Key takeaways

- Risk environment: This isn’t 2007/08 all over again

- Economic Outlook: Labor markets remain tight for now

- Equities: Positioning brushes off US debt ceiling debate

- Bonds: Model suggests slight underweight

- Current topic: Consumer still strong but first signs of weakness

Fed pivot postponed

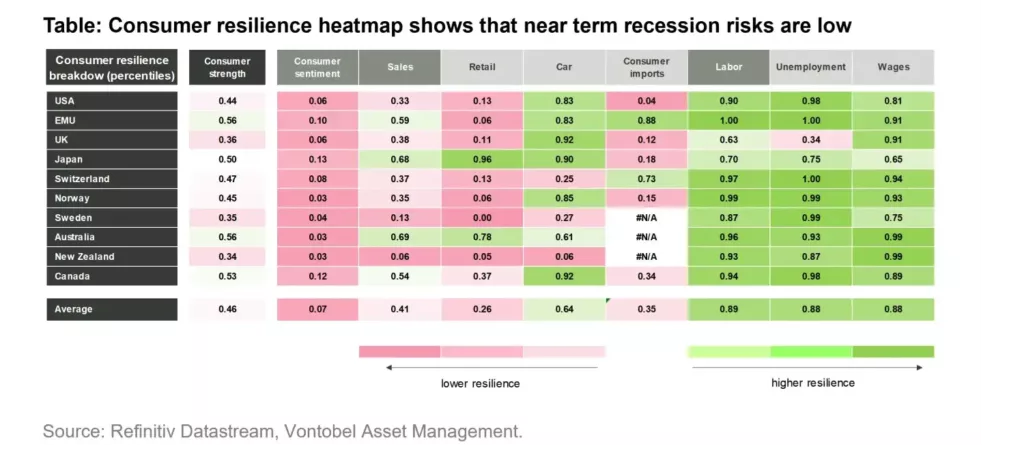

Nothing seems to be able to derail equities this year as they shrug off cracks in the banking sector, last-minute US debt ceiling agreements, weakening economic momentum in developed markets in Q2 as well as the surprisingly hawkish Fed policy meeting. The main reason for this display of calm is likely the resilience of the consumer1. As we show in our current topic of this edition, first signs of fatigue have become visible, but as long as the labor market remains historically tight, near-term recession risks are low.

Therefore, the window of opportunity for the Fed to engineer a soft landing with a policy pivot has not closed yet, giving investors enough reasons to remain cautiously constructive on risky assets. Even though the Fed passed on the opportunity for a pivot in June, our equity allocation model GLOCAP still detects signs for a nearing policy change, which is indicated by the continuously strong term spread contribution to the equity overweight. Developed markets’ economic relapse into contraction may change the Fed’s opinion later this year, but labor markets will probably have to ease first.

1. Edward Leamer shows that housing market data has a long lead to economic recessions, but consumer data give signals closer to the recession. See Edward E. Leamer (2007) “Housing is the business cycle”, NBER Working Paper no. 13428

Risk environment: This isn’t 2007/08 all over again

The Move Index measuring bond market volatility is slowly reverting back to June 2022 lows. But due to the conspicuously low volatility of the equity market (VIX Index) the convergence of equity to bond market volatility remains close to historical extremes. Uncertainty about future monetary policy remains the main obstacle for bond volatility to come down faster, with the Fed indicating at their June policy meeting that more rate hikes may come in 2023.

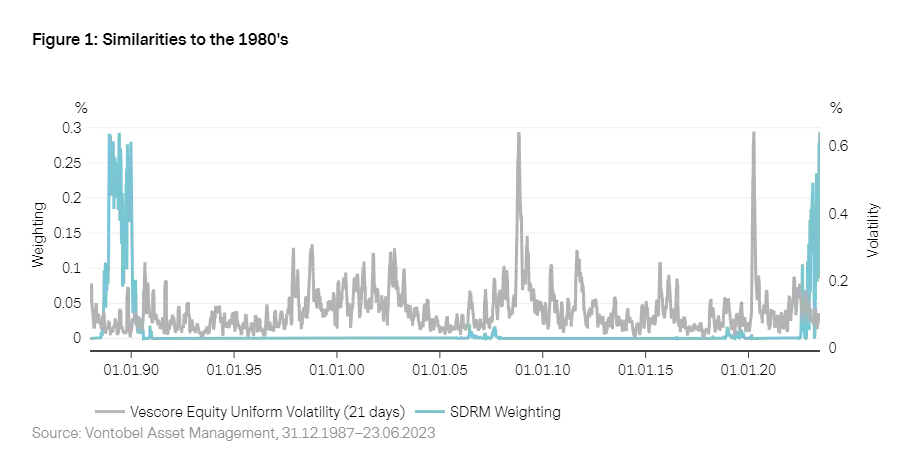

Our risk model SDRM2 sticks to the comparison of the current environment with the late 1980s. Back then, an aggressive tightening cycle triggered a broad-based credit crunch leading to the default of more than 1000 savings and loans institutions. According to our analysis,3 risks are primarily concentrated in US regional banks loaded up with commercial real estate. However, banking sector risks on a systemic level seem limited, as banking regulation in the 2010s led to a de-leveraging of systemically relevant banks. This means that even if there is a possibility for further defaults in banking, they should remain confined to certain areas of the sector. This conclusion confirms the SDRM results, which sees little comparison with the Great Financial Crisis.

2. More information on our SDRM model can be found in “ Risk Management: Forward on calm seas, adaptive and agile in stormy phases ”.

3. See “ Vulnerabilities in the banking sector are below historical averages ” in the April 2023 edition of the Global Market Outlook.

Economic outlook: Labor markets remain tight for now

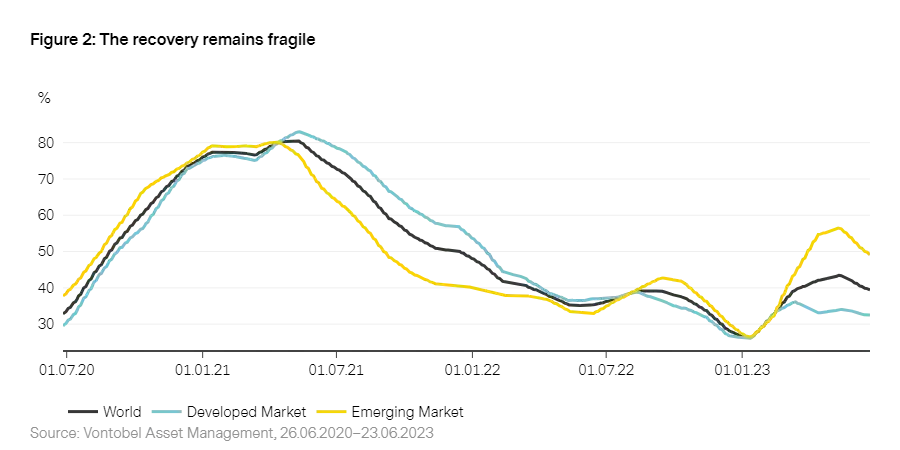

Economic data deteriorated over recent months. Especially banking sector activity and economic sentiment data grinded lower again after a constructive start into the year. Consumer sentiment for example is as low as in only 10% of observations since the 1990s. Despite the weak sentiment, global labor markets remain tight for the time being suggesting low risks of a severe recession in the near term. However, the deterioration of sentiment made the Wave4 revert back to contraction. Against the background of the hawkish June Fed meeting, tight monetary policy remains tight and suggests a high probability of around 90% of the Wave remaining in contraction.

Developed markets remain in contraction

Developed markets remain in contraction with the US continuing to lose economic momentum. Real money supply remains historically tight keeping the probability of developed markets remaining in contraction in the near term at 90%. The June central bank meetings did not bring more clarity on the future timing of the policy pivot and therefore on the turnaround of real money growth, with the ECB continuing its tightening cycle and the Fed indicating that more hikes may come. Despite the resilience of the consumer data processed by the Wave, which suggests that a recession in the US is still a little way off, other Wave sectors remain outright weak, in particular the housing and banking sectors. But even the strong labor market in the US and elsewhere is slowly losing momentum.

Emerging economies: June setback

The emerging market Wave suffered a setback in June and re-entered contraction. In addition to weaker sentiment data the foreign trade component deteriorated most, indicating weak demand from major developed economies. This has been in particular been the case for China. After a strong gain in economic momentum earlier this year, China re-entered a slowdown, with import growth dropping from +8% year-over-year to -8%. The housing market recovery stalled as well, which led to a swift central bank reaction, with the PBoC easing several policy tools increasing the probability of stronger growth momentum later this year.

4. For further inside into the Wave business cycle model we refer to our white paper “The Vescore Wave – a superior business-cycle model”

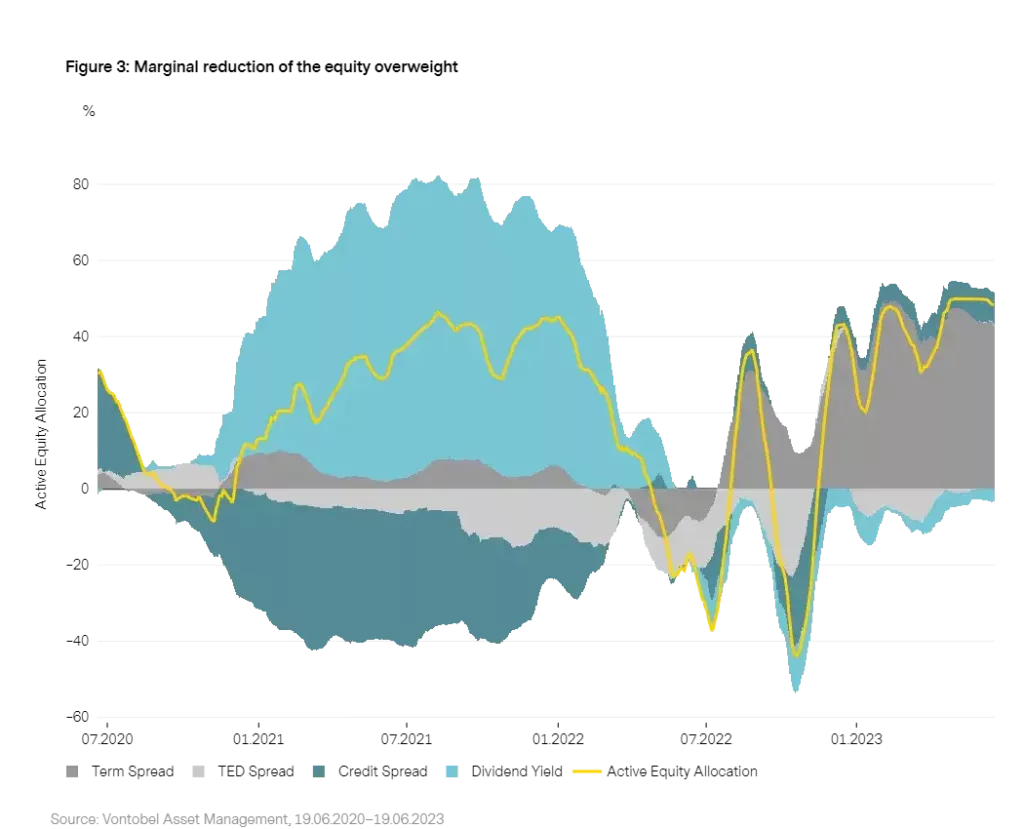

Equities: positioning rather unaffected by debt ceiling debate

The US debt ceiling tantrum has proven to be a non-event as anticipated by our equity allocation model GLOCAP. But after almost two months of running a maximum equity allocation, GLOCAP has started to reduce the equity overweight slightly as the hawkish June Fed communiqué has been weighing a bit on the term spread contribution. However, overall, the picture remains largely unchanged as the model keeps detecting the possibility of a nearing Fed pivot which it takes as a positive for equities on account of an unabatedly strong contribution by the term spread.

The contribution of the credit spread remains – albeit much at a lower level – positive as well. Corporate profits have rather surprised to the upside during the recent earnings season on the back of consumers’ resilience in countries such as the US. As this resilience keeps recession risks in check for the time being, credit spreads have near-term potential for compression. Equity valuation seems less attractive, which leads to a slightly negative contribution of the dividend yield. The contribution of the TED spread remains – as in previous months – neutral.

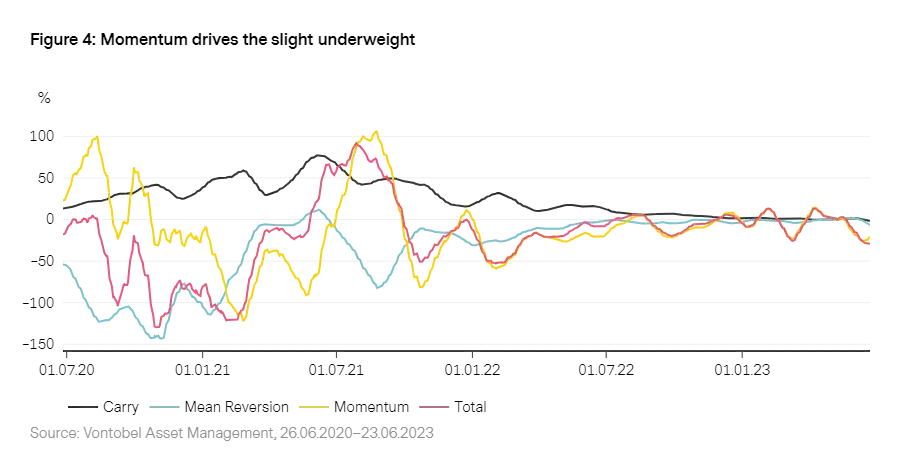

Bonds: Models suggests slight underweight

Considering the continuously high bond market volatility, expected risk-adjusted bond returns are still not very attractive, despite the higher yield. The surprisingly hawkish June Fed policy meeting failed to change our bond allocation models’ view significantly. Similar to our equity model, our fixed income model FINCA is constructive on a nearing Fed policy pivot. However, at the same time, carry is neutral and momentum is slightly negative which, overall, translates into a small underweight.

Current topic: Consumer still strong but first signs of weakness have popped up

Since summer 2022 when it became apparent that the US Fed had entered one of the most aggressive policy tightening cycles in history and that the energy crisis was hitting Europe, recession predictions grew rampant. Our own model estimates also argued for a recession in the second half of this year5. However, these recession predictions have been postponed several times so far. The major reason for this is the resilience of the consumer in a number of countries such as the US.

Reason enough for us to investigate how sustainable this resilience is.

Our consumer resilience index consists of six variables covered by the Wave: consumer sentiment, retail and car sales, unemployment rate and wage growth and consumer import growth. After a transformation into percentiles to make these time series comparable, a simple average is taken to derive the consumer resilience index.

The final result shows that indeed the consumer is fairly resilient because the current G10 average is close to the historical average (50th percentile, see table). However, some clouds have started to gather as consumer sentiment approaches historical lows in most developed markets. The 7th percentile for developed markets indicates that in only 7 percent of observations consumer sentiment has been worse than now. Usually, this marks the first step of fading consumer resilience. But as long as consumption activity (e.g. car sales) remains solid and labour market conditions remain tight, recession risks are – in the absence of banking sector stress – contained. However, once the labor market starts to deteriorate, a recession often follows within three quarters6. Taking into account that the unemployment rate in many developed markets continues to be low, a recession is unlikely to happen before Q1 2024.

5. See “ What do our models think about US recession risks? ”

6. Our analysis of 10 developed markets since the 1950s shows that the probability of a recession after the low in the unemployment rate is above 70%, whereas on average three quarters lay between the low in the unemployment rate and the start of the recession.

Important Information: Past performance is not a reliable indicator of current or future performance. Indices are unmanaged; no fees or expenses are reflected; and one cannot invest directly in an index

Any projections or forward-looking statements herein are based on a variety of estimates and assumptions. There can be no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. The inclusion of projections or forecasts should not be regarded as an indication that Vontobel considers the projections or forecasts to be reliable predictors of future events, and they should not be relied upon as such. Diversification and/or asset allocation neither assures a profit nor eliminates the risk of investment losses.

Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice. This document is for information purposes only and does not constitute an offer, solicitation or recommendation to buy or sell any investment instruments, to effect any transactions or to conclude any legal act of any kind whatsoever.