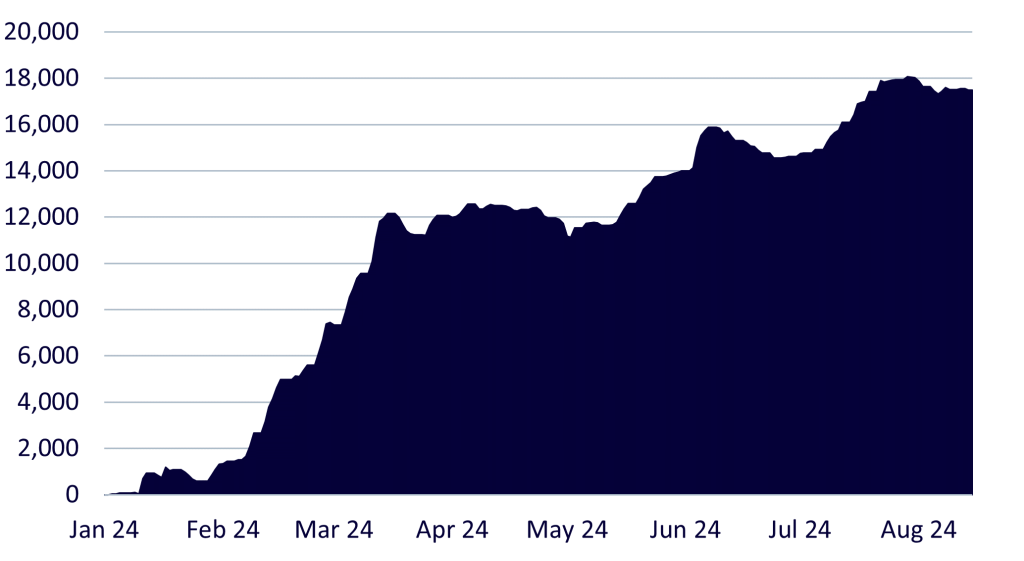

2024 has marked several significant milestones for bitcoin entering mainstream finance and becoming more institutionalised. Earlier this year, the launch of spot bitcoin exchange-traded products (ETPs) in the US garnered record inflows, marking a significant milestone for the maturity of this asset class. Following suit, in the summer of 2024, ether ETPs were approved in the US, leading to sizable flows during the first few weeks. Overall, the global spot crypto ETP space has seen net inflows of over US $16 billion year-to-date.

Figure 1: Global crypto ETP net flows, in USD millions

Key Takeaways

- Institutional interest in the largest tokens, namely bitcoin and ether, is accelerating, supported by regulated vehicles such as ETPs.

- The recent bitcoin halving has tightened supply by reducing the issuance of new bitcoin, effectively reducing the supply available to meet this demand.

- A more accommodative interest rate environment may attract more investors seeking risk-on exposures, buoying crypto prices with greater investment.

- Related ProductsWisdomTree Physical Bitcoin, WisdomTree Physical Ethereum, WisdomTree Physical Solana, WisdomTree Physical Crypto Mega Cap Equal WeightFind out more

Institutional adoption and market maturity

2024 has marked several significant milestones for bitcoin entering mainstream finance and becoming more institutionalised. Earlier this year, the launch of spot bitcoin exchange-traded products (ETPs) in the US garnered record inflows, marking a significant milestone for the maturity of this asset class. Following suit, in the summer of 2024, ether ETPs were approved in the US, leading to sizable flows during the first few weeks. Overall, the global spot crypto ETP space has seen net inflows of over US $16 billion year-to-date.

Figure 1: Global crypto ETP net flows, in USD millions

Source: Bloomberg. Data as of 15 August 2024. You cannot invest directly in an index. Historical performance is not an indication of future performance, and any investment may go down in value.

The flood of assets into these products so far this year underscores the trend of adoption and the popularity of accessing this nascent and rapidly growing asset class via ETPs. These regulated investment vehicles offer ease of access without the compliance and technological overhead of managing wallets and private keys, bringing familiarity and comfort to investors in an unfamiliar space.

With investors worldwide now having regulated ways to access spot bitcoin and other crypto exposures, the trend of institutional adoption is clearly underway.

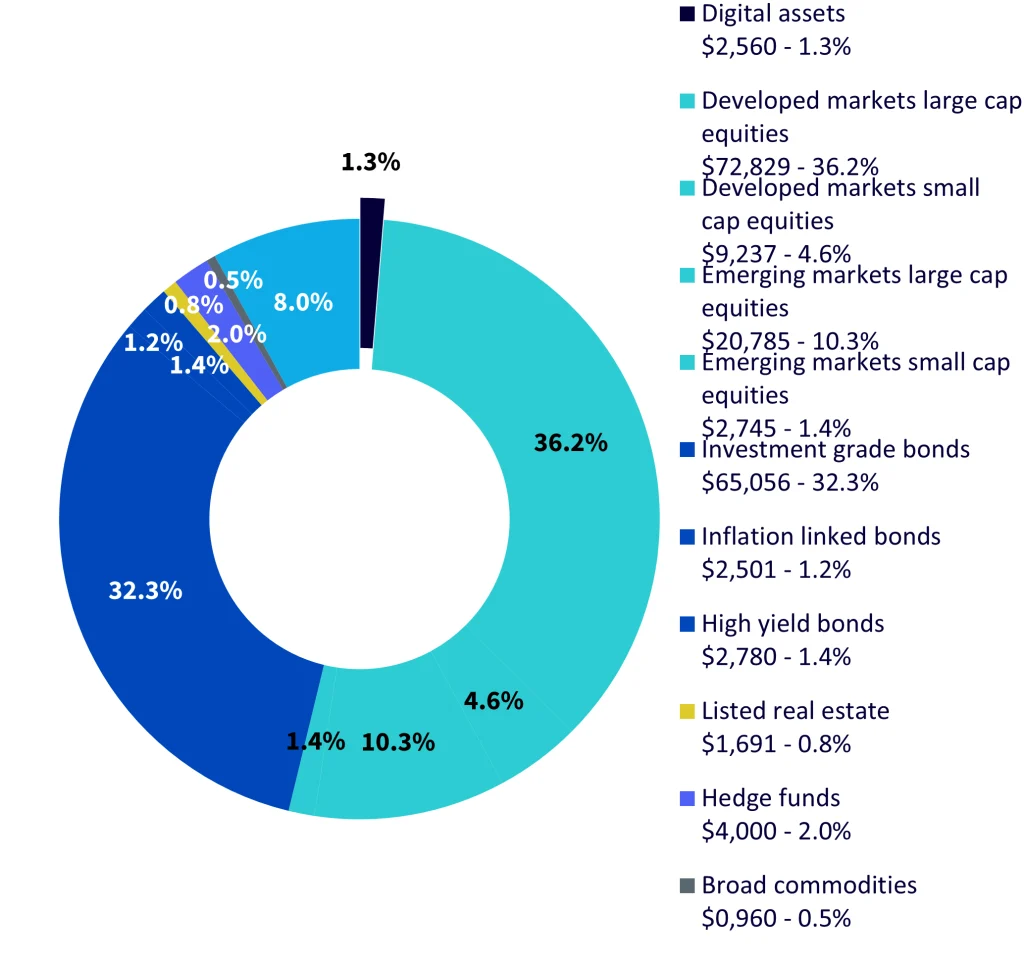

Figure 2: Market cap weighted allocation of an illustrative multi-asset portfolio

Source: Bloomberg, WisdomTree. Data as of 28 June 2024. Market caps are shown in USD billion. You cannot invest directly in an index. Historical performance is not an indication of future performance, and any investment may go down in value.

The overall crypto market now stands at an impressive US $2.5 trillion1, which accounts for roughly 1.5% of the global opportunity set of listed, investable assets. As a result, investors seeking neutral market exposure need to have approximately 1.5% of their portfolios invested in crypto if they want to match this. By not having any exposure to this growing asset class, portfolio managers are making an active decision to underweight the asset class. Typically, such an active decision would require a strong investment thesis against the asset class; for example, if portfolio managers decide not to invest in European equities, they usually have clear reasoning.

Crypto market cycles and trends

Bitcoin halving events, occurring roughly every four years, are key drivers of crypto market cycles. The latest took place in April 2024, reducing the newly issued bitcoin supply from 6.25 to 3.125 per block. These halving events will continue for decades to come until the maximum supply of 21 million is reached in approximately year 21402. Around 19.7 million bitcoin (nearly 97% of the total supply) are currently in circulation, with as much as a million or more lost forever3. In the wake of halving events, the increased supply pressure has historically led to positive price action, resulting in cyclical uptrends.

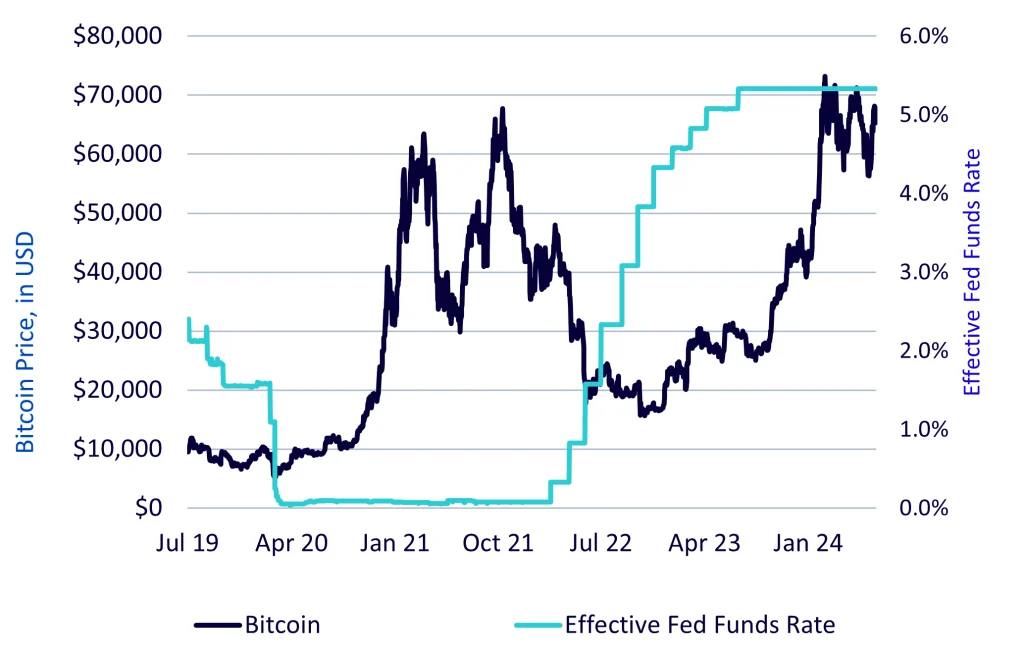

Another key area of influence in market cycles is macroeconomic policy impacts. More liquidity in the financial system and lower central bank policy rates have benefited crypto prices in the past, as demonstrated by Figure 3. If we were to look back to the low-interest rate period in the early 2020s amidst the COVID-19 pandemic, crypto prices skyrocketed.

Figure 3: Bitcoin versus Fed funds rate

Source: Bloomberg. Data as of 26 July 2024. Index tickers: XBTUSD, FEDL01. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investment may go down in value.

The US Federal Reserve (Fed) is expected to join other central banks in cutting interest rates due to the improved inflation outlook, with the market pricing in rate cuts to begin in September of this year. This may lead to additional capital flowing into risk assets as investors look further out on the risk spectrum to source positive returns to the portfolio as the US treasury ‘risk-free rate’ is reduced.

On-chain developments and technological innovations

Earlier this year, the Ethereum Dencun upgrade enabled layer 2 solutions, including Base, Optimism, and Arbitrum, to settle transactions faster and cheaper using the Ethereum blockchain. This upgrade is crucial in scaling Ethereum, which has faced competition from emerging blockchains offering similar capabilities, particularly Solana.

Solana is also gearing up for significant upgrades, including the Firedancer software update in 2025, allowing it to surpass a million transactions per second. More recently, Solana has experienced significant growth in user engagement, surpassing that of Ethereum, although much of this has been driven by meme coin trading on decentralised exchanges. While meme coins may not be the most productive use case, cheaper and faster transactions enable more experimentation and innovation, fostering the development of new applications and technologies and greater user adoption.

Moving beyond meme coins to a more institutional use case, the space of tokenised assets is showing significant promise. The tokenisation of traditional blockchain assets has grown exponentially over the past few years, starting primarily with tokenised USD stablecoins. Since then, various assets – including commodities, fixed income, equities, and real estate – have emerged, sparking a transition from a financial ecosystem running on spreadsheets to one powered by blockchain.

These are only a few ways technological innovations transform the digital asset landscape. While Ethereum remains the dominant smart contract platform where most of the ‘primary’ activity occurs, Solana’s rising usage indicates a competitive environment fostering rapid advancements. Scalability and efficiency upgrades are prime examples of how these innovations drive new growth and activity. The growth of applications such as tokenised assets, decentralised finance and other blockchain-based solutions underscores the sector’s potential for substantial growth.

Conclusion

Several key trends are converging that collectively paint a promising outlook for the cryptocurrency market in the second half of 2024. The rise in institutional adoption signals increased confidence and participation from major financial institutions, opening the door to new sources of demand. Institutional interest in the largest tokens is accelerating, supported by regulated vehicles such as ETPs. The recent bitcoin halving has tightened supply by reducing the issuance of new bitcoin, effectively reducing the supply available to meet this demand. Additionally, a more accommodative interest rate environment may attract more investors seeking risk-on exposures, buoying crypto prices with greater investment. Furthermore, innovations and increased activity are driving greater adoption of decentralised blockchains, fostering their growth and embedding them into the fabric of our society. If all these trends converge, the crypto market may see significant tailwinds that jolt it into the next bull market by year-end.

The full outlook can be viewed here.

1 Source: CoinGecko, 30 July 2024.

2 Source: ig.com, July 2024. Forecasts are not an indication of future performance, and any investments are subject to risks and uncertainties.

3 Source: Fortune.com, 24 April 2024.