- Understanding of how to invest in solutions to biodiversity loss remains nascent, despite wide-reaching economic dependencies on nature.

- Yet solutions to each of the overarching drivers of biodiversity loss do exist and, to varying extents, present investable opportunities.

- Limited data on nature-related impacts remains an issue, but investors can continue to advance their understanding by mapping the activities of their portfolio companies.

The scale of exposure to nature-related risks means investors must urgently understand the drivers of biodiversity loss and invest in ways to reduce them

On the 50th anniversary of the first UN Conference on Environment and Development (UNCED), nations gathered in 2022 to agree the Kunming-Montreal Global Biodiversity Framework at the COP15 summit. It was agreed that at least US$200bn per year in global biodiversity-related finance should be mobilised, from public and private sources, by 2030.1

Despite this ambition, there is limited information about how companies can address nature-related risks and opportunities. We must collectively find ways to invest that protect and, if possible, restore biodiversity, but it is not obvious how, at least for the private sector. There is a lot of buzz about ‘nature positive’ investing, but not many brass tacks.

That vagueness may surprise investors accustomed to the idea of investing to mitigate and adapt to climate change. Unlike climate change, for which greenhouse gas (GHG) emissions and avoided emissions are measurable indicators of a company’s impact, biodiversity has no simple global metrics and is highly location specific. Despite increasing awareness of our collective dependency on nature, there is limited understanding of where and how this affects individual companies.

It is vital that understanding improves and that more capital is allocated towards companies whose products and services reduce the drivers of biodiversity loss. According to the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES), there are five direct drivers: changing land and sea use, overexploitation of organisms, climate change, pollution and invasive species.

Investors may not have a full and complete understanding yet of the opportunities arising from addressing biodiversity loss, but can start by taking a page from the climate investing book: invest in things that reduce drivers of the problem.

Given the enormous value of nature for humanity and the economy, we believe that as awareness of the risks of biodiversity loss grows among policy makers and consumers there will be more long-term opportunities for solutions that reduce and remove these risks. It follows that investors should start paying more attention to where these opportunities are already emerging.

Financial exposure to biodiversity loss

The extent of biodiversity loss is staggering: the Living Planet Index, a measure of biodiversity based on population trends among species on land and in water, recorded an average 69% decline among animal populations between 1970 and 2018.2

The biodiversity crisis we face is a consequence of economic and technological development in which polluters and others who disrupt natural processes generally don’t have to pay for the impacts of these externalities. It is also a result of the fact that there are over 8bn people on Earth today with rising consumption.

Until now, we have been able to rely on ecosystem services – the varied benefits provided by the natural world to human wellbeing, either directly or indirectly – for free.3 There is no single widely accepted method for valuing ecosystem services. Nor do we have accurate accounting for the status of and impacts on natural capital from human activity. Yet both are needed to help investors understand the value drivers for preventing biodiversity loss.

After all, sustained biodiversity loss carries systemic risks. A widely quoted statistic from the World Economic Forum estimates that half of global GDP is highly or moderately dependent on biodiversity.4 And in a more fundamental sense, biodiversity is what makes our air breathable and our water drinkable.

It follows that investment portfolios carry significant exposure to risks related to biodiversity loss. A 2023 study estimated that about 75% of the total market capitalisation of the FTSE 100 index of large UK-listed companies is dependent on ecosystem services.5

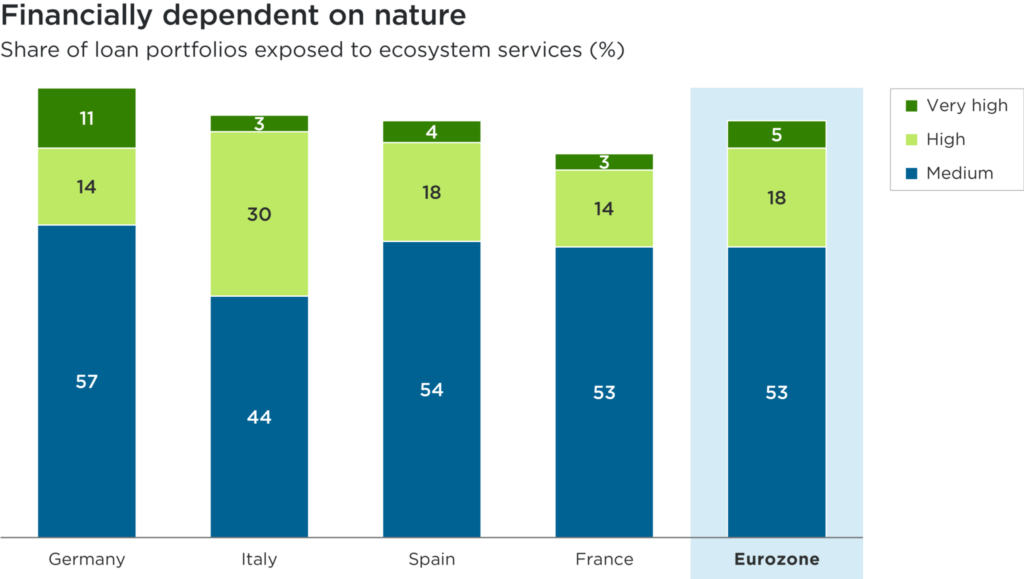

Lenders too are heavily exposed. Another recent study summarised research showing that more than 75% of Eurozone banks’ loans to companies by value (totalling €3.2 trillion) have strong dependencies on at least one ecosystem service (see the chart below).6 Almost 25% of loan portfolios have ‘high’ or ‘very high’ exposure. Continued deterioration of biodiversity could ultimately result in a reduction of creditworthiness for these loans, and potential losses for lenders.

Share of portfolio exposed to ecosystem services. Materiality scores are considered ‘low’ (from 0.2 to 0.4), ‘medium’ (0.4 to 0.6), ‘high’ (0.6 to 0.8) and ‘very high’ (0.8 to 1). This measure is calculated considering the average total dependency score across relevant ecosystem services. An ecosystem service is labelled ‘relevant’ if it has a total dependency score greater than 0.2. Selected Eurozone economies, plus Eurozone average.

Source: EXIOBASE, ENCORE, AnaCredit and European Central Bank calculations, published in Boldrini, S., et al, November 2023: Living in a world of disappearing nature – physical risk and the implications for financial stability. European Central Bank Occasional Paper Series

However, the financial sector can also play a critical role in addressing the degradation of natural ecosystems by both engaging with companies to reduce their negative impact on nature and by deploying capital into solution providers whose products and services play a positive role in halting and reversing biodiversity loss.

Impax are strong supporters of the recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD) which we believe will raise investors’ awareness of their dependency on nature and the nature-related risks and opportunities they face through their financing activities

Investing to reduce the drivers of biodiversity loss

Admittedly, we need a lot more information to comprehend the dependencies of financial assets on ecosystem services and biodiversity. This should not deter us from starting to address biodiversity-related risks, though, and seeking out solutions to the challenge.

We recently supported a research project, undertaken by independent academics from Imperial College London, to explore examples of companies protecting biodiversity within their operations. The analysis found that, unless required by regulation, companies only take action where it achieves corporate objectives like improving supply chain resilience or building reputational value.

Though this research highlighted the limited scale of corporate action to protect biodiversity directly, companies are already indirectly reducing pressure on nature through their line of business.

To differing extents, there are products and services that can address, or at least alleviate, the pressures on ecosystems from each of the five drivers of biodiversity loss identified by IPBES. In turn, given the critical importance of mitigating biodiversity loss to the global economy – and society – we believe that these can foster long-term opportunities for investors. Here are a couple of examples relating to each driver:

First, changing land and sea use:

- Precision agriculture technologies that help farmers grow more food on existing agricultural lands

- Natural ingredients and processes that preserve food and so reduce food waste, reducing pressure for the conversion of more wild ecosystems

Second, overexploitation of organisms:

- Sustainable land-based aquaculture can help to avoid overexploitation of marine food resources

- Plant-based proteins that substitute for resource-intensive animal protein in human and animal diets

Third, climate change:

- GHG mitigating solutions like renewable energy should contribute to the protection of ecosystems vulnerable to the effects of climate change

- Energy-efficiency solutions that also reduce GHG emissions share this impact

Fourth, pollution:

- Testing and treatment of air, soil and water can help control pollution and reduce or prevent harm to plants and animals

- Circular packaging solutions can substitute for single-use plastics and so help avoid plastic pollution

Fifth, invasive species:

- Bilge-water treatment can help the global shipping industry avoid introducing invasive non-native species to new regions.

Understanding our investee companies’ solutions

An important step in the journey to channelling more capital towards solutions that reduce these biodiversity drivers is to understand exposure to them today. As well as helping advance our understanding, mapping exercises create benchmarks against which future allocations can be evaluated.

We do not manage a dedicated ‘biodiversity’ strategy but do widely invest across our Environmental Markets strategies in innovative solutions to environmental problems, including climate change, pollution and resource depletion.

We have undertaken a detailed assessment of one of these investment strategy’s exposures to the five areas of ‘biodiversity solutions’. Based on a mapping of portfolio company activities, we categorised the strategy’s exposure to Tier 1, 2 and 3 activities, as they pertain to solutions to biodiversity loss, as follows.

| Tier 1 | Activities with significant and clear benefits in mitigating the pressures caused by at least one of the five biodiversity loss drivers. |

| Tier 2 | Activities with more limited but positive benefits in mitigating the pressures caused by at least one of the five biodiversity loss drivers. |

| Tier 3 | Activities that have some effects that can be positive in mitigating the pressures caused by at least one of the five biodiversity loss drivers. Note that these activities are not considered to represent ‘solutions’. |

We found that about one-third of this particular portfolio is contributing to solutions to biodiversity loss at a Tier 1 level. Most exposure is in three areas: land and sea use change, climate change and pollution prevention.

It is important to stress that this is a preliminary analysis, not the last best word on our contributions to protecting biodiversity. Nor should the assessment be regarded as evaluating net contribution to biodiversity: this analysis concentrated on companies’ products and services mitigating the five drivers but did not assess their activities’ contributions to biodiversity loss.

We do, however, systematically evaluate biodiversity-related risks in our investment process, both in our top-down sector analysis and bottom-up company sustainability analysis. Nature is also one of our four thematic areas of company engagement, through which we look to manage investment-related risks and improve outcomes.

We are mindful that, as with climate solutions investing, there are times when the solution to the problem is not immaculate. For example, wind turbines cause a number of bird deaths and shifting to plant-based diets still may involve conversion of natural ecosystems to agricultural monocultures. Many providers of climate solutions are industrials companies – the fourth most carbon-intensive sector.7 It is important to note all the biodiversity impacts of our investments, positive and negative.

Better data and disclosure are critical steps to shine a light on the issues and enable an accurate assessment – and valuation – of the risks and opportunities associated with biodiversity loss and its mitigation. Encouragingly, many companies, alongside the scientific community, are contributing to a rapid expansion of the data landscape. Only once the information gap has been bridged will capital flows begin to move the needle on biodiversity loss.

For now, we believe this is the kind of analysis investors must start doing in order to rise to the ambitions for private sector finance that COP15 envisioned to halt biodiversity loss by 2050. Directing capital into promising areas at scale will be a long journey, but we have to get moving – and without delay.

Advocating for change

Alongside our investment activities, we look to shape better policymaking on addressing biodiversity loss – and accelerate the transition to a more sustainable economy – through our stewardship and advocacy work. Our approach is codified in Impax’s Approach to Nature, Biodiversity and Deforestation.

To date, many investors have understandably focused on targeting reducing tropical deforestation, a highly visible and significant facet of the land-water use change driver of biodiversity loss. Impax is a founding member of the Finance Sector Deforestation Action (FSDA) initiative, under which signatories commit to best efforts to eliminate forest-risk agricultural commodity-driven deforestation activities by investee companies. The Investor Policy Dialogue on Deforestation (IPDD) initiative, of which we are also part, aims to coordinate a public policy dialogue among investors on halting deforestation. We have also recently joined the PRI’s new Spring initiative, aimed at biodiversity policy, the Nature Action 100 engagements, and are an early adopter of the TNFD.

Deforestation has by no means been defeated, but these initiatives offer a path towards that goal. More work is now needed that focuses on tackling land use change on the 90% of the Earth’s surface that is not forested.

1 Convention on Biological Diversity, 2022: COP15: Nations Adopt Four Goals, 23 Targets for 2030 in Landmark UN Biodiversity Agreement

2 World Wide Fund for Nature and the Zoological Society of London

3 The EPA defines ecosystem services as “Ecosystem goods and services produce the many life-sustaining benefits we receive from nature—clean air and water, fertile soil for crop production, pollination, and flood control.”

4 World Economic Forum, in collaboration with PwC, 2020: Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy

5 Layman, H. et al., September 2023: Short term solutions to biodiversity conservation in portfolio construction: forward looking disclosure and classification-based metrics. Business Strategy and the Environment

6 Boldrini, S. et al., November 2023: Living in a world if disappearing nature: physical risk and the implications for financial stability. European Central Bank Occasional Paper Series

7 Based on Scope 1 and 2 emissions.