One week into the Labour premiership and the self-titled “party of change” have been busy. Here, Shayan Ratnasingam, senior research analyst at Gravis, reflects on the announcements regarding infrastructure that have been made so far.

Infrastructure and Renewables

In her maiden speech, Chancellor Rachel Reeves, reaffirmed many of Labour’s manifesto commitments. This included plans to reform the National Planning Policy Framework (NPPF) and to deliver key infrastructure by taking decisions on large projects at a national level, rather than locally, which will help unlock onshore renewable development.

Labour’s stated policy objective is to triple the UK’s solar and quadruple offshore wind capacity by 2030, from 16.7GW and 14.7GW respectively. A draft of the NPPF, which lays out the details of how this will work, is expected before Parliament rises for recess in August.

The Chancellor released further details around the new £7.3bn National Wealth Fund (NWF) which will be allocated through the UK Infrastructure Bank to support “new industries of the future“. Labour’s manifesto pledged:

- £1.8bn to upgrade ports and build supply chains across the UK

- £1.5bn to new gigafactories so our automotive industry leads the world

- £2.5 billion to rebuild our steel industry.

- £1.0 billion to develop carbon capture.

- £500m to progress green hydrogen

It has been also reported that Labour expects to usher in a further £20bn of private sector money. We are yet to hear details on the nature of GB Energy, but there is optimism about future opportunities. Planning permission reform is long overdue and will be welcomed by investors. This will need to be supported by appropriate budgets for the Contracts for Difference (CfD) scheme, the main mechanism to support renewable energy development, to match the UK’s ambition to meet its net zero goals.

We note the £31bn of capital investment the National Grid has committed to upgrade the UK electricity transmission and distribution network, which was supported by a £7bn equity raise in June 2024. We are still waiting on the details of Labour’s industrial plan required to support the supply chain and required labour skills to support these projects.

Housing

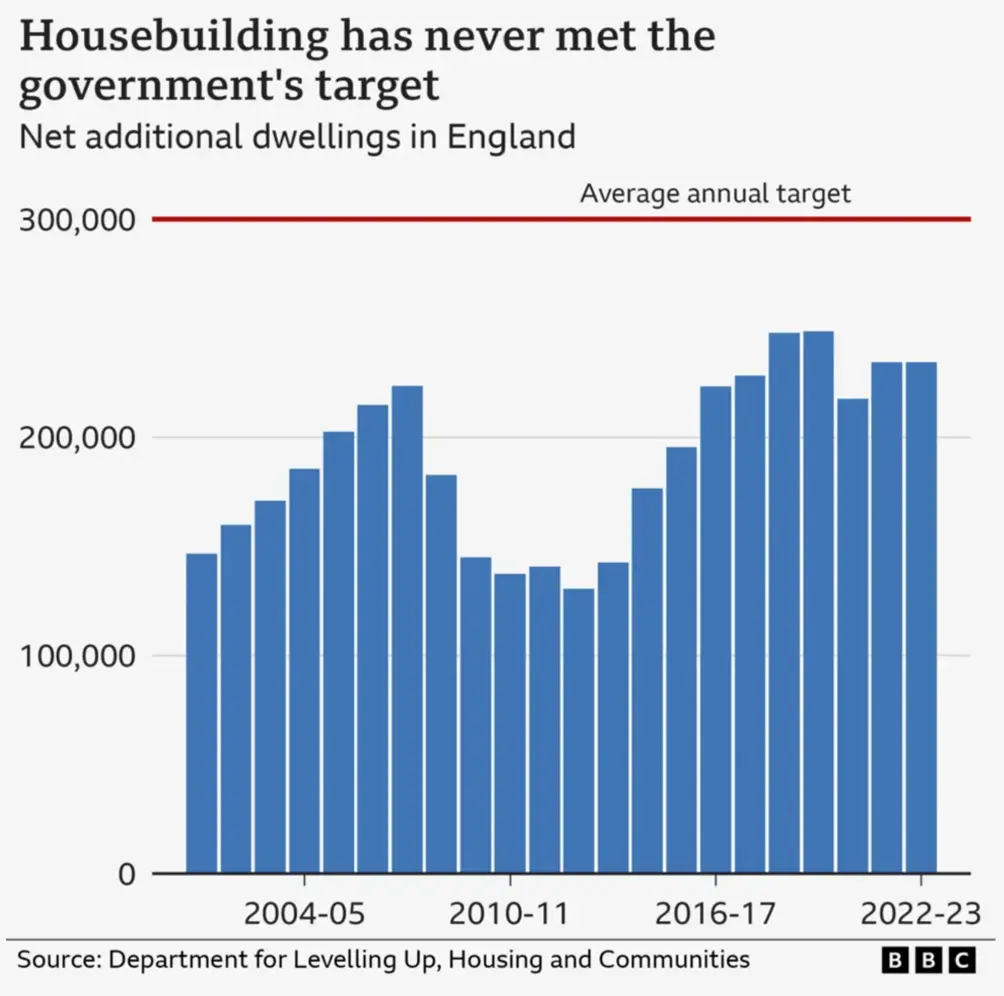

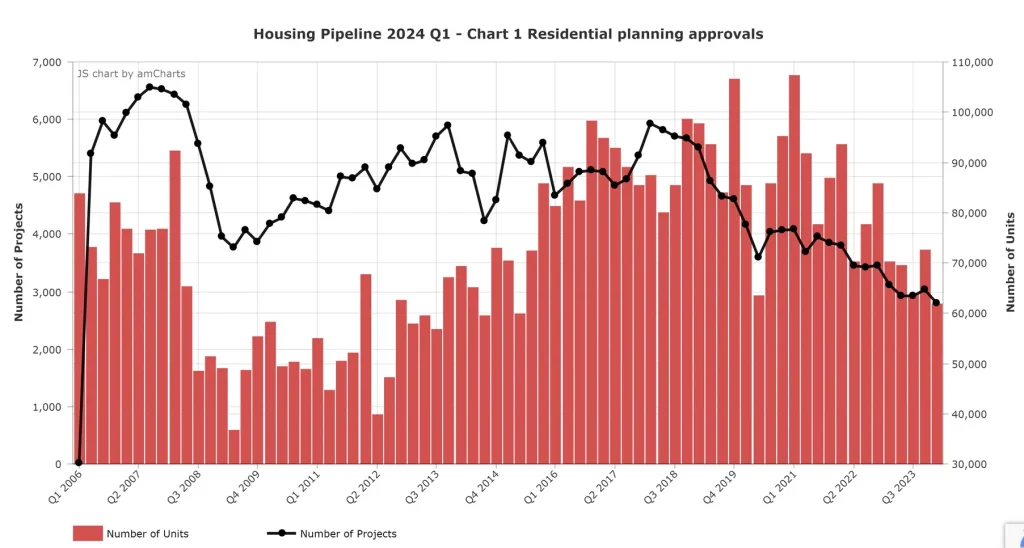

The Chancellor reconfirmed the Government’s commitment to delivering 1.5 million homes and reintroduced mandatory housing targets, a policy the previous Conversative government had failed to achieve. As things stand, in the 12 months to the end of March 2024, the Home Builders Federation reported the number of new homes and sites given planning permission – a lead indicator of future supply levels – was 236,644, the lowest 12-month total for almost a decade.

The Deputy Prime Minister, and Secretary of State for Housing, Communities and Local Government, Angela Rayner, will work with local councils and planning authorities to review green belt boundaries. Labour would like to prioritise building on brownfield sites and poor-quality areas in the green belt, described as the “grey belt”. Knight Frank has previously estimated this could unlock the development for 100,000-200,000 new homes, most of which will be in the south of England and London’s green belt area. The real test will be whether these ambitions can be implemented in the face of local opposition.

Labour is further planning to unlock circa 60,000 new homes by scrapping environmental rules around nutrient neutrality, something the previous Conservative government attempted to get through the House of Lords, and Labour had opposed. The EU directive was initially introduced to protect local ecosystems and water systems from the run-off of polluting nutrients like phosphates, nitrates and sulphates from extra wastewater and sewage produced by new homes and construction sites.

This comes at a time when water companies are already under pressure to invest and reinforce the existing national water infrastructure, whilst simultaneously trying to reduce the cost burden to consumer bills amidst cost of living crisis. With Ofwat having just released its draft determination on the water companies’ business plans, we question whether this has this factored in the potential explosion in house building labour are planning?

Whilst planning reforms and reinstating government mandatory targets are a step in the right direction, it may take years to feed through into new housing stock. There are other challenges Labour will need to tackle, such as labour shortages, and the compatibility of housing projects with the existing infrastructure such capacity in the electricity grid, constraints in the water and sewage systems, and the transportation network. This will require coordination among different levels of government and a national strategy.

There is also the case for the government to provide financial support for both the developers to deliver the homes, especially social housing, and first-time buyers. The Home Builders Federation has recommended the expansion of green mortgages, and the abolishment of stamp duty for the purchase of homes with an A or B EPC.

Data centres

It has been reported that the Deputy Prime Minister has stepped in to review the failed planning application of two data centres in two green belt areas: 84,000 sqm in Hertfordshire, and 65,000 sqm in Buckinghamshire.

This could be a sign that more intervention to support UK’s digital infrastructure is to come – intervention and investment that will be vital to both enabling the UK to embrace what is undeniably a long-term mega trend, and also for the UK to maintain its position as one of the largest data centre hubs in the world.

Water

Last Thursday, UK water regulator, Ofwat, released its delayed draft determinations on the business plans submitted by water companies for the 2024 price reviews (PR24), which covers 2025-30. Ofwat approved £88bn of total expenditure, which was £16bn lower than sought by the water companies but represented a £29bn increase over the previous regulatory period, PR19.

Average bills are set to increase +21%/£19 y/y over the five-year period, or £94 in total in nominal terms vs. the proposed increase of £144. It’s important to also highlight £35bn will be used to invest in new infrastructure, trebling the £11bn in the previous regulatory period. It is estimated the business plans will require the industry to raise £7bn of new equity and £13bn of new debt issuance by 2030.

Thames Water, the thorn in the UK water sector’s side, was placed into special “turnaround oversight regime”, and its business plan received an ‘inadequate’ rating from Ofwat which scaled back its capex request by £5bn to £16.9bn, 20% of which is conditional on Thames Water demonstrating its ability to deliver. The regulator is further threatening to impose a £141m fine if the company does not improve its plans of the final decision.

Labour has effectively ruled out nationalising the water companies as it’s not in line with its fiscal rules, and Ofwat is faced with the dilemma of incentivising water and waste companies to reduce spills and pollution, ensure they earn returns that can secure financing, whilst maintaining an investment grade credit rating, setting a long-term strategy for investment in the water network, and reducing the impact on bills for customers. This inevitably leads to compromise, which will draw criticism for not going further.

Labour described UK’s water network as a “nature emergency” in its manifesto. Following the publication of Ofwat’s draft determinations, Environment Secretary Steve Reed announced a series of measures. This included: (i) ringfencing infrastructure investments – as part of its report, Ofwat had announced plans for a clawback guarantee, which will ensure money not spent on investment is returned to customers; and (ii) consumers will gain new powers to summon board members and hold water company bosses to account. Labour is also drawing up legalisation that will put failing companies in “special measures” with a ban on bonuses for executives, and pursue criminal charges for the worst companies. Such measures are welcomed, but need to be implemented such that the UK water sector remains investable.

Draft decisions are now open for consultation and water companies have until 28 August to respond. It is expected Ofwat will issue its final decisions on 19 December 2024, but may extend into January 2025.

With the announcement of Ofwat’s draft determinations and the political uncertainty removed with a new Labour government, two of three uncertainties that were hanging over the sector have been somewhat lifted. Come December, however, the water companies may appeal the Final Determination, and a referral to the Competition and Markets Authority could prolong the process by 6-12 months.

We are further waiting on the final findings of the Ofwat and Environment Agency investigation, announced in 2021, into the treatment of wastewater and sewage by water and wastewater companies. Preliminary findings have been shared with Thames Water Northumbrian Water and Yorkshire Water, and they are still progressing with a further three. In the case of any breaches, Ofwat can issue fines up to 10% of relevant turnover.

It appears the market has welcomed Ofwat’s draft determinations with the three UK listed water companies, with Pennon (+9.7%), Severn Trent (+7.6%) and United Utilities (+2.6%) performing well on the day, though some of that upside was given back in last Friday’s trading.

Important Information

This article has been prepared by Gravis Advisory Limited (“Gravis”) and is for information purposes only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Any recipients outside the UK should inform themselves of and observe any applicable legal or regulatory requirements in their jurisdiction. It should not be considered as a recommendation, invitation or inducement that any investor should subscribe for, dispose of or purchase any securities or enter into any other transaction with any fund affiliated with Gravis.

Although high standards have been used in the preparation of the information, analysis, views and projections presented, no responsibility or liability whatsoever can be accepted by Gravis for any errors, omissions, misstatements, loss or damage resultant from any use of, reliance on, or reference to the contents. The views and opinions contained herein may not necessarily represent views expressed or reflected in other Gravis communications, strategies or funds and are subject to change.

Gravis Advisory Limited is authorised and regulated by the Financial Conduct Authority registered in England & Wales No: 09910124. Gravis Advisory Limited’s principal place of business is: 24 Savile Row, London, W1S 2ES