It is important to categorise correctly. Marco Polo, when in Sumatra, thought that he had seen unicorns. “Very nearly as big” as the “wild elephants”, he wrote in ‘The Travels’. Sig. Polo in fact saw rhinoceroses.

All month long obituaries for Decentralized Finance (DeFi) have been written1 as exposure to the liquidation of Three Arrows Capital, a hedge fund, has become evident amongst many companies in the relatively new ‘crypto lending’ space (e.g. BlockFi, Celsius, Voyager Digital, etc). Not all horned animals are unicorns however – and not all companies operating on the crypto rails are ‘DeFi’.

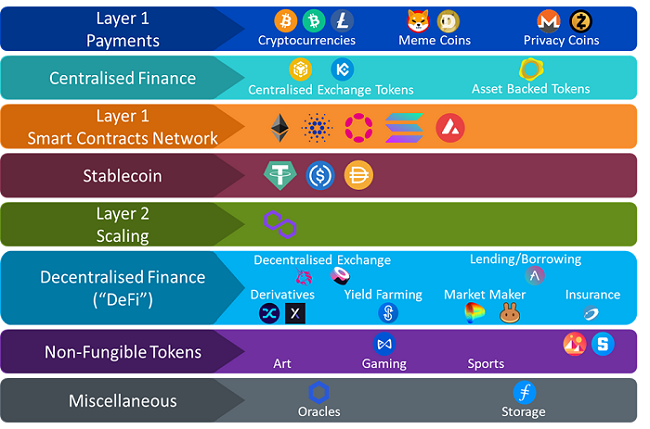

Introducing the WisdomTree Digital Assets Taxonomy

To understand what is happening it is helpful to refer to a reading grid. WisdomTree has developed its WisdomTree Digital Assets Taxonomy for precisely this purpose. Outlined in detail in the recently released WisdomTree Insights – A New Asset Class: Investing in the Digital Asset Ecosystem the taxonomy:

- Classifies digital assets into distinct and easily understandable categories

- Assists in understanding the investment opportunity of each digital asset through the prism of the category that they belong to (that is the ‘use-case’)

- Allows one to build an investment case for each individual asset with its opportunities, risks and relevant metrics to monitor

DeFi’ is one of eight segments in the taxonomy. It is joined by other segments such as: smart contract platforms, non-fungible tokens (NFTs), and the somewhat nebulous ‘miscellaneous’.

Figure: The WisdomTree Digital Assets Taxonomy v1.0 (July 2022)

Source: WisdomTree

Turning back to DeFi, one can use the following definition: “Decentralized Finance offers financial instruments without relying on financial intermediaries as brokerages, exchanges, or banks by using smart contracts on a blockchain.”2

The most important part of this definition is the reference to: ‘using smart contracts on a blockchain’. Doing so creates a number of implications. First, one can audit the holdings at any point in time owing to the transparent nature of distributed ledgers (blockchains) and open source smart contract code. Second, the rules of the contract are very clear. Those who use these DeFi apps do so in possession of their public/private key pair, which means that they self-custody their assets and decide when and how those assets can and are used.

This is very different to the entities, like Three Arrows Capital (3AC), that have caused so much commotion over the past month.

DeFi is very different to Centralized Finance (CeFi), which is sometimes termed Traditional Finance (TradFi). The difficulty, at present, is that these two concepts are blurring as traditional financial companies integrate distributed ledger technology into their operations.

So what is ‘DeFi’ and what is not?

The collapse of Terraform Lab’s UST/LUNA was entirely linked to the digital assets space – though it could arguably be categrorised as ‘DeFi’ or not. Formally categorised as a ‘layer 1 smart contract platform’, according to the WisdomTree Digital Asset Taxonomy, prior to its collapse, the LUNA network was used to issue the UST ‘stablecoin’. In this way it crossed taxonomy segments – LUNA constituting a layer 1 network cryptocurrency and UST, a stablecoin. LUNA went from around US$41 billion in market capitalisation at the beginning of April 2022 then plummeted US$300 million by mid-May3. At its high the amount ofoutstanding UST was over US$18 billion. By 1 July 2022 one UST was trading at 4c on the dollar4.

The collapse of UST/LUNA left a number of entities exposed in the relatively new crypto lending industry. It was thought that 3AC had over US$200 million in exposure to LUNA though it is hard to know this definitively5. Entities like Three Arrows Capital do not appear in the taxonomy. That is because they do not issue their own token, nor do they run ‘blockchain’ infrastructure. Three Arrows Capital is (was) a hedge fund that took leveraged, long positions on a highly volatile asset class – and lost. The outcome is unsurprising.

A more interesting case study is crypto lender Celsius, which suspended withdrawals in the wake of the 3AC debacle citing, “extreme market conditions”6. The interesting thing about Celsius was that it issued its own CEL token. Lenders could opt to be paid back their interest in the CEL token, which has lost 88.5% of its value since its all time high7. As a consequence, the CEL token was categorised in the WisdomTree Digital Asset Taxonomy as a ‘DeFi’ token used for ‘Lending’. Celsius is (was) an incorporated entity in the United Kingdom8. It straddles the line between a centralised lending company coupled with its own crypto token.

Contrast this with crypto lender BlockFi, which began to cut headcount9 before revealing it was one of a number of companies involved in the liquidation of positions belonging 3AC10. BlockFi does not have its own token, nor does it really have much to do with digital asset networks except that it lent out clients’ digital assets to other intermediaries.

Another similar example is crypto broker Voyager Digital, which revealed that 3AC was unable to meet payments on a loan of 15,250 BTC, worth about US$305m, and US$350m of USD Coin (USDC).11 Voyager filed for chapter 11 bankruptcy on 6 July12. Market maker and lender, Genesis, may have hundreds of millions of dollars of exposure to 3AC.13 Neither entity has its own token – yet notice that Voyager was dealing in so-called ‘stablecoins’ (i.e. Circle’s US-regulated USDC). Even in the ‘stablecoin’ segment of the WisdomTree Digital Asset Taxonomy there is a lot of nuance.14

DeFi is dead, long live DeFi

The turbulent events of June and July have had an upside. The events have demonstrated the strengths of many decentralised finance (DeFi) applications (e.g. Compound, Aave, Maker), which are still running smoothly. Positions have been liquidated, when necessary, using automated computer scripts (‘smart contracts’) to conduct what can be a messy business. These applications have had 24/7 uptime, performed as designed and are globally accessible to anyone with a cell phone and internet connection. These applications provide transparency and auditability that are so often not present in the traditional financial system.

It is only by categorising cryptocurrencies, networks and tokens correctly that one can see where the real problems – and opportunities – lie. This is what the WisdomTree Digital Assets Taxonomy does. To brand all the insolvencies of the crypto lending industry as ‘DeFi’ would be akin to mistaking all horned animals for rhinos.

Sources

1 https://www.wsj.com/articles/defis-existential-problem-it-only-lends-money-to-itself-11656503840 ; https://podcasts.apple.com/gb/podcast/money-talks-from-the-economist/id420929545

2 https://en.wikipedia.org/wiki/Decentralized_finance

3 https://www.coingecko.com/en/coins/terra-luna

4 https://www.coingecko.com/en/coins/terra-usd

5 https://www.wsj.com/articles/battered-crypto-hedge-fund-three-arrows-capital-considers-asset-sales-bailout-11655469932?mod=latest_headlines

6 https://blog.celsius.network/a-memo-to-the-celsius-community-59532a06ecc6

7 https://www.coingecko.com/en/coins/celsius-network-token

8 https://celsius.network/about-us

9 https://www.reuters.com/business/finance/crypto-firm-blockfi-cut-headcount-by-20-2022-06-13/

10 https://www.ft.com/content/126d8b02-f06a-4fd9-a57b-9f4ceab3de71

11 https://www.prnewswire.com/news-releases/voyager-digital-provides-market-update-301575492.html

12 https://cointelegraph.com/news/voyager-digital-files-for-chapter-11-bankruptcy-proposes-recovery-plan

13 https://www.coindesk.com/business/2022/06/29/genesis-faces-hundreds-of-millions-in-losses-as-3ac-exposure-swamps-crypto-lenders-sources/

14 https://www.wisdomtree.eu/en-gb/blog/2022-05-13/digital-asset-market-note-a-depegging-soros-would-be-proud-of