‘Don’t put all your eggs into one basket’ is a well-known phrase highlighting the importance of diversification. When investors diversify their portfolios, they allocate to different asset classes and/or to different assets within their selected asset class.

Key Takeaways

- Bitcoin is a cryptocurrency mega cap name with a significant track record.

- As bitcoin is not correlated to traditional assets, it can significantly improve a multi-asset portfolio’s risk/return profile.

- While the Sharpe Ratio increases together with an increase in bitcoin allocation within 60/40 Global Portfolio, a 1% bitcoin allocation is a sensible starting point for most investors as it represents a market-neutral view.

- Related ProductsWisdomTree Physical Bitcoin, WisdomTree Physical Crypto Mega Cap Equal Weight

Find out more

‘Don’t put all your eggs into one basket’ is a well-known phrase highlighting the importance of diversification. When investors diversify their portfolios, they allocate to different asset classes and/or to different assets within their selected asset class.

By way of example, equity investors can diversify their portfolios by investing into:

- Emerging markets alongside developed markets

- Small caps alongside large and mid caps

For multi-asset investors, sensible allocation to alternatives alongside standard equity and fixed-income investments can be key for achieving the best outcomes.

An asset class that can no longer be ignored

By now, cryptocurrencies have an over 15-year track record and represent a significant portion of the investable market portfolio. While most investors would prefer to pretend that cryptocurrencies do not exist as they are still relatively difficult to understand and assess, they now understand that they need to spend some time getting their heads around this nascent but rapidly growing and developing asset class.

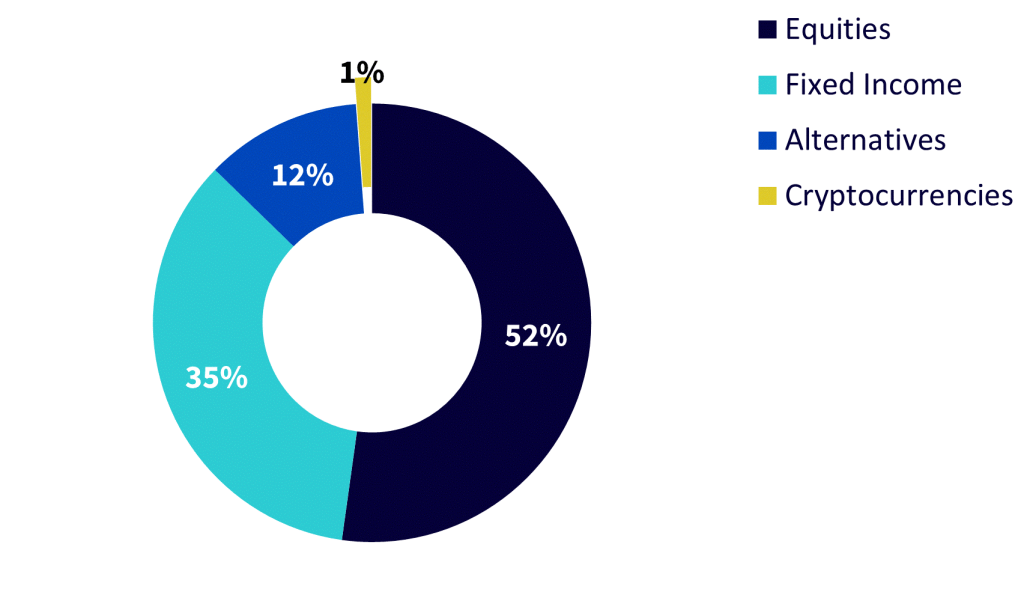

Figure 1: The market portfolio

Source: Bloomberg, WisdomTree. As of 30 September 2024. In USD. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investment may go down in value.

Figure 1 (above) shows the market portfolio of all listed, investable assets that are accessible to investors. With a market cap of over US $2 trillion1, cryptocurrencies represent approximately 1% of the market portfolio that has a total market cap of just over US $200 trillion2. Bitcoin is a cryptocurrency mega cap name, and it continues to represent just over half of cryptocurrency market cap3.

What is the key benefit of adding bitcoin to a multi-asset portfolio?

Portfolio diversification

According to our 2024 Professional Investor Survey, 35.13% of respondents said they believed that ‘diversification as an uncorrelated asset’ was the role that cryptocurrency played in a portfolio4. Bitcoin has historically had a low correlation with traditional assets. Figure 2 (below) illustrates this by showing correlations between bitcoin and traditional assets over the past two years. The bitcoin line is extremely green, which indicates that it is not correlated to any other assets shown in the table.

Figure 2: Correlations between bitcoin and traditional assets

Source: Bloomberg, WisdomTree. From 30 September 2022 to 30 September 2024. In USD. Based on Weekly Returns. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investment may go down in value.

While Figure 2 (above) is limited to the last two years, the story it tells has been true since bitcoin’s inception. It is also very interesting to note that gold is more correlated to equities and fixed income than bitcoin.

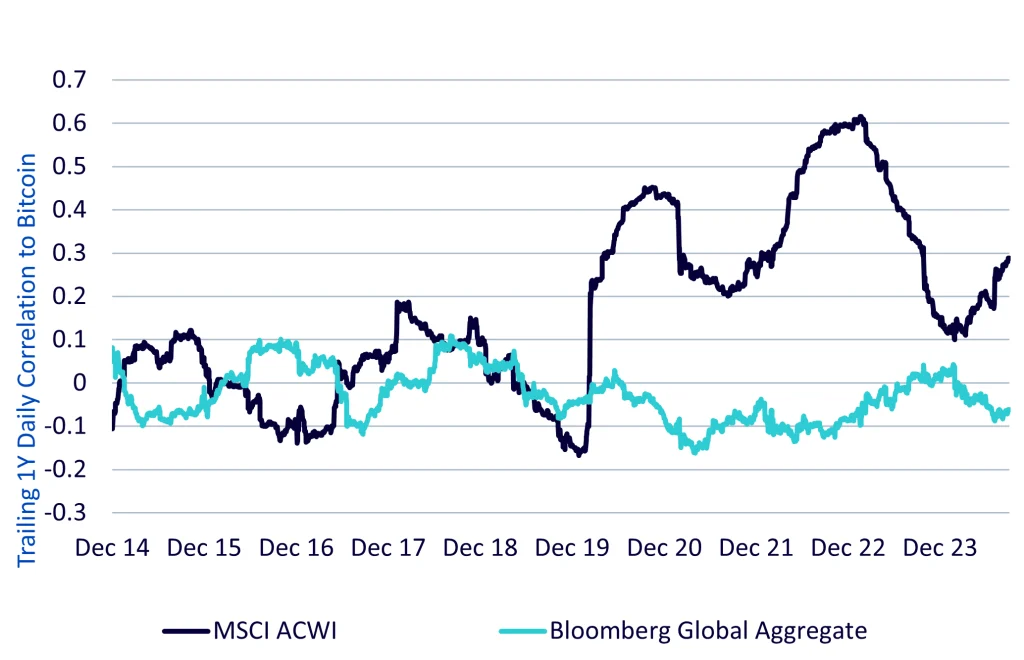

As the 60/40 Global Portfolio remains a standard multi-asset portfolio, investors tend to want to see how bitcoin’s correlation to the MSCI All Country World (MSCI ACWI) and Bloomberg Global Aggregate indices has changed over time.

Figure 3: Trailing one-year daily correlation to bitcoin

Source: Bloomberg, WisdomTree. From 31 December 2014 to 30 September 2024. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investment may go down in value.

Figure 3 (above) shows that historically, the trailing one-year (1Y) daily correlation has been:

- Relatively stable between bitcoin and fixed income (i.e. Bloomberg Global Aggregate)

- More varied between bitcoin and equities (i.e. MSCI ACWI) with all-time high of just over 0.6 reached in March 2023

While bitcoin’s correlation with the MSCI ACWI index has varied over time, historically, allocating as little as 1% of the 60/40 Global Portfolio to bitcoin has improved the risk/return profile of that portfolio, as shown in Figure 4 (below).

Figure 4: Bitcoin in multi-asset portfolio

Source: Bloomberg, WisdomTree. From 31 December 2013 to 30 September 2024. In USD. Based on daily returns. The 60/40 Global Portfolio is composed of 60% MSCI All Country World and 40% Bloomberg Multiverse. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investment may go down in value.

Conclusion

Cryptocurrencies have a significant track record and represent approximately 1% of the listed market portfolio that most investors can easily access. Bitcoin is a cryptocurrency mega cap name, and it continues to represent just over half of the cryptocurrency market cap. As bitcoin is uncorrelated to traditional assets, it can significantly improve the risk/return profile of a multi-asset portfolio.

While the Sharpe Ratio increases with an increase in bitcoin allocation within the 60/40 Global Portfolio, a 1% bitcoin allocation is a sensible starting point for most investors as it represents a market-neutral view.

1 Source: Bloomberg, WisdomTree. 30 September 2024.

2 Source: Bloomberg, WisdomTree. 30 September 2024.

3 Source: Messari. 22 October 2024.

4 WisdomTree, Censuswide. Pan-Europe Professional Investor Survey Research, a Survey of 817 professional investors across Europe, conducted June-July 2024.

5 Source: Bloomberg, WisdomTree. From 31 December 2013 to 30 September 2024. In USD. Based on daily returns. The 60/40 Global Portfolio is composed of 60% MSCI All Country World and 40%.