Key Takeaways

- $US1.7 trillion was invested into clean energy in 2023, 65% more than into fossil fuels, and as the energy transition accelerates this gap will continue to widen.

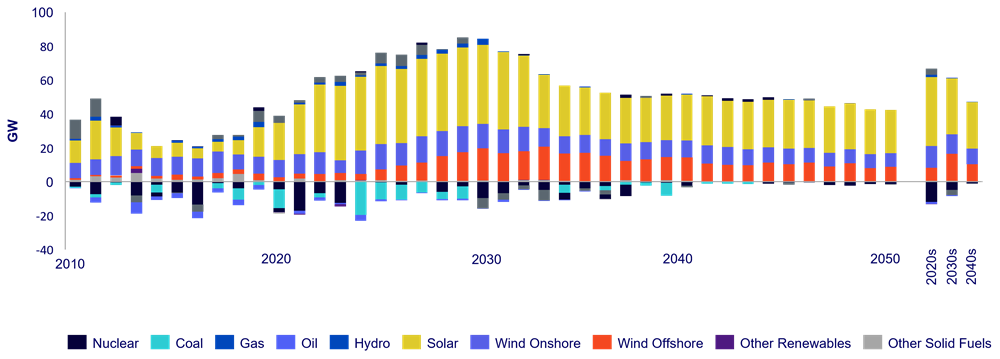

- Wood Mackenzie expects more than 610 gigawatts (GW) of new wind, solar and energy storage capacity to be built across Europe by 2030 alone in a base case and more aggressive climate action would require an even bigger capacity build out this decade.

- Related ProductsWisdomTree Battery Solutions UCITS ETF – USD Acc, WisdomTree Renewable Energy UCITS ETF – USD Acc, WisdomTree Battery Metals, WisdomTree Energy Transition MetalsFind out more

In 2023, the clean energy industry witnessed one of the toughest years in its short history. Supply chain issues, the energy crisis prompted by Russia’s invasion of Ukraine and the ensuing ramp of interest rates and inflation hit all entities across the natural resources value chain. Clean energy bore the brunt of these global tensions more than other sectors in this space. By the end of last year clean energy stocks were down and underperforming against the overall market and their energy market peers.

2024 has begun on a different note. The macroeconomic indicators for the global economy and key markets are increasingly positive. The clean energy investment landscape remained quite robust through the 2023 headwinds and that’s a solid foundation for further expansion, especially as new routes to market open up. COP28 gave the energy transition a boost, in terms of new commitments, and demand across the clean energy value chains is showing signs of life. 2024 could well prove to be a renaissance for the energy transition.

Macroeconomic investment conditions improving

Central bank interest rates are likely to get cut after two years of aggressive hikes. Investment delays have resulted in pent-up capital, with investor appetite for the power and renewables opportunities afoot across Europe. Although rates may drop slower than most onlookers wish, we expect the soft-landing outlook with resettling of interest rates to spur on investment activity once again.

Clean energy investment foundation is strong

Although investment sentiment in relation to fossil fuels has shifted recently, to make them somewhat fashionable again as energy security has been reprioritised, the energy transition and investment into clean energy has not slowed down. $US1.7 trillion was invested into clean energy in 20231, 65% more than into fossil fuels, and as the energy transition accelerates this gap will continue to widen. Wood Mackenzie expects more than 610 gigawatts (GW) of new wind, solar and energy storage capacity to be built across Europe by 2030 alone in a base case and more aggressive climate action would require an even bigger capacity build out this decade.

Figure 2: EU 27, UK & Norway – net capacity additions. Strong focus on change by 2030 delivers a surge in renewable investment, 613 GW of low carbon capacity in needed to reformat the system by 2030.

More routes to market opening

In addition, routes to market for renewables are also reopening. Government administrations are increasing auction ceiling prices to ensure they bring much needed wind and solar capacity to market once again. For instance, after no successful bids in 2023, the UK Government is increasing its offshore wind auction ceiling price by 66% from £44/MWh to £73/MWh to spur on the market once again.

Power purchase agreement2 (PPA) markets are also set to strengthen. Solar PPA volumes came back in 2023 after a slump in 2022, due to an uncertain market with major policy shifts, such as windfall taxes and high-price pressures. On the other hand, wind PPA volumes continue to slump, with a cost premium to solar and longer development lead times. However, as these issues subside, this market should also pick up in 2024.

Batteries moving to centre stage

Meanwhile, recycling electrons to enable renewables is now a strong growth market across Europe. Battery energy storage, a technology often underestimated and misunderstood, finally takes off. Solar hybridization3 ramps up and as the market matures primary applications move to trading and arbitrage, the largest value pools in power markets. Wood Mackenzie forecasts the 34 gigawatt hour (GWh) installed base in 2023 to grow ten-fold by 2032.

COP28 boost

COP28 will be remembered as one of the most important COPs and a decisive moment in the fight against climate change. There are two main reasons for this assessment.

COPs are judged on the deals reached and COP28 meant business. The World Climate Action Summit brought together high-level talks amongst 154 Heads of State and Government, and 22 International Leaders on 1-2 December. The event brought forth new deals on loss and damage – the liability payments no other COP has been able to deliver on – plus new deals on the potent GHG methane and technology specific accords on renewables, nuclear and carbon capture. Two weeks later, the talks closed with an unprecedented acknowledgment of the need to transition away from the fossil-fuelled energy system. It’s taken about 30 years of negotiation to get such a statement. From Rio, to Kyoto, to Paris, climate change talks have never been able to reach agreement on this point. The importance of bringing the cause of climate into the agreed response is a watershed and a major boost for the energy transition.

Conclusion

The potential for a renaissance is not without risk. All eyes are hoping for an acceleration of interest rate reductions. If reductions do not materialise this will push the market back. Renewable power markets in Europe continue to be agonisingly coupled with gas prices setting the underlying power price. Another unsettling event on wider global geopolitics could have detrimental consequences on energy prices for this sector and slow down this much needed upturn. And yet, with robust macroeconomic fundamentals, capable value chains and policy tailwinds, 2024 has kicked off with increased expectations that the promise of the energy transition will be realised in the year to come.

Solutions available through WisdomTree

WisdomTree has partnered with Wood Mackenzie to offer investors a range of solutions in the energy transition theme. Wood Mackenzie’s deep industry expertise is embedded within the products to offer investors a thoughtfully crafted exposure to various aspects of the energy transition theme.

WisdomTree Battery Solutions UCITS ETF (VOLT) invests across the battery value chain which is a function of four key categories – raw materials, manufacturing, enablers, and emerging technologies. Within those categories, the fund gives investors exposure to as many as 37 different subsectors.

WisdomTree Renewable Energy UCITS ETF (WRNW) gives investors exposure to the renewable energy value chain by identifying 32 unique subsectors across raw materials, manufacturing, enablers, application, and emerging technologies.

Investors also have the option to invest in carefully curated commodity baskets. WisdomTree Energy Transition Metals (WENT) invests in 10 key energy transition commodities: aluminium, copper, nickel, platinum, silver, tin, zinc, lead, cobalt, and lithium. WisdomTree Battery Metals (WATT) invests in 7 key battery commodities: aluminium, copper, nickel, zinc, lead, cobalt, and lithium.

Sources

1 Source: International Energy Agency (IEA)

2 A power purchase agreement is a long-term contract between a generator of electricity, who supplies the power, and a customer, who is the offtaker. Customer types include utilities, corporations or governments.

3 A hybrid solar system allows the output of a solar system to be first fed into a hybrid inverter and battery storage system before any generation is delivered to the grid, thereby allowing the producer to retain a portion of output for selective own use or sale.