WisdomTree has the pleasure of working with Bessemer Venture Partners (BVP) to provide expertise and insight in the cloud computing market.

BVP publishes annual research on the ‘Cloud 100’—the 100 most significant private market cloud companies. In software, trends of behavior and activity in the private markets have a lot of connections to what we see in the public markets. The single most significant change, year-over-year, was the introduction of ChatGPT and the subsequent focus on large language models (LLMs) and generative artificial intelligence (AI). However, it is also useful to look at fundamentals like growth and valuation in an environment characterised by much higher interest rates.

The peak valuations observed in late 20211 were actually not that far back on the calendar. The 2023 Cloud 100 report, combined with the earnings reports of companies coming in, could serve to give us all important perspective on the software space.

The valuation journey

In publicly-listed software companies, we have experienced the massive run up in valuations through 2021, with 2022 being a tougher year and now 2023 being a recovery rally. In Figure 1, we see BVP’s numbers on the valuation of the private, Cloud 100 companies:

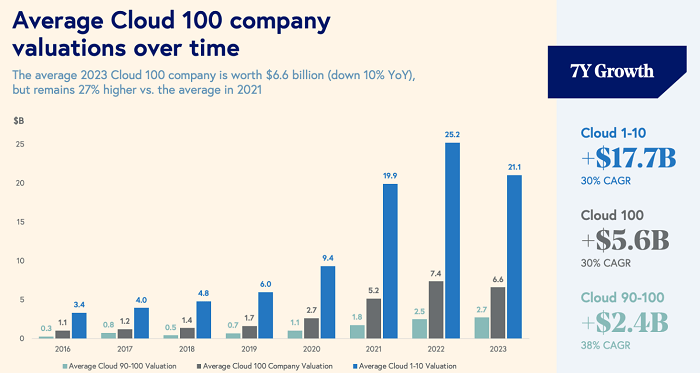

- Figure 1 specifies three numbers for each year: one represents the top 10 cloud companies; another represents the 90-100th private cloud companies; and the third is the full list.

- The average 2023 Cloud 100 company is worth $6.6 billion, 10% lower year-over-year, but still 27% higher relative to the average seen in 2021. It has been a tougher environment but, evidently, not a disaster.

- Over the past seven years, we see that the top 10 private cloud companies grew their valuations at a 30% average annual rate—adding $17.7 billion in value—but we can also note that the companies ranked 90th to 100th grew their valuations at a 38% average annual rate. The important point is that the private markets are seeing valuation expansion across the spectrum, not just across the top companies.

Figure 1: Average Cloud 100 company valuations over time

Source: D’onofrio et al. “The Cloud 100 Benchmarks Report 2023.” Bessemer Venture Partners. August 8, 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

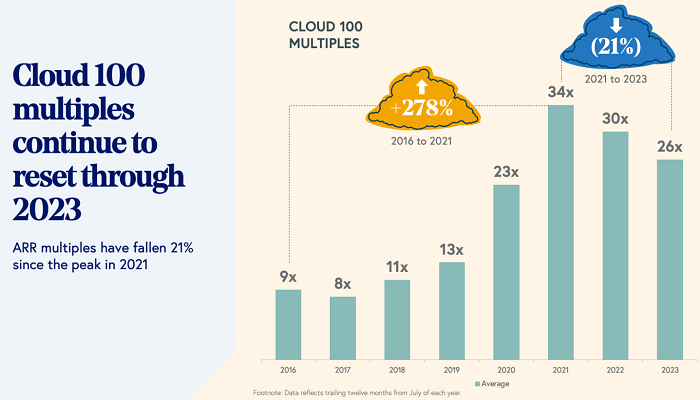

Another important metric for software companies regards ‘annual recurring revenue’ (ARR). One can take the market value of private companies and relate this back to the ARR. Figure 2 shows that, from the near-term peak in 2021, the Cloud 100 has gone from 34x to 26x (a 21% decline) on this basis.

- However, we know that nothing tends to progress in straight line trends indefinitely. From 2016 to 2021, we saw the ARR multiple go from 9x to 34x, an increase of 278%. With interest rates now significantly higher, it was natural to see multiples adjust.

Figure 2: Cloud 100 multiples based on annual recurring revenue

Source: D’onofrio et al. “The Cloud 100 Benchmarks Report 2023.” Bessemer Venture Partners. August 8, 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

Growth is the other side of valuation

Whenever we speak to investors about the valuation of software companies, we make sure to bring growth into the discussion because, relative to many other business models, it may be that software just has a structurally higher valuation multiple. One reason for this is that many software companies also have a structurally higher growth rate.

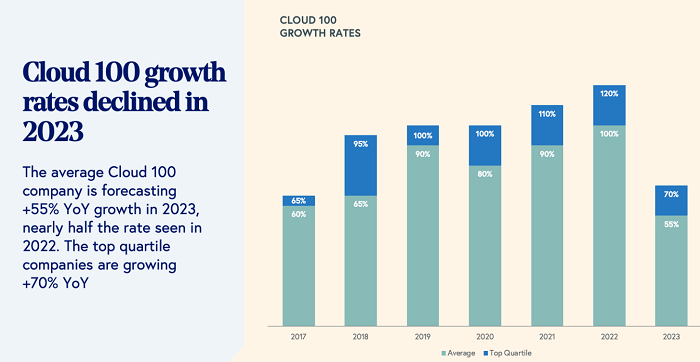

In Figure 3, we see:

- The average Cloud 100 company was forecasting 60% growth in 2017—a figure that grew to 100% in 2022. It is natural that there is some volatility in this measure, so the 2023 figure dropped back to 55%.

- In software, the best companies frequently have fundamentals that are an order of magnitude above the average or poorer companies. If we see the top quartile of the Cloud 100, the average company was forecasting 65% revenue growth in 2017, which expanded to 120% in 2022. This figure also dropped in 2023, but in this case, to 70%.

Figure 3: Cloud 100 growth rates

Source: D’onofrio et al. “The Cloud 100 Benchmarks Report 2023.” Bessemer Venture Partners. August 8, 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

Earnings season: optimisation vs recession

We all saw inflation spike and central banks react, and it was natural to assume that raising policy rates to combat inflation could yield a recession. While a possible recession was discussed, it was important to view overall technology budgets through this lens. Spending on software is not unlimited, and it is this spending from which the revenue growth across cloud computing companies largely comes. One of the most important barometers is the revenue growth at the ‘big 3’ (Google Cloud, Amazon Web Services and Microsoft Azure), since they represent the majority of the cloud market. If these companies see revenue contraction, it becomes more challenging for the general cloud company to showcase strong growth.

- Google Cloud: Google Cloud is the smallest of the big 3 in aggregate, generating a little more than $8 billion in revenue for the quarter ended 30 June 2023, representing about 28% annual growth2.

- Amazon Web Services: Amazon Web Services is the largest of the big 3 on a market share basis, and the platform generated more than $22.1 billion in revenue for the quarter, representing about 12% year-over-year growth. Trailing 12-month net sales for the platform were at $85.4 billion3.

- Microsoft Azure: Microsoft Azure is in the number 2 position on a market share basis within the big 3, and Microsoft reported Azure and other cloud services grew revenues 27% year-over-year on a constant currency basis4.

The year-over-year revenue growth on these platforms is no longer above 30%. However, it is still positive, and we are talking about an overall pool of revenues that is in the range of $200 billion annually.

AI could be an accelerant

The story of 2023 has been artificial intelligence. Alphabet’s earnings call included the following quote5:

Our AI-optimised infrastructure is a leading platform for training and serving generative AI models. More than 70% of Gen AI unicorns are Google Cloud customers, including Cohere, Jasper, Typeface, and many more.

While the future may include more AI on physical devices like smartphones, currently the majority of development, training and inference is done in the cloud.

Microsoft has jumped ahead in the AI storytelling battle, offering access to GPT-4 through its Azure platform and setting a premium price point of $30 per user per month for access to Co Pilot as part of Office 3656.

Many see a ‘battle’ developing between Alphabet and Microsoft, but Amazon.com is no slouch. Within the AWS ecosystem, they have specially designed semiconductors for training (Trainium) and inference (Inferentia) for the efficient training and deployment of large AI models7.

Conclusion: AI and cloud are closely related

We support BVPs view that AI represents an accelerant to the growth of software, as it gives users another reason to assess their tech ecosystem and whether it is up to their evolving needs. While performance is certainly unlikely to be uniform, we believe if AI is taking off, the drivers will be related to cloud’s take off.

Sources

1 Source: Bloomberg, using the BVP Nasdaq Emerging Cloud Index universe, with valuations measured during November and December 2021.

2 Source: https://abc.xyz/assets/20/ef/844a05b84b6f9dbf2c3592e7d9c7/2023q2-alphabet-earnings-release.pdf

3 Source: https://s2.q4cdn.com/299287126/files/doc_financials/2023/q2/Webslides_Q223_Final.pdf

5 Source: https://abc.xyz/assets/f1/cc/ee9f31bd40e399789d3fb8315bc7/2023-q2-earnings-transcript.pdf

6 Source: Weiss et al. “Inspire-d by an Even Larger Microsoft 365 Copilot.” Morgan Stanley Research. July 19, 2023.

7 Source: Amazon Web Services general AI capability information.