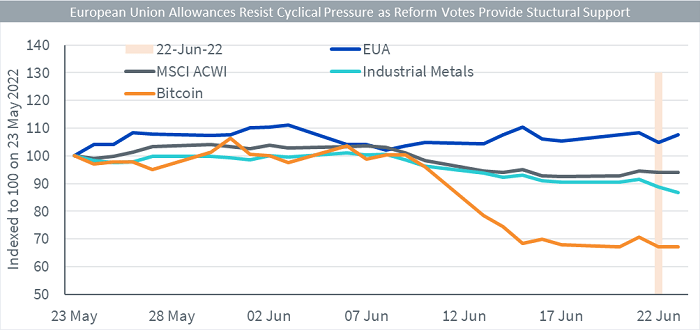

Although European Union Allowance (EUA) futures fell 3.4% on 22nd June 2022, alongside a bloodbath in most cyclical assets, there were reasons for the market to celebrate as the European Parliament finally agreed on a set of reforms that is instrumental for delivering on its climate promises. Key reforms to the European Emissions Trading System were voted down earlier this month as Green, and Socialist lawmakers rejected the proposal because of conservative groups’ amendments they said weakened it too much, while right-wing groups considered it too ambitious. A further set of amendments have been agreed upon by both sides of the aisle, paving the way for a tighter EUA market. We are already seeing EUA prices rally after the broad-based market selloff on Wednesday, 22nd. Moreover, EUA prices have held better over the past month than other assets that are pricing in more recession risk, as EUAs could continue to see structural support..

Source: WisdomTree, Bloomberg. EUA = December 2022 EUA Futures Price, MSCI ACWI = MSCI All Country World Index, industrial Metals = Bloomberg Commodity Industrial Metals Subindex, Bitcoin = Bitcoin/US Dollar cross. All in local currency. 23rd May 2022 to 23rd June 2022.

Historical performance is not an indication of future performance, and any investments may go down in value.

Key outcomes from the 22nd June vote and debates

- New emission reduction goal for sectors covered by the ETS is 63% by 2030 from 2005 levels, a more ambitious target than the 61% proposed by the European Commission

- Faster phase-out of free allowances that are currently given to some sectors that are more internationally mobile (and hence at risk of leaving the European Union). This paves the way for a Carbon Border Adjustment Mechanism (CBAM), to replace free allowances. The CBAM’ levels the playing field’ by imposing a tax on imports of goods that compete with sectors subject to ETS compliance.

- Restricting access to underlying physical EUAs to just compliance entities and financial intermediaries acting on behalf of compliance entities. That is to exclude financial speculations from the underlying EUAs. Financial speculators can still access the EUA futures market. Implementation in 2025 would be still subject to an impact assessment by the Commission in 2023.

- Adjusting Article 29a, which is the ETS intervention mechanism. Previously, if prices of EUAs for the last six months were more than threefold higher than the average price for the preceding two years, the European Commission could release more EUAs, subject to a committee determining that the prices were diverging away from fundamentals. The trigger will be amended so that prices need to double rather than triple the last two years’ average.

- The shipping industry will be included in the ETS from 2024. It will include intra-EU voyages and half of the emissions from extra-EU voyages from 2024-2026.

- The Fit for 55 proposals by the European Commission includes an establishment of a separate emissions trading system for buildings and transport. The European Parliament has sought to exclude households and private vehicles from this new ETS before 2029. Given the cost-of-living and energy crisis, it is unsurprising that this carve-out has been pushed through. A Social Climate Fund, which received support from Parliament on 22nd June, should assist in the decarbonisation of these new sectors.

How is faster decarbonisation to be achieved?

The Linear Reduction Factor (LRF) is the amount by which the cap on emissions covered by the ETS reduces each year. It is currently set at 2.2% per year until 2030. The Parliament has voted in favour of a more aggressive LRF of 4.4% in 2024 and 2025, 4.5% in 2026, 2027 and 2028 and 4.6% in 2029. That compares to the July 2021 Commission’s proposal of 4.4% in the 2024-2030 period. Also, Parliament has voted in favour of a 70 million tonnes re-basement in 2024 and another 50 million tonnes in 2026.

Free allowance phase-out and CBAM go hand-in-hand

Parliament voted in favour of phasing out free allowances from 2027-2032. That is a more ambitious timeframe than the Commission proposed in July 2021 (where they were looking for a phase-out from 2026-2036). The Parliament also extended the scope of CBAM beyond the Commission’s proposal of just cement, power, fertilisers, iron steel and aluminium to include polymers, organic chemicals, and hydrogen (subject to feasibility assessments).

A done deal?

As with everything going through a legislative process, none of this is a done deal. The European Council needs to agree before a trilogue discussion starts (between the Parliament, Council and Commission). France, who is chairing EU Council meetings in the first half of this year, wants to reach a deal on the position of national governments on 27th June 2022. The Czech Republic takes over the Presidency of the Council on 1st July 2022 so France is keen to hit a milestone before the transition takes place. Trilogue discussions are expected in September.

Conclusions

Reaching a Parliamentary agreement on 22nd June was important in keeping the reform process broadly on track after the failed votes on 8th June. Parliament has pushed for a stronger reform on several fronts than the Commission’s proposals in July 2021. Aspects that were weakened, including Article 29a and exclusion of households from the new buildings and transport ETS were highly predictable given the cost-of-living crisis.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.