Significant optimism followed the post-covid reopening of China’s economy at the end of last year but subsequent economic developments have been disappointing. In this Macro Flash Note, Daniel Murray highlights the challenges China faces in trying to balance three different sets of objectives – growth, deleveraging and geopolitics – and how this is dampening the prospects for the economy.

There was much fanfare following the surprise reopening of China’s economy late last year. It had been hoped and expected that the Chinese authorities would follow up with various measures designed to support the economy and encourage growth. Unfortunately, that has not happened. Instead, there has been a series of wide-ranging policy announcements though with little detail provided and limited perceived impact on economic activity.

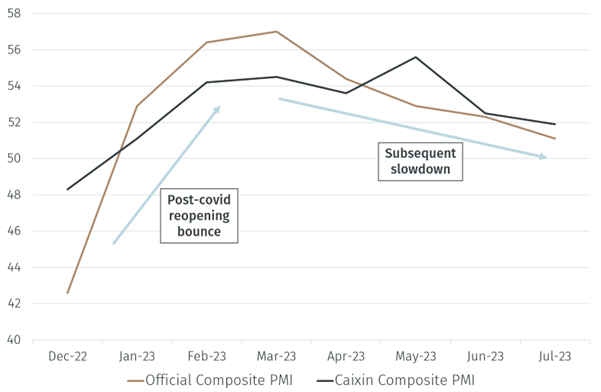

Chart 1. Weak Chinese PMIs

Source: Bloomberg, EFGAM calculations. Data as of 21 August 2023.

Against this background, it is not so surprising that Chinese economic data have disappointed this year. After a rebound in GDP growth in the first quarter, the rate of economic expansion has subsequently slowed; in Q1 GDP expanded by 2.2% quarter-on-quarter but in Q2 that had slowed to 0.8%. Monthly data have also been weaker than expected. Thus, retail sales growth slowed to just 2.5% year-on-year (YoY) in July, property investment contracted by 8.5% YoY in July, there has been a sharp slowdown in loan growth over the past few months and Purchasing Managers’ Index (PMI) data has been weaker.

It is true that the authorities have announced some policies to support the economy but there has been scant detail and hence it has been difficult to ascertain the expected impact. Furthermore, there has been only very modest monetary support: the one-year loan prime rate has been cut by just 20bps this year and the five-year rate by just 10bps, while the required reserve ratio has been cut by only 25bps.

This naturally begs the question: why have the Chinese authorities been so reticent to support the economy?

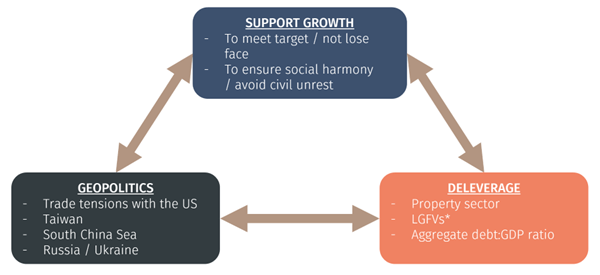

One explanation lies in thinking about the different and potentially conflicting objectives that China is trying to achieve simultaneously. These can conveniently be divided into three groups:

- Promoting growth

- Deleveraging the economy

- Geopolitics

Chart 2 illustrates these.

Chart 2. China’s Impossible Trilogy of Objectives

Source: EFGAM calculations. Data as of 21 August 2023.

In an ideal world China would be able to pursue all three of these objectives at the same time. However, in practice that is difficult:

- If the Chinese authorities retain their geopolitical stance, that will limit the ability of China to grow externally since trade linkages with the US – China’s biggest export market – will be restricted. The authorities would then have to support growth via an alternative route, something that has historically been achieved by re-leveraging the economy, especially via the property sector and its linkages with local governments.

- If the Chinese authorities wish to continue to de-lever the economy, that will naturally constrain growth. This could be offset by an improvement in net exports but that is difficult to achieve without a change in China’s geopolitical positioning.

- Alternatively, China can retain its geopolitical positioning and de-lever the economy but that would come at the expense of growth.

The diagram is of course an over-simplification of reality and there may well be additions and changes that others might suggest. Nonetheless, it presents a convenient and helpful framework for helping us think about the prospects for the Chinese economy and how China aligns geopolitically with the rest of the world. China may well feel greater philosophical alignment with Russia but that comes at the cost of limiting growth prospects due to the impact on trade. Similarly, it will be much harder for China to achieve its growth targets if the economy is de-leveraging. At the moment, China appears to be de-emphasising growth in order to maintain its geopolitical stance and to continue to de-lever. Until there are signs of this changing, we should expect growth to disappoint.