After recording their fourth consecutive weekly gain in a shortened Thanksgiving week of trading, stock markets now find themselves a long way from their October lows, with the S&P 500 up over 10%.

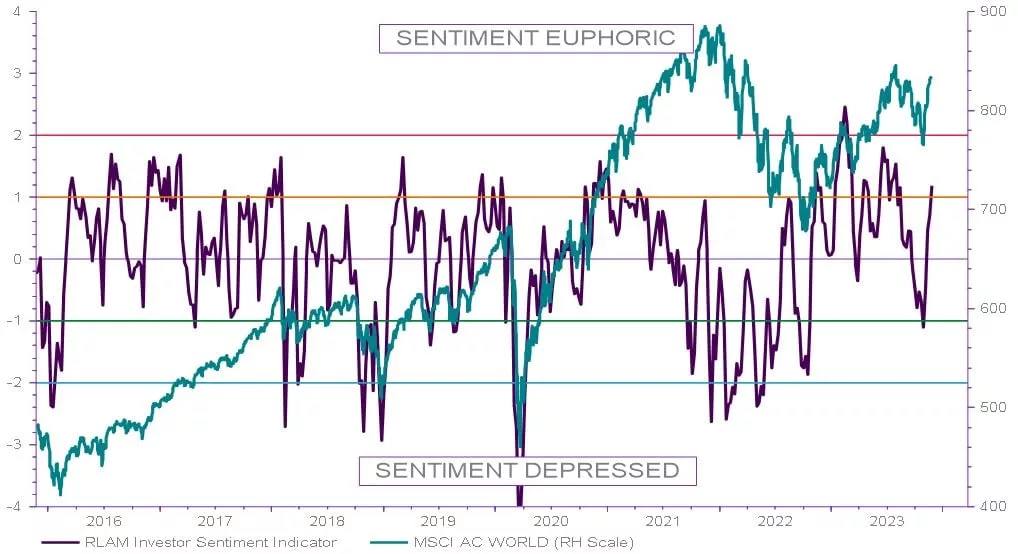

As we head into the festive season, the holiday spirit appears to have spread to equity markets. Risk appetite continues to improve and a popular measure of equity market volatility, the VIX index, has fallen to post-pandemic lows. With retail investors bullish and volatility low, our composite measure of investor sentiment has risen to overly euphoric levels (Chart 1).

Chart 1: Our composite sentiment indicator is showing investors are overly bullish

Source: LSEG Datastream as at 24/11/2023

Although overly bullish sentiment readings can signal to some that markets are becoming frothy, we are unperturbed by this recent jump in investor sentiment and remain positive on equities. Investor euphoria can often accompany strong equity market rallies, just as we saw following the election of President Trump in 2016 and breakthroughs in November 2020 which led to Covid vaccinations.

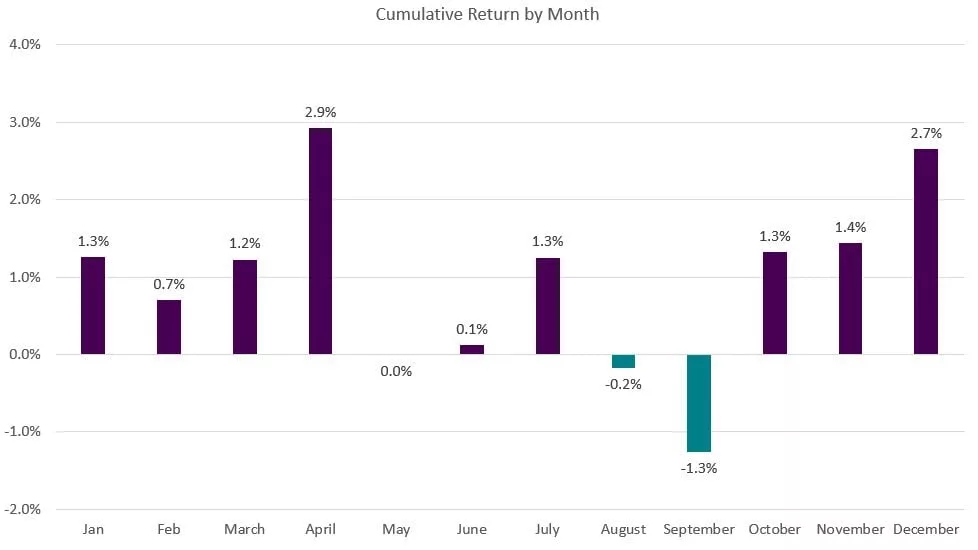

With December historically being one of the most positive months for stock market performance (Chart 2), we would not be surprised to see the Santa rally in stocks continue in the near term – despite the overly cheerful sentiment.

Chart 2: Stock market average returns by month

However, recent cooling of inflation and labour market data has seen investors move to price in an easing of monetary policy next year without major recessions. While this is possible, given long lags of monetary policy, it could be that recessions are delayed rather than cancelled. We’ve also seen central banks push back against market pricing of early rate cuts. The journey could still be bumpy and we remain alert to negative surprises.

This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.