Last week was crucial for 3 of the world’s major Central banks. We witnessed a cocktail of rigor and a constructive approach towards the expansionary turnaround of interest rates. The Bank of Japan’s (BOJ) raised interest rates, bringing the reference rate to 0.25%, the highest level since 20081. On Wednesday 31st it was the turn of the Federal Reserve (Fed), which did not make any decisions on rates but, implicitly opened the door to a 1st rate cut in September. Finally, on Thursday 1st August, it was the Bank of England’s (BOE) turn to decide to start the “easing” phase of monetary policy, through a 0.25% cut2.

The BOJ has decided to start the “normalization” of monetary policy, which has been ultra-expansionary until now. The Monetary Policy Committee chaired by Governor Kazuo Ueda, also decided to halve the enormous Japanese Government Bond purchase plan (JGB). Mr. Ueda highlighted the persistent inflation risks, due to the higher costs of imported goods, therefore revising upwards the forecasts for consumer inflation (CPI) for 2025 from 1.9% to 2.1%1. The monthly value of purchases of bonds and exchange traded investment funds (ETF) will gradually decrease to ¥3trn, from the current ¥6trn, starting from the Q1 20251.

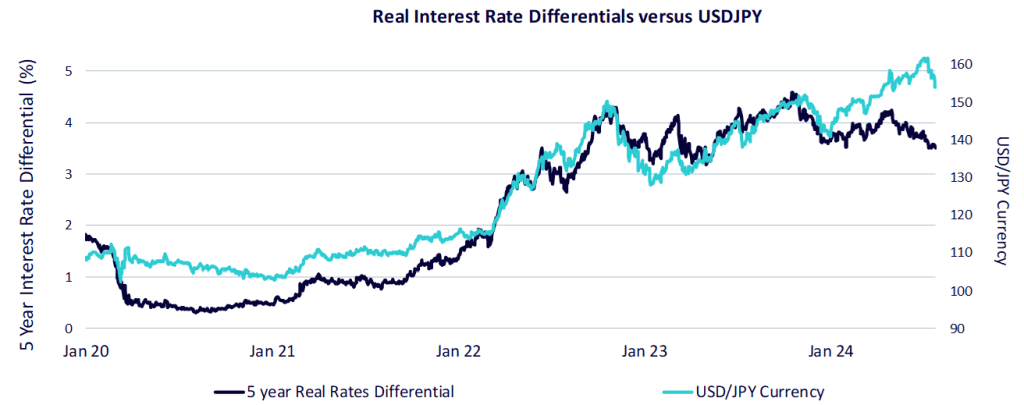

The double move by the BoJ comes just a few hours ahead of the decision of the FOMC (Federal Open Market Committee of the Federal Reserve), which, while leaving rates unchanged, has left the door open for their 1st cut in the September. The choices of the 2 Central Banks are going in the direction hoped for by the markets. The expectations of a narrowing of the interest rate differential between the US and Japan have triggered, in the last 2 weeks, a strengthening of the US Dollar/Yen cross compared to the recent 38-year lows, at 162x.

In the United States, inflation is falling, and growth still remains highest among G10 economies . Powell doesn’t hide a certain optimism but underlines that the Fed wants to see retail inflation that impacts families the most (i.e. PCE – Personal consumer expenditures) fall steadily to 2.0% before acting on the rate cut4.

Inflation has nevertheless fallen significantly and a change in monetary policy appears closer, probably in the September FOMC, which is the last before the American Presidential elections in early November.

However, at the end of July 31st meeting, the Fed preferred to leave the 5.25-5.50% range unchanged for the 8th time in a row, alias at the highest level in over 20 years, explaining that it “does not consider it appropriate to reduce rates until it has greater confidence that inflation is moving sustainably towards 2%”4.

Indeed, although the labour market continued to grow, the unemployment rate went from 3.7% in December 2023 to 4.3% in July 2024 . On the subject, Jerome Powell was clear: “for a long time, since inflation arrived, it was right to keep the main focus on it, but now that it has slowed, and the labour market has cooled we must try to look at both objectives”. The “dual mandate” of the Federal Reserve, that is, to pursue both employment growth and price stability objectives, was therefore reaffirmed.

The BOE on August 1st decided to embark on the 1st rate cut since March 2020 from 5.25% to 5.00%, market expectations were not so clear, and equally so was the vote of the Board: 5 in favour and 4 against, with the decisive vote of Governor Bailey. Bailey was also quick to point out that further reductions will be carefully evaluated to avoid cutting too much or too quickly5.

The drop in consumer inflation in the United Kingdom to 2.0% in June contributed to supporting the hypothesis of a cut in July, although the “core” inflation (ex-food and energy) remained high, 3.5%, as had only happened in 2011 in the new millennium6. Inflation, moreover, could rise again as early as July due to a statistical effect, and then stall around 2.5% assuming that average monthly increases between now and December are between +0.1 and +0.2%7.

For the BoE, the biggest source of concern remains wages, whose growth rate has been close to +6% for several months, and which could have intuitive positive effects on personal spending, but negative effects on inflation dynamics in the remaining part of 20246.

2024, although later than expected, is the year of the turning point towards an expansionary monetary policy in those countries where the fight against inflation had been mainly based on the increase in the cost of borrowing. A gradual decline in interest rates could produce more favourable financial conditions, lower bond yields and better prospects for stock market performance.

Bitcoin's unique role as 'digital gold' in a portfolio

As investors consider the impacts of rate cuts on traditional asset classes, an emerging asset class that can no longer be overlooked is crypto. With a total market cap of over $2trn, crypto has become a key diversifier and growth driver in modern-day multi-asset portfolios . With anticipated rate cuts on the horizon, additional capital may flow into higher-risk assets like crypto. Lower central bank policy rates have historically benefited crypto prices, as seen during the low-interest rate period in the early 2020s. This shift in the macroeconomic environment, along with Bitcoin’s unique role as ‘digital gold’ in a portfolio, growing institutional adoption, and heightened geopolitical risk, positions it to potentially outperform in the back half of 2024.

Fierce rotation across large and small cap stocks

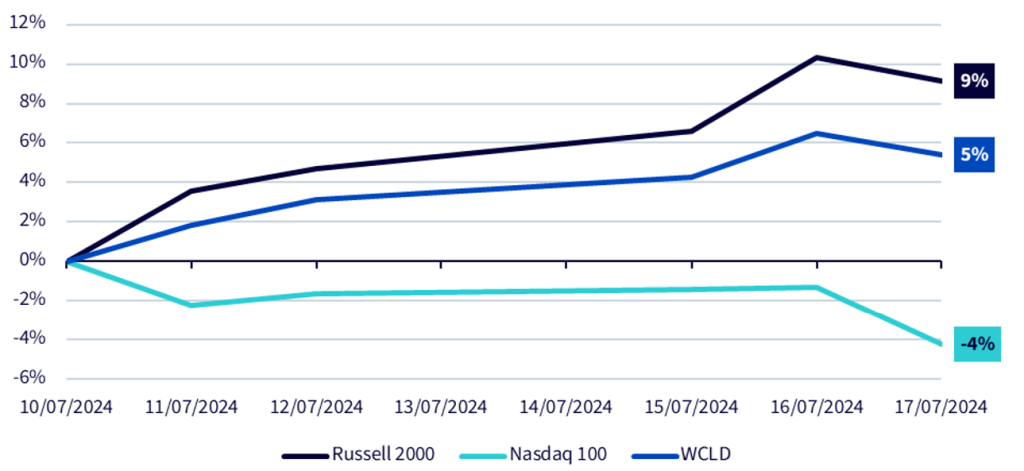

In the world of equities, mid and small-cap stocks responded positively to the expectation of rate cuts. When the US CPI for June was released on July 11, it came in lower than expected, which stabiles the market expectation on the rate cuts in September. As a result, the Russell 2000 index surged by 9.2% in the week following the CPI release9. This development also potentially benefits tech-focused ETFs that overweight mid-small caps.

Take, for instance, the WisdomTree Cloud Computing UCITS ETF (WCLD). WCLD focuses on companies providing cloud-based software and services. Around 62% of its exposure is to mid-small caps as of 31 July 2024. In the week after July 11, the mid-cap and small-cap components of WCLD delivered returns of 5.5% and 10.4%, respectively, while the large-cap holdings in the portfolio returned -1.7%.10 As the anticipation of rate cuts stabilizes, mid and small caps in the tech sector are likely to benefit due to reduced funding costs and improved valuations.

Cumulative Returns Since US June CPI Released

Source: Bloomberg. WCLD’s return is based on the fund’s NAV in USD. Historical performance is not an indication of future performance, and any investments may go down in value.

Yen correction can reverse

USD/JPY has corrected 7.4% off its highs11. The BOJ has made a political decision to support the Yen. This is evident as the Japanese economy’s growth in Q1 was weak and inflation has been falling. In such as scenario we would expect the BOJ to support the economy. Real wages have been falling owing to the relatively higher level of inflation and higher social security contributions. By raising interest rates, the BOJ expects the economy to remain robust and inflation to remain high. However, if these expectations fail to materialise the Yen could reverse its recent appreciation versus the US dollar.

Source

1 Bank of Japan as of 31 July 2024

2 Bloomberg as of 1 August 2024

3 Bloomberg as of 30 June 2024

4 Bloomberg as of 1 August 2024

5 Bloomberg as of 2 August 2024

6 Office for National Statistics as of 17 July 2024

7 Bloomberg, WisdomTree as of 31 July 2024

8 Bloomberg as of 31 July 2024

9 Bloomberg from 8 July to 12 July 2024

10 Bloomberg as of 31 July 2024

11 Bloomberg from 10 July to 1 August 2024