Investing in the UK listed property sector through real estate investment trusts (REITs) provides access to a resilient and growing asset class that offers valuable enhancements to multi-asset portfolios. Beyond the inclusion of UK listed real estate, investors should focus their exposure on listed real estate aligned with the four mega trends shaping the future of the UK property sector: generation rent, ageing population, digitalisation and urbanisation.

Matthew Norris, Fund Adviser to the VT Gravis UK Listed Property (PAIF) Fund explains how specialist, best in class REITs benefiting from these four mega trends are driving next generation real estate and details the strong opportunity available from investing in a portfolio of best-in-class UK listed REITs.

The mega trends and next generation real estate

- The UK is experiencing a demographic shift characterised by an ageing population, with the segment aged 85 and above the fastest growing demographic in the country. Consequently, demand is being fuelled for supportive real estate in the form of GP surgeries and care homes, with REITs such as Assura, Primary Health Properties and Impact Healthcare REIT building and operating these next generation healthcare assets.

- We’re in the midst of the Fourth Industrial Revolution, with the digitalisation of society shaping how we live, work and play. Notably, online shopping now accounts for 27% of all transactions in the UK, and to facilitate this, real estate is required in the form of new ‘industrials’ such as e-commerce fulfilment centres and urban logistics assets.

- Urbanisation is also becoming increasingly important, with growing cities the hubs of opportunity and offices serving as collaborative spaces. The face of office space is shifting, with demand focusing on high-quality modern office space, with green environmentally offices being prime, eliciting high rents and increased demand.

- Generation Rent is the fastest growing mega trend in the UK real estate market, with strong growth in UK rental sector as, unable to buy, renters increasingly seek high quality housing leased by professional landlords. This does not just apply to young professional families, but is also evident in the student accommodation sector with strong demand for purpose-built student accommodation.

Current macro environment – the pros and cons

Positively for the listed real estate sector, markets expectations are for UK base rates to peak in Q4 2023, with cuts beginning in Q3 2024. Economists and traders are currently forecasting the Bank of England base rate peaks at 5.25%-5.50% in Q4 2023, supported by commentary from Andrew Bailey, Governor of the Bank of England, that we are “much nearer the peak”. This too is supported by inflation data with this declining to 6.7% in August 2023, a significant drop from its peak of 11.1% in October 2022. This trend of decline is anticipated to continue with the Bank of England forecasting inflation to fall to 4.9% by Q4 2023, eventually returning to the target of 2% by Q2 2025.

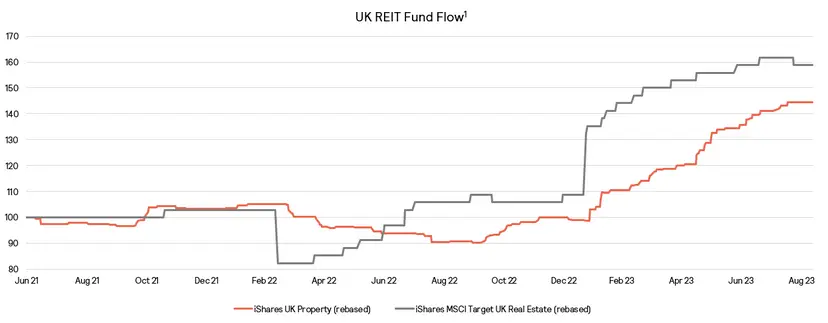

With this expectation of peaking interest rates, markets see medium-term funding costs declining, with the yield on 5-year gilts plateauing around 4.6%. Looking ahead five years, there is an anticipation of decline to 4.3%. These positive news stories have resulted in investor interest in REITs, which piqued in 2023, with net inflows into REIT tracker funds.

However, we are currently in a low-growth environment, with economists forecasting real GDP growth of 0.6% in 2024, followed by 1.5% in 2025. While the Bloomberg recession probability index has decreased from its peak of 80% at the close of 2022, it remains in a somewhat uncertain range of around 60%.

A low growth economy does not however signal challenges for the listed real estate market in its totality. Given this, a focus away from the cyclical sub-sectors (such as hotels and regional offices) should be considered with instead a focus on the less GDP sensitive areas such as healthcare, logistics, and the build-to-rent sector, which are better positioned to thrive in the current economic environment. The VT Gravis UK Listed Property (PAIF) Fund’s focus on REITs benefiting from the four mega trends of ageing population, digitalisation, urbanisation and generation rent, therefore puts it in good stead to weather an economic downturn.

Why invest in UK listed property?

With UK REITs currently trading at a wide discount relative to their historical averages, now represents an attractive opportunity to acquire them, with UK REITs on average trading at a 30% discount to their net asset value (NAV), significantly below the historic 10 year average of a 14% discount.

Looking from a share price returns perspective, investing in REITs again offers a potentially fantastic opportunity. Historically investors have been rewarded for investing around points of extreme NAV discounts. Purchasing at a 30% discount to the end of month NAV has delivered a positive one-year return 95% of the time, with the two-year average return exceeding 50% three fifths of the time.

Beyond potential share price upside, REIT operational performance continue to be strong when looking at the REITs to which the VT Gravis UK Listed Property (PAIF) Fund is exposed. For example, looking to the mega trends, the ageing population mega trend is currently trading at a 20% discount to NAV, whilst Government backed, in many cases inflation-linked, rental income continues to be received.

Simultaneously, the generation rent mega trend is trading at a 22% discount to NAV whilst witnessing the fastest growing rental income in the market at the moment. PRS REIT has experienced 7.5% rental growth over the last 12 months. Empiric Student has achieved 9% rental growth in the current academic year, while Unite Student are forecasting 5% rental growth for the 2024-2025 academic year.

Beyond strong rent collection, the REITs in which the VT Gravis UK Listed Property (PAIF) Fund invests are well positioned from a balance sheet perspective with an average loan to value of 30%, with 80% of the debt being fixed or capped, with a 5.8-year average maturity and an average cost of debt of 3.2%. This supports the REITs ability to provide healthy dividend growth with growing rental income streams and fixed cost of debt.

Outlook

Overall, the outlook for the UK listed property sector remains optimistic. With strong operational performance, growing rents and fixed rate debt, the REITs to which the VT Gravis UK Listed Property (PAIF) Fund has exposure continue to deliver investors long-term, growing income.

With the macroeconomic headwinds facing the UK listed property sector beginning to abate, the significant discounts to NAV at which UK listed REITs continue to trade offers an incredibly attractive entry point to this asset class.

Gravis. Important Notice (2023)

Past performance is not indicative of future performance, the value of your investment may go down as well as up. This video is published for general information only and is not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this video, no responsibility or liability whatsoever can be accepted by Gravis for any loss or damage resultant from any use of, reliance on, or reference to the contents. As a general report, the views and opinions contained herein may not necessarily represent views expressed or reflected in other Gravis communications, strategies or funds.