Stocks rallied hard from October onwards on broadening signs of a soft landing – or rather a ‘no-landing’ – in the US economy. This month we’ve seen some weakness, partly due to the exchange of missiles between Israel and Iran but also stronger-than-expected US data and high core inflation prints.

Fixed income investors started the year expecting six rate cuts from the US Federal Reserve (Fed). Now they’re pricing in fewer than two. I’ve been asking for a while if the Fed’s next move should be a hike and lately I get fewer funny looks.

The downside of avoiding a recession is that we may already be moving into late cycle. To put it another way, the scope for a long period of strong disinflationary growth, with equities benefiting from corporate earnings growth and falling interest rates, may not be there. Tight labour markets and rising oil prices serve as a reminder that inflation problems could resurface sooner than people expect.

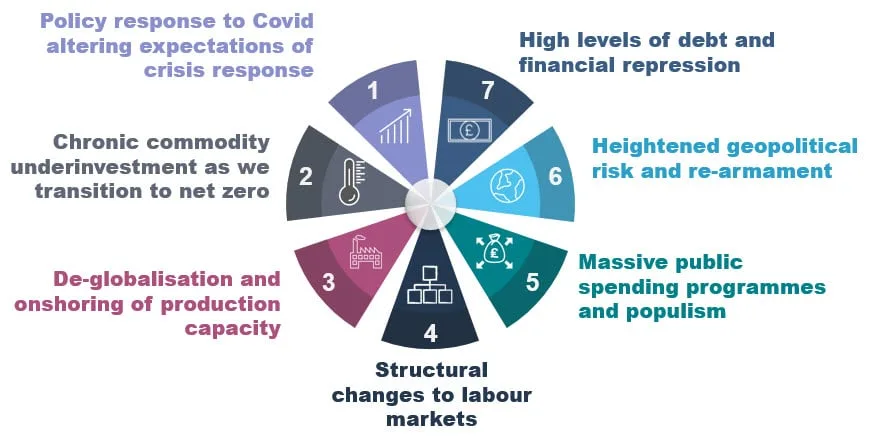

There are good reasons to think the inflation spike of 2021/2 wasn’t a one-off. We see a new era of ‘Spikeflation’ – like the 1970s and the two world wars – in which periods of low inflation are interrupted by price level shocks that move inflation sharply higher. Among a wide range of structural factors (Chart 1) that make the world more prone to inflation spikes, net zero plays a part. Fossil fuel extractors are, understandably, cutting their investment in new capacity and this makes spikes in price more likely when supplies are disrupted or if demand overshoots. Against this backdrop, commodity prices will be more sensitive to economic growth and to geopolitical events – not just in the Middle East but also in Ukraine and potentially Taiwan, where concerns are growing that a Donald Trump-led White House might embolden Russia and China in their territorial ambitions.

Chart 1: Drivers of the new era of Spikeflation

- Policy response to Covid altering expectations of crisis response

- Chronic commodity underinvestment as we transition to net zero

- De-globalisation and onshoring of production capacity

- Structural changes to labour markets

- Massive public spending programmes and populism

- Heightened geopolitical risk and re-armament

- High levels of debt and financial repression

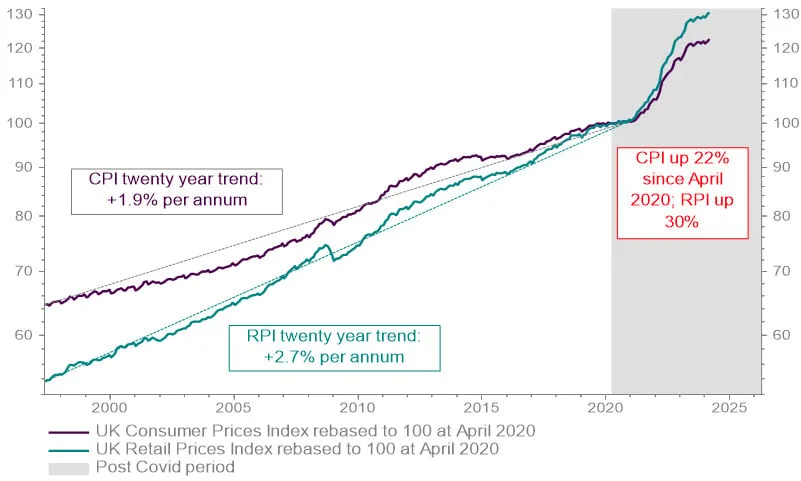

Over and above everything there’s the level of debt. Highly indebted governments are more likely to resort to inflation as a form of taxation. In theory, central banks are supposed to protect investors from unanticipated inflation. In practice, they rarely do anything to reverse large price level shocks, because the economic and social costs are deemed too high. The pandemic is a case in point. Between being granted operational independence in May 1997 and the onset of Covid, the Bank of England kept inflation very close to its 2.0% annual target (Chart 2). Since April 2020, however, when the price level should have risen by around 8%, it is up by more than 20%, or more than 30% on the old retail prices measure which includes mortgage costs. You can be sure the Bank has no intention of undershooting inflation by 12% over the next few years. They will let bygones be bygones. Central banks do a good job of controlling inflation between crises, but as with dieting between meals, the end result isn’t always ideal.

Chart 2: UK CPI and RPI since Bank of England Independence

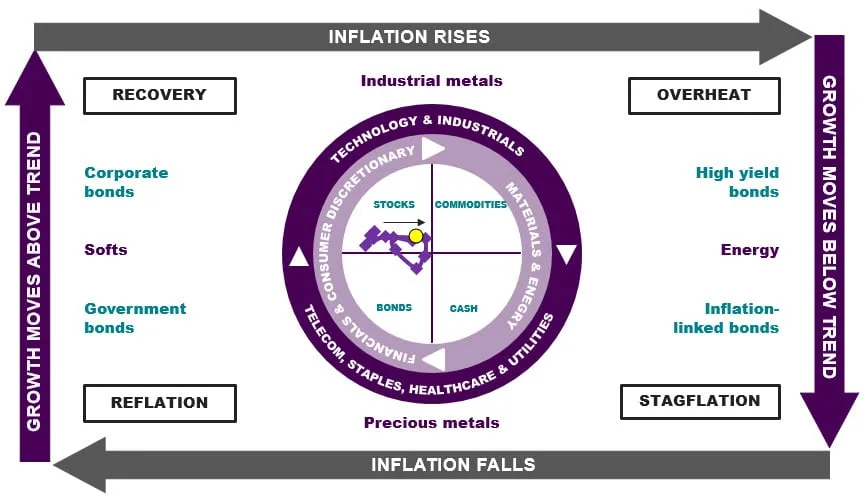

Combine commodity underinvestment and geopolitical stress with tight labour markets and stronger-than-expected growth and you can see why the Investment Clock model that guides our asset allocation is already heading towards Overheat (Chart 3). This is the late cycle phase characterised by strong growth and rising inflation. Central banks typically hike rates at these times, rather than cut them. At the broad asset class level, commodities tend to offer the best returns while government bonds often struggle. Stocks sometimes do well, sometimes not so well, depending on the tug of war between stronger earnings growth and the valuation impact of rising interest rates.

Chart 3: Investment Clock ticks towards Overheat

Source: RLAM. For illustrative purposes only. Trail shows monthly readings based on global growth and inflation indicators

For investors who cut their teeth in the four disinflationary decades prior to the pandemic, it’s a different world. We see two big implications for portfolio construction. First, protect yourself against inflationary shocks by diversifying broadly beyond stocks and bonds. We would consider including commodities, commercial property and a higher strategic weighting to UK equities than implied by the market’s share in global indices. Second, consider approaches that can use tactical asset allocation to alter asset class exposures across what could be shorter, more volatile business cycles. More frequent inflation spikes mean more frequent recessions. Boom-bust is back.

This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.