Key Takeaways

- Ethereum Dencun Upgrade has been a success

- Ethereum making progress towards improved scalability

- Cheaper transactions for layer 2’s

- Related ProductsWisdomTree Physical EthereumFind out more

On March 13, 2024, Ethereum achieved a significant milestone with the successful mainnet deployment of the Dencun Upgrade. This upgrade, which represents the culmination of extensive development efforts and collaboration among Ethereum core developers, introduced changes to the network that reduce fees and increase transaction speeds for layer two solutions settling transactions on Ethereum.

Why does this matter? For Ethereum to remain competitive as a layer one smart contract platform, serving as the ‘base layer’ or foundation of the ever-expanding web3 economy, many use cases require cheaper transactions and higher transaction throughput. For example, gaming applications may require significant data transfer, leading to many blockchain transactions, which can amount to high costs when playing a blockchain game. In decentralised finance (DeFi), it may be reasonable to think that structuring a multi-leg DeFi trade on Ethereum for a cost of 50+ USD is small for large investors, but for those deploying smaller amounts of capital, these costs can eat into the position’s potential returns. Through Layer 2 solutions (L2s) that ‘sit on top’ of Ethereum, which ‘bundle’ transactions and settle them on Ethereum together, users and applications can garner cheaper transaction fees and higher transaction speeds, making these innovative blockchain use cases more accessible.

Blockchain and Payments Platform Transaction Speeds and Costs

| Blockchain/Payments Platform | Max Transaction Per Second | Fee (USD) |

| Bitcoin | 10.9 | 6.29 |

| Ethereum | 62.3 | 13.24 |

| Arbitrum | 380 | 0.06 |

| Optimism | 32.9 | <0.01 |

| Solana | 1,604 | <0.01 |

| Polygon | 282 | 1.29 |

| L2 Post Dencun (Est.) | 1,000 | 0.01 |

| L2 Full Danksharding (Est.) | 1,000,000 | <0.01 |

| Visa | 65,000 | *1.30% |

Proto-Danksharding: A Step Towards Full Danksharding

How these reduced costs and improved speeds are achieved is through something called proto-danksharding.

At its core, proto-danksharding introduces a novel transaction type that deals with “blobs” of data. These blobs are stored only for a limited duration and remain inaccessible to the Ethereum Virtual Machine (EVM). By leveraging these data blobs, layer 2’s can substantially reduce the expenses associated with transmitting data, ultimately leading to more affordable transactions for end users.

The term “proto” signifies that this proposal serves as a foundational step toward implementing full “danksharding.” While proto-danksharding provides immediate benefits, the long-term vision aims to extend scalability advantages even further, to a stage where transaction speeds surpass 1,000,000 transactions per second.

The Future of Ethereum

With the successful deployment of the Dencun Upgrade, Ethereum has taken a major step towards solving the scalability problem that has plagued many blockchain platforms. By supporting a variety of layer 2 solutions and dApps, Ethereum aims to become the dominant base layer of the web3 world, where users have more control, privacy, and freedom over their online activities.

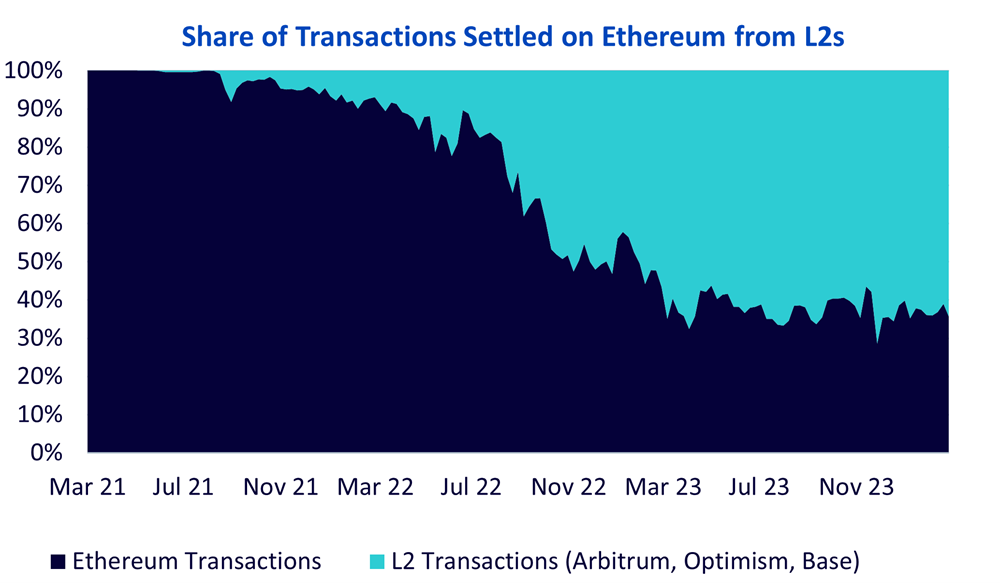

Since late 2022, L2 transactions have become a greater portion of transactions settled on Ethereum. With the introduction of proto-danksharding and the resulting speed and fee benefits, these L2’s have the potential to steal market share from some of the other competing layer 1 smart contract platforms, moving activities from 3rd party blockchains to an already dominant and highly integregated Ethereum / L2 ecosystem. This is a compelling scenario for Ethereum investors, who stand to benefit from the possible increased adoption and innovation of L2s who use Ethereum as their final settlement layer.

The Dencun Upgrade and the introduction of proto-danksharding have set the stage for a bright future for Ethereum. With continued development and innovation, the platform is poised to lead the transition towards a more decentralized and equitable web3 world.

The WisdomTree Physical Ethereum ETP gives investors access to this exciting asset in a simple, secure and low-cost way through regulated, major European markets. WisdomTree was the first established ETP issuer to provide European investors with institutional-grade physically backed crypto exposure, following the launch of the WisdomTree Physical Bitcoin ETP in December 2019. Our physically backed crypto ETPs leverage WisdomTree’s deep expertise in physically backed ETPs, gained from 20 years of experience providing and managing physical gold ETPs. Some of the key features of the WisdomTree Physical Ethereum ETP are:

- 100% physically backed by Ether

- Institutional-grade custody via a dual custodian model

- Secured in ‘cold storage’

- Low cost with a management fee of 0.35%

- Staking rewards through a transparent and risk-managed approach

| ETP name |

MER |

ISIN |

WKN |

|---|---|---|---|

| WisdomTree Physical Ethereum (ETHW) | 0.35% | GB00BJYDH394 | A3GQ45 |