Key points:

- The equity outlook for 2023 is more positive than last year due to easing inflationary pressures, a peak in the rate tightening cycle and cheaper company valuations.

- While recession is likely in the UK, well-capitalised banks and healthy consumer savings mean that the dip could be more shallow than previous downturns.

- Long-term trends driving sectoral growth remain in place and we are maintaining our focus on these through this period of uncertainty.

As we look ahead to what 2023 might hold for investors in UK equity, many of the same questions the market had in 2022 are still being asked. What level do rates need to reach to solve the inflation problem? And what damage will they do on the way there?

2022 will not be a year that investors look back on with much fondness. It was the worst year for equities since the global financial crisis and the worst for fixed income in over 200 years. The year started nervously, with the inflation debate raging and the somewhat optimistic term ‘transitory’ having already become the buzz word.

Then Putin invaded Russia and everything changed. Energy costs spiked combined with Covid induced shortages drove up the price of pretty much everything. Caught off guard, central banks could not stare double digit inflation in the face and do nothing, leading to a round of steep interest rate rises across developed markets.

Equity markets went into retreat throughout the year, with long duration growth equities bearing the brunt of the impact, globally and not least in the UK.

2023 could see the pressure start to dissipate

For equity investors, at least the starting point for 2023 has been very different from last year. Valuations are below their long-run average and most economic forecasters believe that policy rates will go only a little higher (the ‘market’ is not anticipating too many more interest rate rises in this hiking cycle….).

What evidence do we have to reassure us that this might be the case?

- Many of the cost inputs into inflation – raw materials, supply chain, labour availability, freight rates – appear to be easing.

- The strength of the US Dollar has faded and should also help bring inflation back down, as many of these inputs are ‘dollarised’.

- As a result, moderating inflation data and a balanced approach from the Bank of England should relieve the upward presusure on interest rates.

Between them, these factors could pave the way for UK equities to move higher.

Uninspiring earnings could sap market enthusiasm

The most pressing near-term headwind to navigate is corporate earnings. At best, these are set to be uninspiring as slowing demand, caused by inflation, and accelerated interest rate rises are coinciding with elevated wage growth. As a result, both the top and bottom lines are going to be challenged.

On a positive note, the banking system is going into a potential recession better capitalised than it has been in decades, suggesting that a shallower outcome is more likely than a deeper one.

As long-term investors, it is our job to stay focussed and true to our core investment beliefs. These hold that the real drivers of equity outperformance are not short-term but rather reside in the hands of companies that have the ability to expand their economic output over the long-term. It is easy to lose sight of this during periods of market turmoil when capital flows react to competing macro-economic forces.

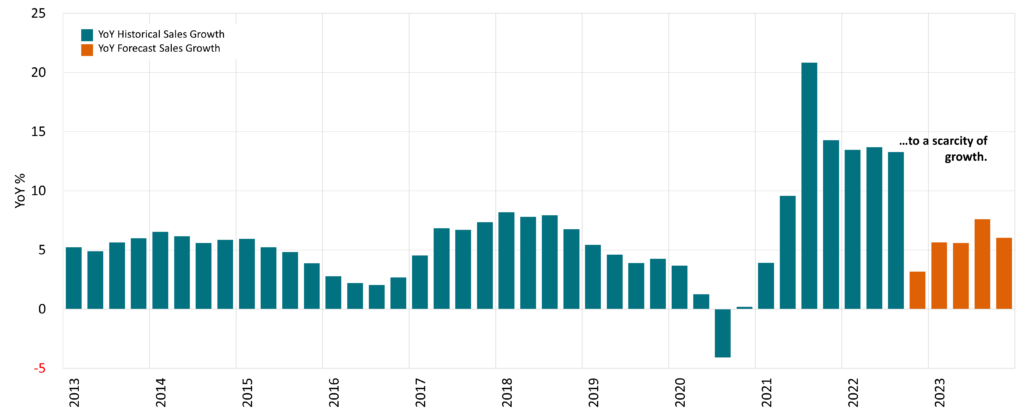

The post-Covid bounce meant growth was abundant and ubiquitous, a far cry from the situation leading up to the event. This left structural growth companies looking expensive as growth was available in the ‘old economy value companies’ that had been previously limping along for many years. Higher-for-longer interest rates will mean growth once again becomes a scarce commodity and investors will once again seek the unique attributes of growth companies.

Scarcity of growth in 2023

MSCI All Countries World Index historical sales growth (median)

Source: AXA IM, FactSet, Bloomberg as of 31/12/2022. For illustrative purposes only. Past performance is not an indicator of future returns

Long-term trends drive long-term returns

We seek to invest in sustainable global megatrends, which are so called for good reason. While decisions may get delayed, the tectonic plates of change ensure that they won’t get derailed.

The trends we are investing in include:

Planet – Climate change and decarbonisation

The critical need to reduce the human impact on the planet will ensure that businesses such as SSE – which supplies the green energy that the UK will need for generations to come – will stay resilient. In addition, businesses providing sustainability benefits linked to resource and energy efficiency, sustainable infrastructure and low-carbon transportation will enjoy strong end markets for years to come. We believe Rotork, DiscoverIE, Weir and Trainline are well-placed to capture this.

Progress – Automation and digitisation

Automation and digitalisation continue to resonate in both a high and low inflation world as companies seek efficiency gains, cost reductions as well as improved customer service and convenience. Kainos and Kin & Carta are helping to enable this change and are likely to deliver growth as a result. While online penetration has fallen back to its long-run average, after the Covid surge, it is still set to continue its relentless upward march. Companies such as GB Group, Rightmove, Experian and Accesso are set to remain long-run beneficiaries of this trend.

People – Demographics

An ageing global population and growing global middle class present enormous opportunities for healthcare solution providers. Companies associated with the ever-increasing levels of research and development associated with it. Astrazeneca, Croda, Convatec and Oxford Nanopore are likely to show both growth and resilience in their earnings thanks to this.

Making predictions around likely return outcomes in 2023 is challenging. However, on a medium-term view we believe our investments are well positioned to ride through any possible turbulence.

We believe we own good quality businesses that can reinvest and compound their returns over time by actively focusing on responsible, reliable and ultimately sustainable businesses. Maintaining a disciplined approach and robust investment process provides the most certain path to potential long-term return.