Companies seeking to upend entire industries can be exceptional investments, but need patience and support, as Nick Wood, US Equities Team, explains.

Human nature tends towards pessimism: fearing the worst was essential for our evolutionary survival. We are cursed with the capacity to imagine worst-case scenarios, and to overestimate how likely they are, particularly when managing our finances. It is also the most damaging trait for an equity manager, where market and portfolio returns are driven by remarkably few exceptional companies.

To redress the balance, the US Equities team takes a more optimistic approach, applying a long-term and creative mindset to our analysis and investments. We cannot be both the world’s best holders and sellers of companies. The nature of equity returns means it is in our clients’ interest for us to strive to be the former. But we will only continue to hold a company if we believe it can deliver a return of two and a half times over the next five years with a significantly greater than average (20 per cent) probability. As part of our process, we write a forward-looking hypothesis stating our expectations for each company we’ve invested in, why we hold it, and how we expect it to deliver the return we require.

Revolutionary products

Investment research on portfolio holdings is a continuous activity, and our understanding evolves over time. We have been identifying a subset of companies within the portfolio that can be particularly challenging to hold for long periods of time. We call these companies ‘cultural outliers’.

A cultural outlier is a company addressing a large and ever-expanding market opportunity. The pursuit of this is driven by the perspective of the company’s founder or management team. It’s not about opening a new market by adapting an existing product. This is revolution not evolution. Cultural outliers’ business models enable them to outcompete strategically, but their purpose is not constrained within their current opportunity set. Company culture is the glue that holds it all together.

The challenge in owning these businesses is that they frequently surprise us – and infrequently shock us. They make major strategic decisions which make us uncomfortable at first, challenging the way we look at things. We can’t predict how these companies will change the game, but identifying their exceptional quality prepares us for pleasant surprises and encourages us to back management to execute plans that may take a decade to come to fruition. This potential to surprise becomes part of our forward-looking hypothesis.

Reshaping industries

We are learning from experience. Amazon’s development of AWS or Alphabet’s acquisition of YouTube were difficult to analyse and hard to appreciate at the time.

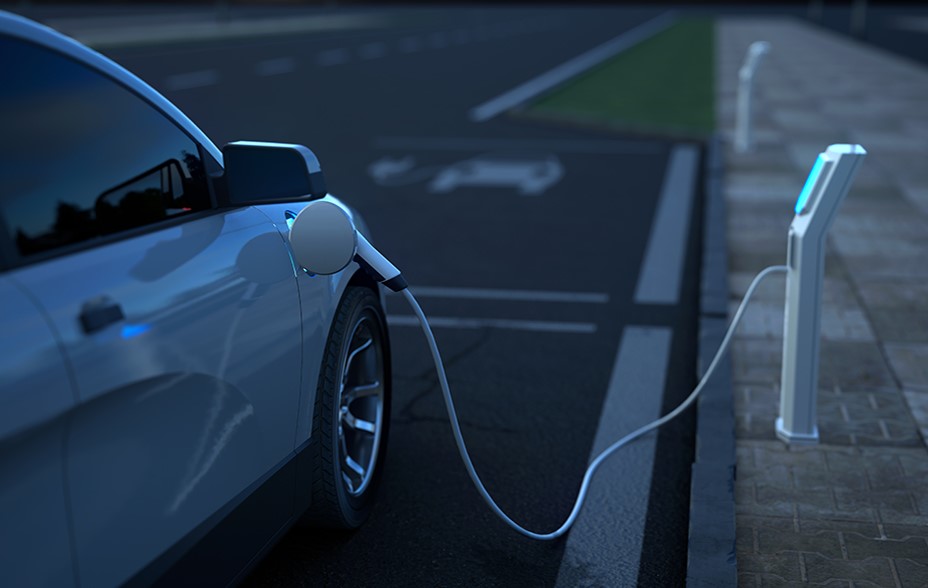

A cultural outlier can be understood in the difference between a hybrid and an electric car. In the 2000s, a car maker could choose to make a hybrid or electric car. A hybrid is an evolution. It harnesses existing skillsets and infrastructure and does not require huge habit change from consumers. Electric vehicles are a revolution, based on an entirely different knowledge base (battery chemistry, car design and software), new inputs (eg lithium), and added infrastructure (eg charging points). You must shift consumer behaviour, helping people overcome range anxiety and learn about charging.

We believe we are at the beginning of a new age of the cultural outliers. As a society we have built up a toolkit over the past few decades made up of:

- the internet

- the rise of software

- the explosion of data

- the decreasing cost of computing power

- the rise of machine learning and AI

- unlocking the power of the genome

These technologies make real what previously existed only in science fiction. In every field, the technological lever is getting longer and longer, enabling the application of these tools to a growing number of industries. This revolution creates winner-takes-most dynamics across these industries. Cultural outliers seek to reshape entire industries by changing the paradigm.

The US Equities Team has identified six such companies within the portfolio:

- the consumer loan provider Affirm

- the real estate analytics specialist CoStar

- the digital insurer Lemonade

- the online shopping platform Shopify

- the electric car maker Tesla

- the cloud-based customer communications software developer Twilio

It’s a fascinating subgroup of the portfolio with the potential to transform industries as large and well established as payments, real estate, insurance, ecommerce, communications, automotive and energy.

We will learn a lot from the exceptional founders and management teams of these companies as they evolve, improving our understanding of their industries and the nature of technology-driven disruption. We must be even more patient than usual in ownership as transformation is never easy. The potential for a few innovative businesses to drive progress as well as stock market returns has perhaps never been greater.

The only certainties are that there will be surprises along the way and that hold discipline, rather than sell discipline, is how we as investors can contribute meaningfully to solving society’s greatest challenges.