been carried out by Eramet at the Doniambo smelter, where a portion of the facility’s ferronickel had been converted to matte for electrolytic nickel production.

However, Tsingshan’s plans have come under fire from critics who argue nickel sulphate produced via this route would carry a significant carbon footprint. As well as high emissions, concerns over nickel tailings dams and land use in tropical rainforest environments also plague nickel laterite miners in South East (SE) Asia. Given projected EV sales will drive demand for nickel sulphate, this would seem to fly in the face of such a sustainability-oriented industry.

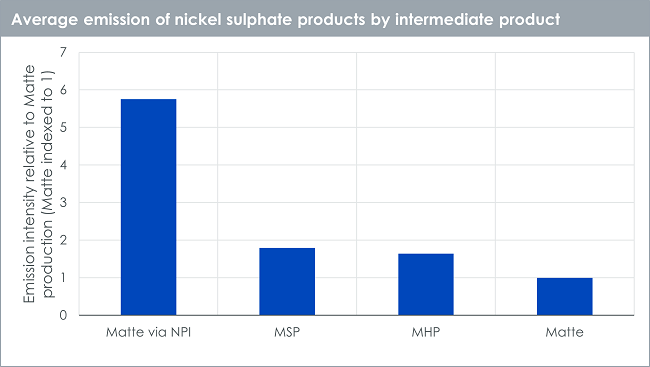

So just how will nickel sulphate produced by Tsingshan’s proposed matte via NPI route stack up against existing routes on a CO2 basis? Is the proposed route as carbon-intense as critics argue, and if so, does the added flexibility of producing nickel sulphate from NPI outweigh the disadvantages of the high embodied emissions?

Historical performance is not an indication of future performance and any investments may go down in value.

To answer these questions, Wood Mackenzie has assessed the CO2 intensity of various nickel sulphate supply routes within the Emissions Benchmarking Tool.

From this, Wood Mackenzie estimate that producing nickel sulphate from Tsingshan’s proposed NPI to matte route will carry a CO2 intensity 4 times greater than the industry average. Embedded emissions from this route are significantly above the average for the nickel sulphate sector.

This high emissions intensity comes down to a significant energy requirement and heavy reliance on high-CO2 coal fuel within the process. The production of nickel matte via NPI requires significant quantities of energy in the smelting process. The majority of this power will be generated by coal fuel, with additional coal used as a reducing agent in the smelting process.

It is important to note that when considering overall lifetime emissions of Internal Combustion Engine (ICE) and electric vehicles, EV’s still perform more favourably. The embedded emissions from nickel sulphate used in cathode production represents a small proportion of overall lifetime embedded emissions of EV ownership. The concern over the high emissions of Tsingshan’s planned route lies in the effect this material will have on supply chains dependent on it which operate in jurisdictions utilising carbon tax schemes.

Impact of carbon tax schemes

Regulators are seeking to support manufactures as they reduce emissions. Carbon policy needs to expand to hit climate goals, but they needed associated measures to protect domestic industry from being unfairly penalised. Understanding embedded emissions of imports is an important step in levelling the playing field. Initiatives such as the EU’s proposed battery passport scheme, carbon border adjustment mechanism, or carbon tax programmes in the US demonstrate that importers of electric vehicle (EV) materials will be subject to financial penalties when importing high-CO2 material.

So, does the added flexibility afforded to Tsingshan via the Morowali plant’s capability to produce nickel matte via NPI negate the possibility of being penalised in certain markets? This will depend on how carbon taxes are levied within this supply chain. Nickel products produced in Indonesia are currently not subject to any carbon taxation domestically. While the country is examining the possibility of introducing an Emissions Trading Scheme (ETS), the exact details are yet to be determined. Any carbon taxes will be levied on downstream sectors of the supply chain, from nickel sulphate production to EV manufacture. ETSs exist to varying degrees within countries within this value chain such as China, the United States, and the EU. However, in the future, these schemes will evolve and expand, representing a significant cost risk for any supply chain dependent on material sourced from the Morowali plant. This, combined with concerns around the optics of sourcing from the highest CO2 route possible, is likely to discourage cathode manufacturers from using this material.

It’s possible that high-CO2 material will find a niche within the nickel market at lower prices, the same dynamic which could result in premiums for low-carbon material. But Tsingshan is making a habit of innovation and is developing a route to market closer to home. Tsingshan and Green Eco Manufacture (GEM) have entered a joint venture to manufacture cathode materials, directly offtaking the high-emissions nickel sulphate. This highlights the challenge facing regulators and automakers targeting lower supply chain emissions: fragmented and complex supply bases restrict visibility of origin. All stakeholders require consistent, transparent and comprehensive data to get a clear picture of the emissions from upstream activities.

This article has been drafted by Dominic Wells, Senior Research Analyst.

The views expressed in this blog are those of Wood Mackenzie, any reference to “we” should be considered the view of Wood Mackenzie and not necessarily those of WisdomTree Europe.

Wood Mackenzie, a Verisk Analytics business, is a trusted source of commercial intelligence for the world’s natural resources sector. Wood Mackenzie empowers clients to make better strategic decisions, providing objective analysis and advice on assets, companies and markets.

Sources

1 Tsingshan Holding Group Co., Ltd. manufactures and distributes stainless steel products. The Company produces stainless steel castings, steel bars, steel wires, steel plates, and other products. Tsingshan Holding Group exports its products to Southeast Asia, Europe, America, and other countries and regions