Equities gained in June, but the advance was hesitant at times as markets wondered about the course of US monetary policy and the effects of the spread of the Delta variant of Covid-19. The economic outlook remains favourable, however, as evidenced by the continued improvement in business survey results and consumer confidence.

It is becoming clear that the post-Covid recovery will resynchronise in the second half of the year as economies reopen while vaccinations campaigns pick up speed, especially in continental Europe.

Global trade is bouncing back at a faster-than-expected pace, resulting in bottlenecks in transport and production and upward price pressures. Commodity prices are rising. Crude oil rose by 11% over the month to USD 74 per barrel of WTI, its highest level since October 2018.

WHO INVITED THE DELTA VARIANT (AND HOW TO GET RID OF IT)?

While investors welcomed the progress being made on vaccinations, the rise in Delta infections in countries including the UK, Australia, Israel and Portugal began to weigh on risky assets towards the end of June. Some governments were forced to delay the end of containment measures or indeed had to tighten social restrictions again. It is clear the fight against the pandemic is not over yet.

According to studies, existing vaccines are effective against variants in that they can prevent serious illness and this has been borne out so far. In other words, the emergence of new variants may slow a return to normalcy, but the effects on the economy should be more muted than those of previous waves of the pandemic.

BYE-BYE REFLATION TRADE?

Are investors right to begin to mourn the passing of the ‘reflationary’ scenario?

The idea that central banks will consent to inflation moving sustainably above their targets appears to have been challenged by the latest comments from the US Federal Reserve. However, it is not clear there is unanimity among monetary policymakers about the need for inflation-busting action already now.

Even if the Fed decides the time has come, investors should expect it to tread cautiously. Any tapering of its monetary policy support is likely to be gradual and the Fed can be expected to endeavour to announce any intentions it may have to reduce the pace of its asset purchases well in advance.

Indeed, news of the start of tapering discussions at the Fed did not trigger any market ‘tantrum’, but the prospect of an earlier-than-expected rise in policy rates still weighed on markets.

EQUITIES – IT IS ABOUT ECONOMIC GROWTH, INFLATION, THE VIRUS AND MORE

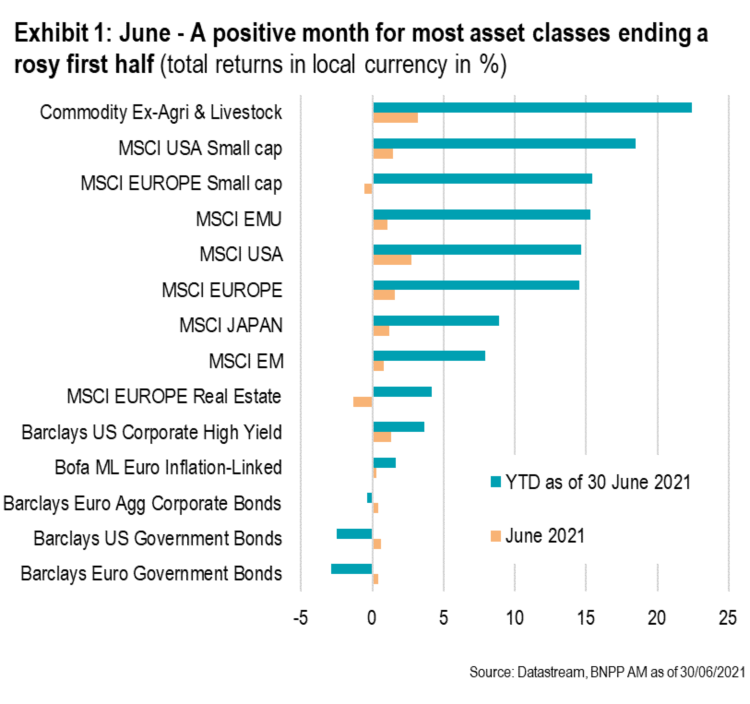

Positive economic prospects helped global equity markets overcome a wobble over US monetary policy, but jitters struck again over the spread of the Delta variant. Nevertheless, the MSCI AC World index ended the month up by 1.2% in US dollar terms, gaining 6.9% over Q2 and 11.4% over H1.

Over each of these periods, emerging market equities underperformed, suffering from the rise in US long-term yields and outbreaks of Covid in regions that had hitherto been less affected. The MSCI Emerging Markets index finished the month practically unchanged at -0.1%, Asian equities underperformed slightly. Over the quarter, the EM index gained 4.4% and its year-to-date rise came out at 6.5%.

The S&P 500 index set new records in June, posting a 2.2% rise. The NASDAQ composite, which had fallen in May, climbed to a high at the end of June for a 5.5% gain from May. US equities outperformed major developed markets: Europe gained 0.6%, but Tokyo’s Nikkei 225 lost a slight 0.2%. The broader Topix index rose by 1.1%.

SHORT-TERM WEAKNESSES EQUAL ATTRACTIVE ENTRY LEVELS

The favourable economic environment should lift companies’ earnings prospects. Equities should thus be able to resist any rise in long-term bond yields that central banks will, in any case, try to limit or at least manage in an orderly fashion. However, if inflation expectations become unanchored, they could derail this scenario, provoking sharp rises in long-term yields.

In the short term, our market indicators are pointing to investor hesitancy. Recent gains occurred amid fairly modest volumes and in technically rather fragile conditions. For instance, when the S&P 500 hit all-time highs, only 6% of its constituent stocks did so too. This signals little upside participation.

We believe a correction in equities would offer investors more attractive entry levels.