We look at the impact of higher inflation on dividends and how this 'new normal' will affect our expectations and investment thesis going forward

Heightened inflation will make it more complicated to identify sustainable dividend growers. We believe a focus on free cash flow margin resiliency will be key

Attractive dividend growth in 2022 should be followed by a healthy but more pedestrian 2023 as many cyclical areas pass peak earnings

The big question is what does an increased inflationary environment mean for dividends over the medium term?

2022 saw the return of inflation. What we haven’t seen is a shift in companies’ dividend policies, which is understandable given their long-term nature. However, we believe we are now likely living through an extended period of higher inflation driven by deglobalisation, energy transition and unfavourable demographics given a rising dependency ratio. In this environment we think many businesses will have to shift their capital return expectations. We are adjusting our expectations to this new normal with the aim of avoiding companies with unsustainable dividend targets.

We believe an ability to show resilient free cash flow margins will be vital in identifying sustainable dividend growers. Consequently, we will be laser focused on ensuring our portfolio companies have pricing power and an ability to manage cost structure and capital investment while operating with a reasonable debt load. This discipline is more important than ever with dividend sustainability more greatly prized in an inflationary environment.

One area we are increasingly cautious about is the US telecom tower sector (and highly levered real estate more generally). US towers have benefited from fixed price escalators of 3% a year1 and falling interest costs, which have driven attractive free-cash-flow (FCF) growth. While the fixed rate pricing now looks less favourable, it can still drive positive operating cash flow growth given limited cost inflation. However, the sector’s high leverage with company bond yields climbing a few hundred basis points provide an ongoing FCF headwind that makes their dividend growth targets look challenging.

Low-cost operators in the energy and mining sector, however, look relatively attractive. Generally, commodity prices have kept pace with inflation while premium assets and strong cost control have led to low break-even price levels. Capital discipline and balance sheet leverage, meanwhile, have improved over the past decade and many players are well positioned for a shift to a greener economy. These business models look more attractive now than when inflation was low and fixed price subscription business models were valued above all else.

A focus on sustainable dividends is vital in income investing. The return of inflation has only reinforced our preference for companies that offer sustainable income and growth, as we believe this is the best approach for total return through the cycle. However, we recognise that the dividend aristocrats – those companies that have the ability to raise dividends every year – will be quite different. Over the past decade, US towers were ideal dividend stocks but this seems unlikely to now be the case.

2022 dividend review

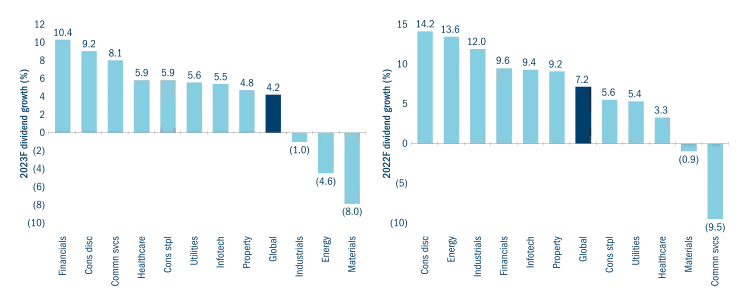

2022 was a good year for dividends, climbing a little over 7% on average globally in a period that saw global GDP crimped by the war in Ukraine and China’s zero-Covid policy (Figure 1 right-hand side). Defensive growth sectors such as consumer staples, utilities and healthcare delivered mid-single digit dividend growth, with the companies in these sectors generally able to pass on inflation through a mix of high margins, pricing power and pass-through mechanics. At the same time, some of the more cyclical sectors such as consumer discretionary and industrials grew dividends in the low double-digit range with companies helped by a mix of recovering end-markets, helpful energy prices and still depressed post-pandemic dividends. At the other end of the spectrum, the materials sector struggled with commodity prices impacting margins for many firms, and the communications sector saw AT&T cut its dividend as it spun off Warner Media2.

Figure 1: Dividend growth by sector – 2023 and 2022

A warm welcome to 2023!

The outlook for dividends is positive in 2023. Expectations are for a rise of 4% globally on average – a healthy if more pedestrian growth rate than we have seen in the past. Dividends from energy and materials sectors face pressure from commodity price movements given dividend pay-out ratio policies at many companies. Financials and consumer discretionary sectors offer good growth, and much of this remains a catch-up in dividend payments from the pandemic period whether due to depressed end markets or restraint in returning capital to shareholders. Once again, defensive growth sectors should generate mid-single digit dividend growth.

2Mention of specific funds is not a recommendation