In this blog, we delve into an intriguing comparison that uncovers the intricate interplay between high interest rates and contingent convertible bonds (CoCos), acknowledging the dynamics governing credit spreads and CoCos spreads as we enter the uncharted territory of the highest interest rates since the inception of CoCos. Factors such as market sentiment, market volatility, macroeconomic shifts, geopolitical events, and regulatory winds contribute to this complex puzzle.

At the core of banks’ operations lies a clear directive: borrowing at lower short-term rates and lending at higher long-term rates. As interest rates ascend to their pinnacle, the net interest margin unfolds. This expanding margin translates into heightened profitability. Picture the act of borrowing at lower rates and lending at higher ones with a substantial gap between them – it’s akin to a sumptuous feast for the financial institution. In the realm of finance, this manoeuvre is textbook material: the classic ‘buy low, sell high’ strategy.

Strengthened by a shared foundation

CoCos benefit directly from the augmented profitability brought about by high interest rates. This robustness resonates through stronger balance sheets, providing a formidable defence against potential CoCos conversion or write-down risks.

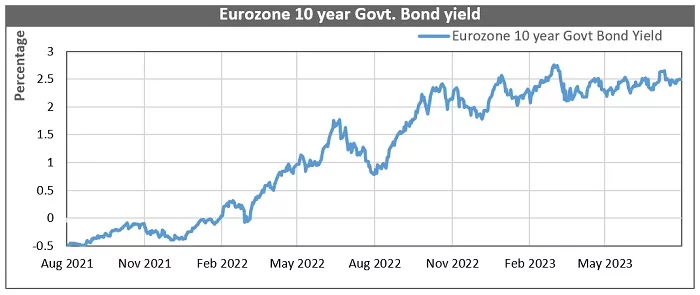

With the European Central Bank (ECB) and Bank of England (BoE) expecting inflation to be higher for longer, it is expected that higher interest rates will also remain, and we are unlikely to see the lower levels of the past for some time. The secondary market has also given similar indications with yields on 10-year and 30-year government bonds trading at multi-decade highs.

Source: Bloomberg. Period from 31 July 2021 to 31 July 2023. Based on BGN quotes of Bid YTM of GTEUR10Y Corp. Historical performance is not an indication of future performance, and any investments may go down in value.

While some smaller banks have recently faced trouble, primarily because of unhedged exposure to longer duration treasuries, we believe the worst is over for the banking sector. The higher rates will likely boost earnings and strengthen banks’ balance sheets as discussed previously. The reduced risk, when fully priced in, could lead to lower spreads on CoCos and potential price gains in the short term. In a rare scenario, where interest rates were to fall in the short term, CoCos are expected to benefit from a drop in yields through potential price gains. It is also important to highlight that CoCos have relatively low duration risk which allows investors to lower their duration risks in the event of further unexpected rate hikes that aren’t already priced in. This highlights the robustness of CoCos at this unique juncture, wherein most scenarios could lead to positive gains with lower duration risk and low write-down and conversion risks.

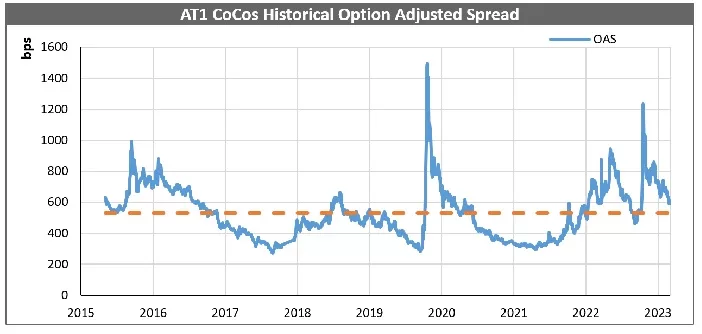

Source: WisdomTree, Markit. Period from 01 October 2015 to 31 July 2023. Calculations include backtested data. OAS is the option-adjusted spread reported by Markit and is based on the effective duration-adjusted market value weighting. Workout dates used in the OAS calculation of individual bonds are reset at the end of the month in case the bonds are not called. This calculation approach impacts the OAS figures for the index intramonth until the workout dates are reset. The strategy is represented by the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value.

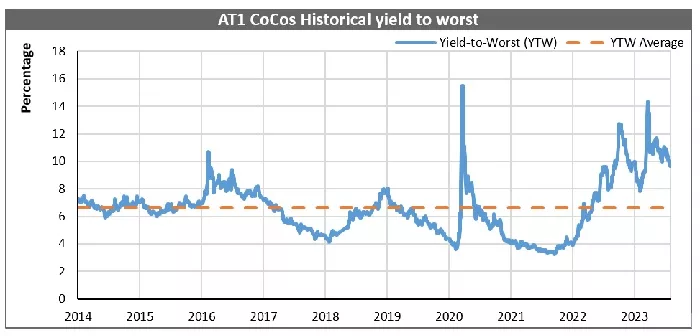

Source: WisdomTree, Markit. Period from 02 January 2014 to 31 July 2023. Calculations include backtested data. YTW is Yield to Worst reported by Markit and is based on the duration-adjusted market value weighting. Workout dates used in the yield to worst calculation of individual bonds are reset at the end of the month in case the bonds are not called. This calculation approach impacts the yield to worst figures for the index intramonth until the workout dates are reset. The strategy is represented by the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value.

Conclusion

In light of the recent shift towards elevated interest rates, we believe that contingent convertible bonds (CoCos) are poised to demonstrate robust performance. This outlook applies to both the short term, where the potential for price appreciation exists, and the long term, propelled by augmented yields. Notably, this is uncharted territory, marked by the highest interest rates ever witnessed since CoCo’s were created and we perceive this as a potential opportunity for an asset class with historically higher risk.