After the start of the global value rotation towards the end of 2021, thematic assets in Europe decreased from $371 billion to $276 billion as of 30 June 20221, mainly due to performance. A significant correction in many themes resulted in a slowdown in thematic flows but pointed to the relative resilience of the European thematic exchange traded funds (ETF) market, with thematic ETFs gathering more flows in Q2 than open-ended funds.

Open-ended funds experienced a larger percentage drop in their assets under management (AUM), compared to ETFs2, as they lost around $85 billion, or 26.4%, compared to around $10 billion, or 20%, in ETFs. The impact on AUM from performance year-to-date was similar in both open-ended funds and ETFs. However, exchange-traded vehicles gathered $3.5 billion or around 23% of the total flows they gathered last year when open-ended funds gathered just $7 billion, or 7% of last year’s flows.

In Q2, the correction that started originally in the growth space further expanded to broad equity markets amidst higher prospects of more hawkish monetary policy in the United States and fears over ensuing economic slowdown and a potential recession. Many themes extended their drawdowns even further. Resurgence of China-centred themes in June was one of the bright spots within the thematic landscape.

In this quarterly thematic review, we will look at the space and analyse the second quarter as well as the first half of the year through the lens of performance, flows, and new launches. For all of our calculations, we will use the WisdomTree Thematic Classification that we have previously introduced in a series of blogs in which we discussed how to classify and select thematic funds.

Winners and losers

As noted in our research paper on thematic investments, themes tend to rotate in flows and performance over time due to their individual narratives. For example, compared to a rough Q1, China-centered themes were most resilient in Q2. They posted strong returns relative to the global equity benchmark in June, as lockdown policies eased in China and the government expressed readiness to provide stimulus for propping up the economy.

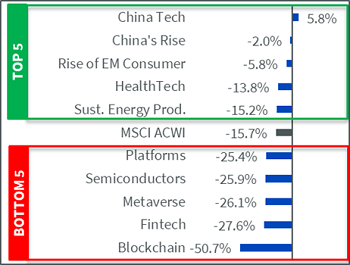

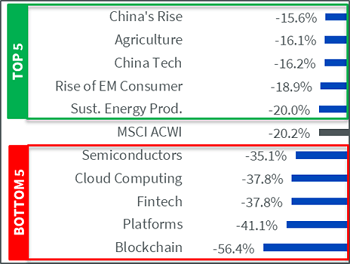

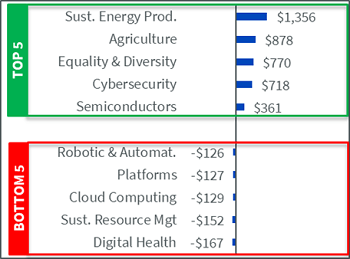

The MSCI ACWI Index lost 15.7% in Q2 and -20.2% year-to-date. Only five themes beat the benchmark year-to-date and seven in the Q2. Overall, most themes posted more negative returns in the Q2 in comparison to the Q1. The major exception were the top 3 themes that benefitted from the rebound of Chinese stocks in June. The performance differential in Q2 vs other themes allowed the China-centered themes to be in the top 5 performing themes year-to-date as well.

Notably, the top performing theme, “China Tech”, was the only theme that delivered positive returns in Q2. “HealthTech” was another technological theme in the top 5 that held up better in the Q2, but year-to-date, it has shed -25.7%. Apart from the themes focused on the Chinese market, sustainable energy production was another theme that appeared in the top 5 both in the Q2 and year-to-date. “Sustainable Energy Production” and “Agriculture” might have better resisted the global correction in equity markets year-to-date, as the war in Ukraine brought them into the spotlight.

Figure 1. Q2 (left) and year-to-date (right) performance of the top 5 and the bottom 5 themes vs MSCI ACWI

Source: WisdomTree, Morningstar, Bloomberg. All data as of 30th June 2022 and based on WisdomTree’s internal classification of thematic funds. Performance is based on monthly returns from Morningstar. Emerging Market (EM).

Please refer to Footnote 1 for the details around the calculation of performance for a given theme.

Historical performance is not an indication of future performance, and any investments may go down in value.

The bottom of the performance spectrum continues to be composed of technology themes, as growth stocks continued to suffer from the value rotation. For most of the themes, we can note crypto, e-commerce and digital payments as common denominators.

A collapse of UST/LUNA around mid-May, deleveraging in the decentralised finance (DeFi) space, and a general risk-off sentiment in the financial markets contributed to the significant correction in blockchain. Platforms & digital markets and fintech & digitalisation of finance were falling out of favour already earlier in the year amidst the concerns over deceleration in the pandemic-driven growth and broader rotation out of growth stocks. The downward trend continued with new strength into the second quarter as inflation, economic slowdown, and recession fears did not bode well for consumer spending and hence potential revenues for e-commerce and digital payment companies.

Semiconductors and cloud computing were the other two tech themes that suffered amidst the global value rotation. The valuations for many cloud computing companies have seen a steep correction from its peak in November last year, offering entry avenues for investors believing in the long-term growth potential offered by the megatrend. As for semiconductors, the global chip shortages over the past two years incentivised companies to work towards ramping up their production. While increasing inflation and economic slowdown are now contributing to uncertainty on the demand side, putting downward pressures on the revenues and margins in the industry.

Flows were muted but point to resilience in ETFs

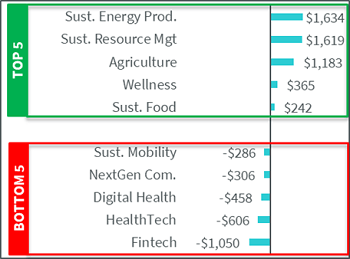

Thematic flows significantly slowed down in 2022 as part of the broader risk-off sentiment in the markets, but the slowdown was much more pronounced for the open-ended funds. In the second quarter, flows into ETFs outpaced open-ended funds, $1.8 billion vs $1.7billion, respectively. This greatly contrasts the annual figures in the last five years, where flows into thematic ETFs amounted to 10%-25% of the open-ended funds. Regarding the most popular themes in Europe, climate change and sustainability themes continued to gather the bulk of the flows.

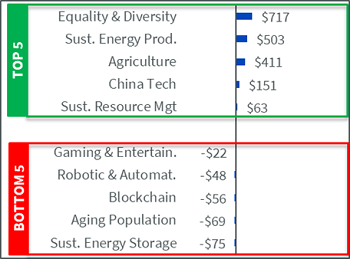

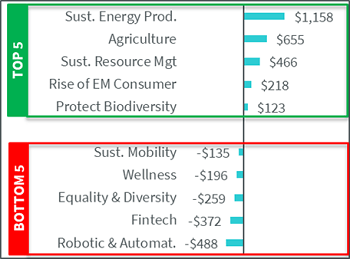

Figure 2. Q2 (top) and year-to-date (bottom) flows in Europe of the top 5 and the bottom 5 themes – ETFs (dark blue) vs open-ended (OE) funds (teal)

Source: WisdomTree, Morningstar, Bloomberg. All data as of 30th June 2022. Data based on WisdomTree’s internal classification of thematic funds.

Historical performance is not an indication of future performance, and any investments may go down in value.

Year-to-date, flows into open-ended funds are still far ahead of ETFs, with $7.5 billion vs. $3.5 billion. Open-ended funds have predominantly suffered from outflows in the technological themes, with $3.6 billion outflows year-to-date and $1.2 billion in Q2 alone. In contrast, to open-ended funds, the tech-focused thematic ETFs were more resilient and continued to gather assets with positive inflows of $177 million in Q2 and $503 million year-to-date. Year-to-date, 4 out of the Bottom 5 themes by flows in both ETFs and open-ended funds were from the technological shifts. However, the picture has slightly changed in Q2, as investors might have found entry opportunities within the tech themes created by the global value rotation.

In contrast to the outflows in open-ended funds, equality, inclusion & diversity was the top gathering theme within ETFs. At the same time, sustainable energy production and agriculture continued to gather significant flows in both wrappers with $1.7 billion and $1.1 billion, respectively. The former theme continued to feature in the top 5 flows from quarter to quarter in the last year, while the agricultural theme entered the top 5 only last quarter potentially on the back of the rally in agricultural commodities amidst the global supply tensions created by the war in Ukraine.

Notably, China tech and the rise of the EM consumer have gathered flows in the second quarter coinciding with the relatively strong performance in both themes.

No sign of deceleration in ETF launches

Huge slowdown in flows within open-ended funds in Europe might have influenced the pace of fund launches in the space. The number of newly introduced funds amounted to 53 compared to 138 for the full 2021 year3. Despite the outflows this year, most of the launches are happening within the technological shifts cluster and such themes as healthtech and metaverse.

In contrast, the thematic ETF providers continue to grow the space with 29 new strategies launched year-to-date and 11 this quarter. Last year the thematic ETF market expanded by 44 products. So, the launches in 2022 are currently on track to overtake that figure. The majority of year-to-date launches in ETFs continue to focus on the “Environmental Pressures” cluster followed by technological shifts. Sustainable energy production andsustainable mobility strategies prevailed in environmental pressures, while technological shifts had a much more diverse mix of launches.

We will continue to closely watch the space in Q3 2022 and we will summarise our findings in the next WisdomTree Quarterly Thematic Review. Stay tuned.

Footnotes

- Performance of a theme: For any given theme, we consider each month all the ETFs and open-ended funds classified in that specific theme that have published a monthly return for that month in Morningstar. We then calculate the average of all those monthly returns to compute the average monthly return for that theme. So, the monthly return for January 2020 for the theme may include 19 funds, while the February 2020 return may comprise 21 funds (if two funds classified in that theme have been launched in the meantime). By collating monthly returns for the theme, we get the theme’s average historical performance. Therefore, the theme’s average historical performance incorporates every ETF, and open-ended fund focused on this theme. The theme’s average historical performance is not biased towards surviving funds or successful funds. Every fund alive in a given month is included irrespective of its future survival or success. Investments that try to focus on multiple themes and, therefore, classified either at cluster or sub-cluster level are not included

Sources

1 Source: WisdomTree based on its Thematics Universe and the underlying data on AuM for the funds provided by Morningstar, as of 30 June 2022.

2 Source: WisdomTree based on its Thematics Universe and the underlying data on AuM for the funds provided by Morningstar, as of 30 June 2022.

3 Source: WisdomTree based on its classification of new fund launches reported by Morningstar, Bloomberg