In previous articles we have discussed volatility in bond prices and the dangers to investors’ capital from having too much duration. One of the key drivers to effective harvesting of the income streams from bonds is managing the risk of capital erosion, after all it is the income (coupon) that is the fixed bit in fixed income. Not all bonds are created equally; some have attributes that render them far less volatile than others. The two most important factors to focus on are interest rate risk and credit risk.

Interest rate risk, normally measured by the duration of the bond, shows how sensitive the bond’s capital price is to movements in interest rate expectations. This follows the same principle as a seesaw, the further you are from the centre (maturity), the more sensitive the price is to changes in interest rates. Short-dated bonds have a natural “pull-to-par” as they approach maturity – they are positioned very near to the centre of the seesaw.

Credit risk often gets over-complicated: it is simply the risk that you won’t receive all the principal – 100 pence in the pound or cents in the dollar – back when the bond matures and get paid all your coupons in the meantime. In developed markets, corporate debt is riskier than sovereign debt but has a larger yield to reflect this increased risk. The extra yield, measured compared to a government bond with a similar maturity, is referred to as a credit spread. This credit spread needs to compensate investors for three risks: default risk (and the recovery rate of pence in the pound of the principal should a default occur), credit quality deterioration risk and illiquidity risk.

Short-dated, investment grade corporate bonds naturally have very low interest rate risk, they are constantly getting closer to the middle of the seesaw. What about their credit risk? Default risk is incredibly low in these household names. It is highly unusual for anything to go wrong so quickly for an investment grade company to suddenly default. The exception occurs in cases of fraud, but even malfeasance does not necessarily wipe the whole company out. Most investment grade companies that encounter difficulties do so over a longer time horizon, possibly as their business model has been rendered obsolete by technological disruption.

Credit deterioration matters more for longer dated bonds. If a credit deterioration were to occur, an increase in the credit spread to account for the increased risk of default as the company transitions from investment grade to high yield (which tend to have credit ratings of BB+ and below) impacts the capital price the market is willing to pay for the bond. For shorter dated bonds, we do our utmost to avoid what are colloquially referred to as “fallen angels” – those companies that have lost their investment grade status. But even in the high yield universe, defaults are rare until you get to the lowest ratings echelons.

Finally, one should be compensated for lower liquidity in corporate bonds. The illiquidity premium does vary through the cycle and is very much dependent on prevailing markets conditions.

By buying a diverse selection of short-dated investment grade corporate bonds one can capture a low volatility income stream. Before we launched the Liontrust GF Absolute Return Bond Fund, we modelled historic returns of these short-dated investment grade corporate bonds in order to thoroughly understand the risk/return profile of this core part of the portfolio. We refer to these yield-generating defensive assets as the Fund’s Carry Component.

The best historic test was to make sure there would not be a rolling 12-month drawdown during the Credit Crunch of 2008/9. What we found was that by using up to 5-year maturity corporates, and up to 3-year maturity financial companies’ bonds, the rolling annual return would have remained positive during the financial crisis. Comparing this Carry Component modelled return with cash rates, we found that an excess return of 1% to 1.5% could be targeted, even during extreme market conditions.

We can use that extra 1% to 1.5% return to form the yield backbone of a low-risk absolute return fund. The Fund has made steady incremental returns since launch in June 2018, with a brief dip in March 2020. Having modelled for the “once-in-a-generation” crisis of 2008/9, an even worse one occurred in March 2020 due to the global Covid-19 pandemic. The Fund invests in liquid instruments and these were marked down due to the wave of selling in the market, but did have a drawdown as all positions are actively marked to market. Through the toughest of market tests the rolling 12-month drawdown lasted less than a month, we think this shows that the proof statement of reality is a much stronger message than the theory.

The Fund’s total return since launch is greater than that suggested by the Carry Component alone. That is because we seek additional returns from alpha opportunities. Furthermore, we manage the Fund’s risk in its entirety which helped to mitigate some of the drawdown in 2020 and led to a rapid recovery. Alpha is generated for the Fund from three sources: Rates – cross market duration opportunities or yield curve management; Allocation – both by geography and fixed income asset class; and Selection – avoiding any losers in the Carry Component and picking winners in slightly longer dated bonds. We cover examples of each below.

Rates – Switzerland Versus Germany

One can create market neutral trades by identifying mispriced opportunities and balancing any risks added to the Fund. On the interest rates and duration front, one source of value is to capture cross-market opportunities in sovereign bond markets with similar characteristics. To revisit our seesaw metaphor, any weight added to one side of the seesaw must have a similar weight added to the other side to maintain balance.

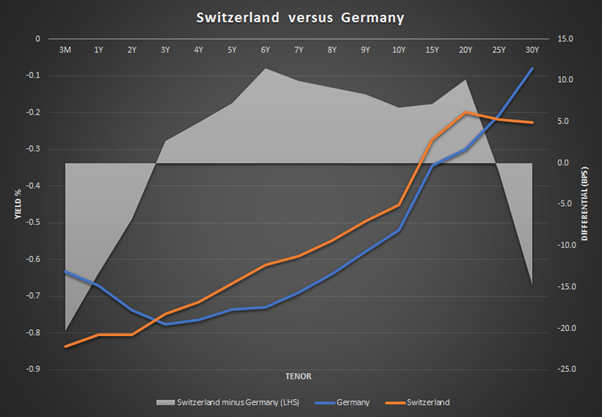

One such cross market opportunity that was implemented earlier this year was to go long Swiss government bonds relative to German ones, both of them AAA-rated European countries. The graph below shows their respective yield curves – with differing maturities along the x-axis. Switzerland (orange line) and Germany (blue line) both had upward sloping curves – meaning longer dated bonds yield more – from 4 to 5-year maturities outwards. However, this was not the case at the very short end; Switzerland has lower base rates and lower yields until you reach 3-year maturities.

The shaded area shows the difference between the two curves measured in basis points (bps). There was an outlier around the 5-year maturity where Swiss bonds were yielding over 10bps more than German ones. The Fund bought 5-year Swiss debt and sold 5-year German BOBL (Bundesobligation) futures against it to create the aforementioned balance in the risk. If nothing happens, this position will make money over the next few years; in a year’s time the current 5-year bond will only have 4 years until maturity, and you can see the expected trajectory as you move further to the left on the X axis. However, pricing anomalies like this don’t hang around forever. Other market participants have clearly identified this opportunity too and the difference between the Swiss bonds and the German 5-year future has now moved from more than 10 bps to close to zero. This is a great example of a low risk, non-directional way of adding value.

Source: Bloomberg, as at end January 2021

Allocation - US Versus European Investment Grade Credit

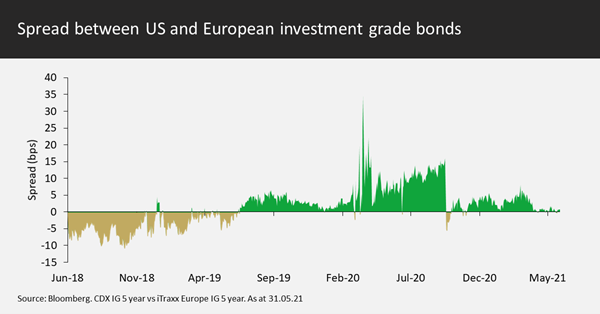

Allocation opportunities occur less frequently, tending to appear in times of heightened market volatility. We saw this during the market crisis caused by the pandemic last year. Normally, there is very little difference between US and European investment grade credit spreads – the chart below shows that they tend to be within a 10bps range of each other. We have used benchmark credit default swap indices – CDX IG for the US and iTraxx Europe this side of the Atlantic – as these can be easily used to increase or decrease exposure to the relevant asset class.

US investment grade witnessed a huge relative underperformance, despite the fact that the pandemic crisis was global. The Fund went long US risk using CDX IG and short risk iTraxx Europe, keeping that metaphorical seesaw balanced once more. This was a great way of taking advantage of the US market overshooting without adding generic credit market risk. This pricing discrepancy was successfully traded a few times, adding 30bps of alpha to the Fund in 2020.

Selection – Exploiting Home Market Bias

We classify any corporate bond that doesn’t fit the strict criteria for the Carry Component as Selection. We limit this exposure to a maximum 20% in investment grade and 10% in quality high yield to avoid adding too much risk to the Fund. There are myriad ways of generating performance in corporate bonds. One of our favourites is exploiting what we refer to as home market bias. This bias occurs due to the natural name familiarity investors have with companies that operate on their doorsteps, meaning US companies’ bonds will tend to have a tighter credit spread in US dollars than they do in euros.

A great example of this occurred in October 2019 when US pharmaceutical giant Eli Lilly issued debt denominated in euros for the first time since 2015. With European investors not knowing this quality company as thoroughly, the bonds ended up pricing with a significantly wider credit spread than their US dollar cousins. This is one of the rare occasions in the Fund when we buy a corporate bond with longer duration to capture the capital upside of credit spread compression. This decision to move further along the seesaw was vindicated over time as the differential narrowed and we eventually took profits in February 2021 having made a capital gain of over 15% on this bond.

Conclusion

Not all bonds are created equally; if you find bonds with the correct attributes, they can be used to create a low-risk portfolio. The Liontrust GF Absolute Return Bond Fund uses short-dated, investment grade corporate bonds to create a Carry Component, a low volatility yield engine for the Fund that should generate cash plus 1% to 1.5% through the cycle. We then seek to supplement these returns with alpha generation without taking too much risk or unbalancing our seesaw. The Fund’s primary aim is to avoid a rolling 12-month drawdown – after all it, is an absolute return fund. There is a secondary aim of generating a gross return of cash plus 2.5% when market conditions permit.

We view this Fund as a good way of making cash work harder, albeit we emphasise that the Fund is low risk, not no risk. Our target of avoiding a rolling 12-month drawdown means the Fund should act as a good nominal store of value. When we add alpha and hit our secondary target of cash plus 2.5% gross, then the Fund also acts as a good real store of value for investors.

To sum up, the boring part of the bond world has its place, and we would argue that now is not the time to be taking the interest rate risk or stressed credit risk that move you to the end of the seesaw.