On a recent episode of the Behind the Markets podcast, I had the opportunity to speak with Catherine LeGraw of GMO, a partner at GMO and member of the firm’s asset allocation team.

We had a fantastic discussion about GMO’s investment philosophy and her team’s high conviction trades. Summing up the GMO process is a unifying philosophy focused on valuation and the belief that the price you pay for an asset is a strong predictor of long-term returns.

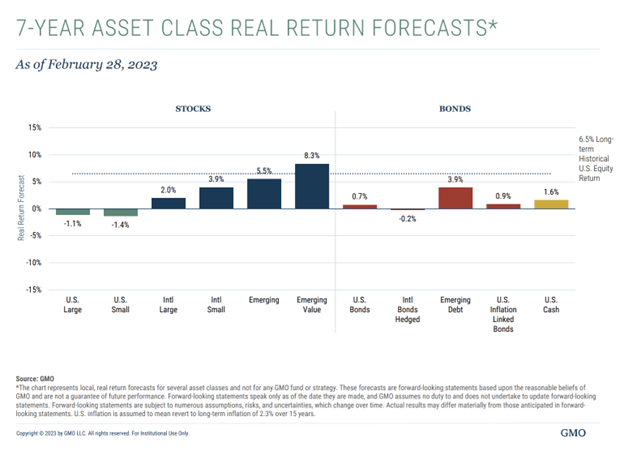

Many of the views we discussed stem from the GMO forecast for real, after inflation returns over the coming 7 years and Catherine graciously shared the February analysis with us here for our discussion recap.

Readers can go to the GMO website monthly around the middle of the month for updates to this chart.

Stocks vs bonds, or both?

GMO’s asset allocation team is more constructive across asset classes than a year ago, after the sell-off. About a year ago, bonds looked expensive near historic lows on interest rates. Today, there is more income to be had. While GMO was leaning more heavily into liquid alternatives last year, recently they are taking more equity beta risk and more duration risk.

Forced to choose, Catherine would pick stocks over bonds, but GMO likes both stocks and bonds more than they did last year.

The GMO model inputs

Catherine discussed how valuation is a huge driver of these forecasts. Each forecast has two components:

- An expected return absent any valuation change. It’s effectively the expected return from fundamentals. So for equities, dividend yield and real growth. From bonds, it will be real yield.

- The other component is expected return from valuation. GMO assumes all assets will return to a long-term fair valuation and builds expected repricing toward fair value.

‘We still love value’

GMO’s work shows value is still quite cheap and it is the team’s highest conviction view right now in terms of an active view. Catherine believes the value versus growth cycle could be just half way through a 4 year or so estimated cycle.

In Catherine’s work, value still needs to outperform growth by about 40% to get to their team’s acceptable fair value.

Their team has so much conviction in the long-term idea here, GMO launched a long value, short growth strategy back in 2020, signaling this would be a megatrend here.

International stocks offer a ‘trifecta’

Catherine sees a trifecta supporting overseas ideas.

- The broad equities have a forecasted real return in the range of 5 to 7% for Europe, Japan, and those non-US developed markets.

- If you’re willing to tilt into the value half of these markets, the value spreads are particularly wide and can capture another 2 to 4% by tilting to value within these markets.

- GMO sees non-US currencies as cheap, offering another 1 to 2% in currency appreciation potential against the US dollar.

0% real return for the S&P 500?

Contrasted with a nearly double-digit forecasted real return for international value stocks, GMO sees the S&P 500 Index with zero real return. By contrast, the deep value part of the US market GMO sees in the 5 to 7% range—similar to the longer-term equity premium for US stocks as a whole. So this is saying the dominating growth segment is really dragging down the GMO forecasts.

Small value?

GMO is tilting towards small cap value, so the value half of small cap, and quite likes Japan small cap value. In the US, small cap quality is their favorite factor at the moment.

To listen to our full conversation with Catherine, please see the following link:

https://open.spotify.com/episode/5ruM9SrZcptnDL0H8n0lZj?si=tcLR7gSQTPWBsSGquFdN6A