With global supply chains under increasing pressure, we believe financial intermediaries can help improve the working capital positions of both buyers and sellers while simultaneously earning a premium above the risk-free rate through short-dated investments.

The cup of tea I’m drinking as I write this blog got here courtesy of a global network of companies that fed their information, processes and resources into the finished product. Increased globalisation and offshore production in recent decades served to extend this network.

However, the COVID-19 pandemic and war in Ukraine have strained supply chains and increased pressure on corporations to access liquidity and optimise their working capital positions.

Enter supply chain financing (SCF).

SCF in action

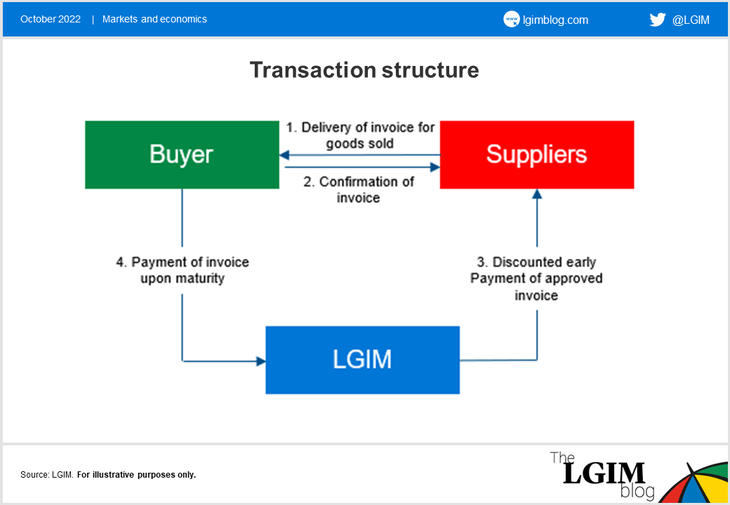

Put simply, SCF is where a supplier of goods sells its invoices at a discount to an intermediary in order to receive immediate payment. The buyer of the goods will then pay the intermediary in full upon maturity of the invoice.

Picture, for example, a large multinational corporation that has around 60,000 suppliers globally and is the world’s biggest buyer of tea. The company enters into an agreement with a SCF intermediary and invites its suppliers to join the programme.

The tea suppliers will invoice the buyer for tea deliveries and will receive immediate payment from the intermediary, who takes a cut. Then, after an extended period, say 120 days, the buyer pays the intermediary in full. All three parties can benefit:

- Buyer: benefits from a more resilient supply chain as the supplier has a stronger working capital position. The buyer may also be able to negotiate extended payment terms, thus optimising their working capital.

- Supplier: benefits from the generation of immediate operating cash flow secured through financing based on the creditworthiness of the large multinational corporate. This is cheaper than borrowing based on their own creditworthiness.

- Intermediary: benefits from a healthy premium above cash, and in many cases above public issuance of the buyer. This is because they can leverage off the market dynamic that is created by the supplier borrowing off the back of the buyer’s credit rating.

Until recently, SCF was a largely bank-funded market. However, banks have been stepping back from this space due to constraints on capital and shrinking balance sheets, creating an opportunity for other large institutional participants to plug the gap. Access to capital can be a major deterrent for small players in this market due to the large volumes involved.

SCF as an asset class

SCF and other working capital strategies can be viewed as an alternative to short-dated liquid credit or an enhancement to existing cash allocations – albeit with less liquidity. They can potentially provide investors with some of the following benefits:

- Premium over cash and risk-free bonds – we have observed pricing ranging from Sonia +0.15-1.5% for investment grade issuance over the last year

- Short-term investments in highly rated issuers have low credit risk

- Historically low volatility due to their floating rate nature

- Short duration in an environment of rising interest rates

- Self-liquidating assets (thus greater funding certainty versus selling liquid assets)

- Historically low correlation to other asset classes

The secondary market for these investments is relatively small, meaning investors should be mindful of the implications for liquidity. However, they typically mature in one to six months, providing a greater degree of natural liquidity than seen in some other private market strategies.

With low market sensitivity, these pools of capital are therefore a potential place for investors to park excess cash while complex and/or long-term investment decisions are being implemented.

We believe investable SCF can play a useful role in a diversified portfolio as well as being a crucial cog in the efficient functioning of our interconnected global supply network. Something to think about when you’re brewing your next cuppa…

Key risk

The value of any investment and any income taken from it is not guaranteed and can go down as well as up, and investors may get back less than the amount originally invested.