Overburdened supply chains and persistent inflation threaten economic and profit growth.

Key Takeaways

- Russia and Ukraine account for a small share of the global economy but are significant producers of food, energy and other natural resources.

- Tightening the availability of vital materials from the region would increase inflationary pressures and could dampen consumer confidence.

- Disrupting the industrial metals supply threatens to aggravate global supply chain backlogs and weigh on corporate earnings.

Russia’s and Ukraine’s combined share of global GDP is relatively modest at approximately 2%. However, given their roles as energy and food producers, a protracted war could restrain economic activity worldwide.

Our global growth portfolios do not have any direct investments in Russia. However, we own businesses that must navigate the conflict’s indirect impacts.

Higher Prices for Energy and Grain Increase Inflationary Pressure

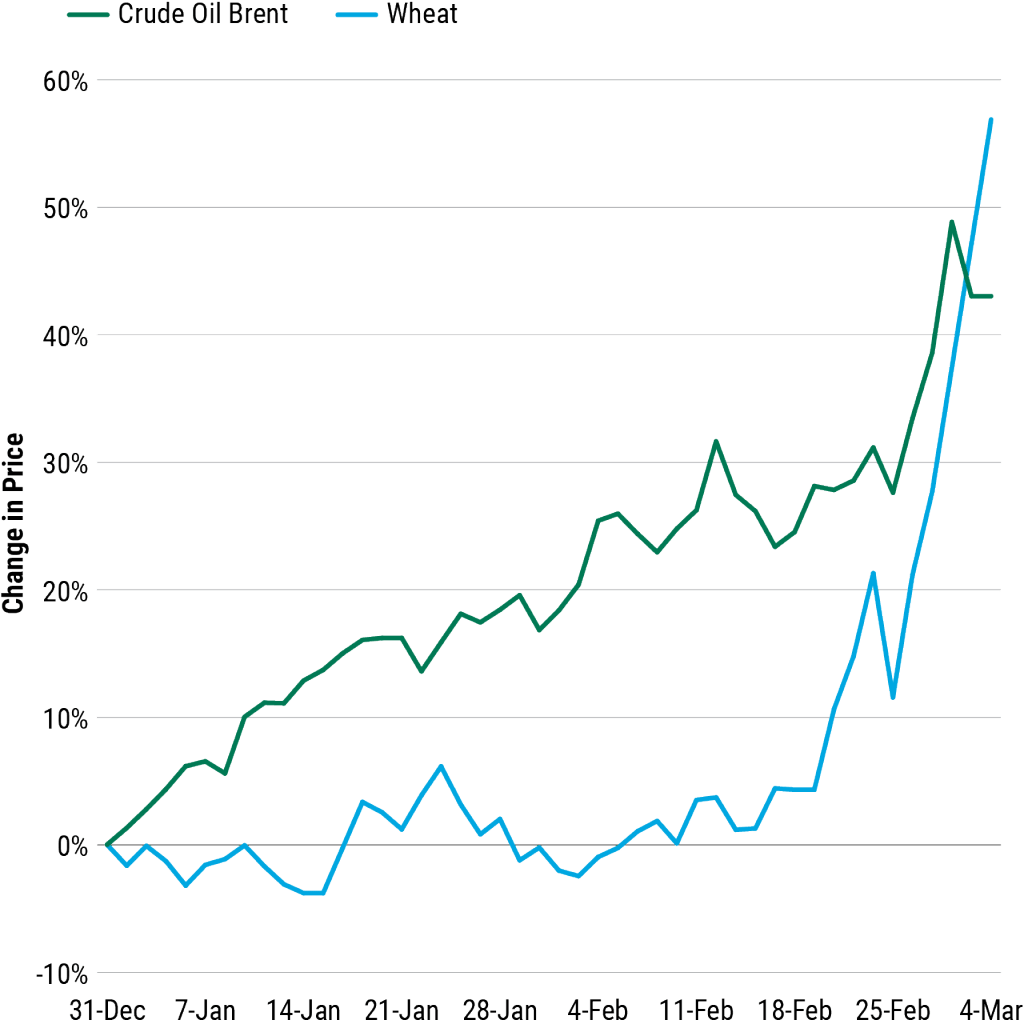

The potential for higher and stickier inflation could weigh on consumer confidence and spending. Russia produces about 10% of the world’s oil, 17% of its natural gas and 11% of its wheat. Ukraine is a significant exporter of wheat and corn. Year-to-date, the spot prices of oil, European natural gas and wheat have risen approximately 48%, 180% and 56%, respectively, as of March 4. See Figure 1.

Renewed Supply Chain Disruptions Could Hinder Industrial Output

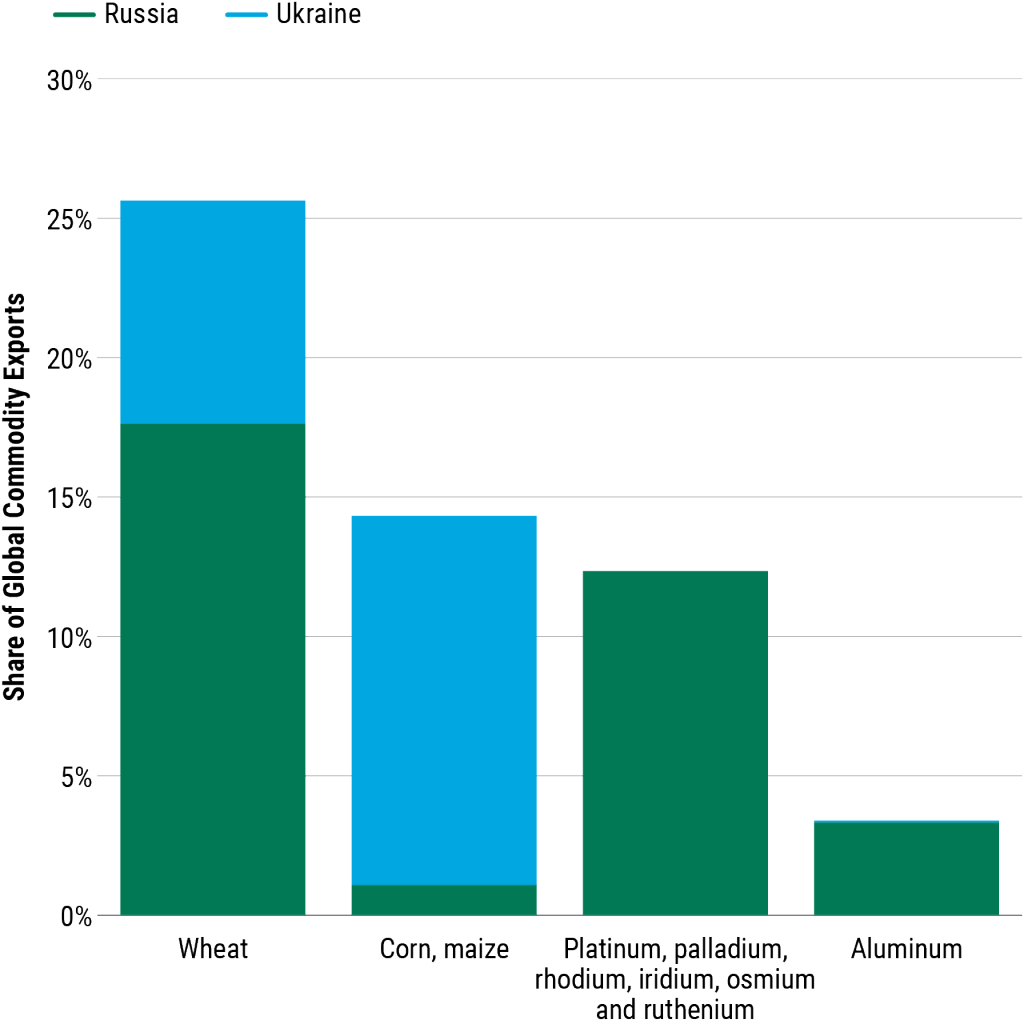

In addition to oil and grain, Russia is a major exporter of industrial metals, including palladium, titanium, platinum and aluminum. A tighter supply of these metals could curb output globally in the automotive, aerospace and semiconductor industries, among others. See Figure 2.

Investment implications that we see from the interruption of Russian and Ukrainian exports to global markets include:

- A shortage of Russian palladium, used primarily in catalytic converters in automobiles, could slow the recovery in European automotive production. Russia produces 43% of the global palladium supply.

- Russian titanium supplier VSMPO-AVISMA is a prominent titanium provider to the aerospace industry. Boeing, Airbus and Embraer depend on these supplies to manufacture aircraft. While these manufacturers have started to reach out to other suppliers, near-term alternatives are limited. An extended loss of access to Russian titanium would likely hinder future global aerospace production volumes.

- Ukraine and Russia are also key suppliers of the purified neon gas used in semiconductor production. The chip supply has already suffered due to COVID-related disruptions in Asia. Any future loss or disruption of critical manufacturing supplies is likely to delay the timeline for normal production.

A Shift in Market Focus

We believe higher prices, moderating consumer demand and worsening supply chain disruptions is likely to compress the growth trajectory of corporate profits. The favorable earnings revision cycle we have experienced for most of the past 18 months is also likely to moderate.

These changes could potentially shift investors’ risk focus from concern about too much inflation to worry about not enough growth. As growth becomes scarcer, we expect businesses that can deliver earnings growth through company-specific growth drivers to regain market leadership.

Historically, markets have rewarded such companies and generated strong risk-adjusted returns for disciplined investors.