Oil demand growth is weakening according to IEA

The International Energy Agency (IEA)’s monthly report points to oil demand growth having weakened in Q4 2023 (from 2.8 mb/d in 3Q23 to 1.8 mb/d in 4Q23) due to China. China’s ability to maintain last year’s growth is under question as the post-COVID reopening boost has clearly passed. The IEA expects a 1.2 mb/d demand growth in 2024, compared with 2.3 mb/d last year.

Although OPEC maintains a bullish stance

The Organization of the Petroleum Exporting Countries (OPEC) on the other hand, remains bullish about demand, expecting a 2.2 mb/d increase in 2024. That is close to double the IEA’s forecast. Compared to last month, OPEC had upwardly adjusted it US demand forecasts and downwardly adjusted its European demand forecasts, in an equally offsetting manner.

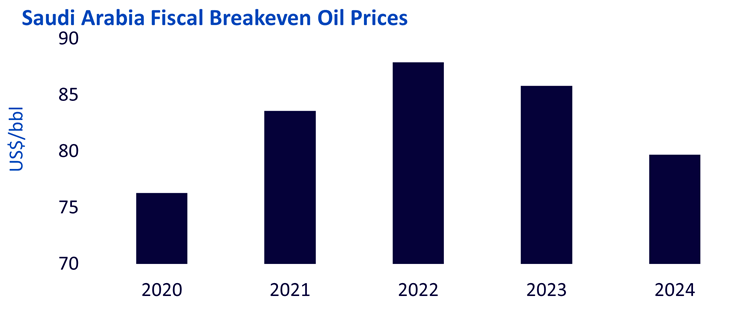

Maybe oil at $80/bbl is enough for the cartel

Based on IEA’s numbers, the oil market risks being in a surplus for most of 2024, if OPEC does not extend its production cuts beyond March 2024. It is therefore surprising that OPEC has not yet started to build the case for more cuts. Possibly Brent crude oil trading above US$80/barrel is enough to keep the group content. The International Monetary Fund’s most recent estimate of the oil price that would allow Saudi Arabia to be in a fiscal balance (where government revenues exactly match its expenditures) sits close to US$80/bbl in 2024 compared nearly US$90/bbl in 2022. Maybe that is why Saudi Arabia’s has not been as vocal in recent months in its call for production restraint as in the past as a result.

But we caution that today’s crude oil price carries a geopolitical premium due to the troubles in the Red Sea. Should that fade, prices could fall, exposing the need for further OPEC restraint.

US supply growth to slow

The US was the strongest source of supply growth in 2023. But there are doubts that pace of growth can be maintained.

OPEC had revised its expectations for US crude oil production in 2024 lower on account of the adverse weather conditions in January 2024. However, at 310 thousand barrels per day (kb/d), its forecast is still a lot stronger than US Energy Information Administration (EIA)’s. The US Energy Information Administration (EIA), which had released its monthly report a week before OPEC and the IEA, had revised its forecast for US crude oil production this year significantly downwards. In January it expected 2024 US crude oil supply growth of 290 kb/d and revised that lower to 170 kb/d in February. Moreover, its forecasts point to total US crude oil production having peaked in December 2023 at 13.3 mb/d and that level not to be reached again until 2025.

While slowing US supply growth will help in the journey to balance oil markets, we believe that OPEC and its partner countries will need to extend its supply restraint and cut production beyond the March 2024 expiry of the current deal. We expect a new deal to be announced in early March 2024.