In our weekly take on the key developments in financial markets and economies, we consider what to make of the latest inflation data and put a spotlight on the divergence between oil and gas prices.

As confidence in the stability of growth has increased in recent weeks, investors are turning their attention to the consequences for inflation and what this means for markets. Accordingly, inflation data took center stage last week.

Japan was the first to report, with inflation overshooting expectations and consumer prices slowing less than expected. Core consumer prices for January fell in line with the Bank of Japan’s (BoJ’s) 2% target versus expectations of 1.9%. However, foreign travel packages were highlighted as a technical factor that inflated the data.

Investors continue to debate if the end of Japan’s negative interest rate policy will start in March or April. However, recent comments from BoJ Governor Ueda suggest the start date could be even later “We are not yet in a position to foresee the achievement of a sustainable and stable inflation target,” he said1.

US data points to July rate cut

Turning to the US, after the previous week’s strong inflation data, investors looked for confirmation from the Federal Open Market Committee’s (FOMC’s) preferred Personal Consumption Expenditure (PCE) report. The data came in line with expectations, with core PCE increasing 0.4% in January and falling to 2.8% on a twelve-month basis.

Bond bears will emphasise six-month annualised core PCE accelerated to 2.5% from 1.9%, but the report only gave confirmation the FOMC will remain on hold until the summer. The overnight interest rate swap market is currently pricing the first full 25 basis points (bps) cut for July.

Lastly, the eurozone released its first look at February’s price data. Disinflation continued in the region, but in a similar pattern to elsewhere — at a slower pace, with prices easing less than anticipated. Headline inflation fell to 2.6% and core inflation to 3.1%, against expectations of 2.5% and 2.9% respectively. The European Central Bank (ECB) will likely be encouraged service prices declined and may feel justified in the decision to wait until the summer before loosening. The overnight interest rate swap market is pricing in an 86% chance the ECB will cut rates by 25bps in June.

HY and EM credit outperform as government bonds slump

With central banks damping expectations of a loosening in the second quarter, and a string of sticky inflationary data, February was a tough month for government bond markets. The selloff in interest rates was led by the front end of curves — yields in US and Germany two-year bonds rose 41bps and 48bps respectively.

There was better news for high-yield corporate credit, which outperformed investment grade and generated a positive total return for the month. Emerging-market (EM) credit was also a clear winner. EM central banks have already started loosening policy rates, and valuations and the pick-up in coupons remain appealing. Meanwhile, a significant shortage of new supply and underweight positioning from global investors looking to increase exposure are pushing a strong technical bid for securities.

For equity markets, it was another strong month for the Magnificent Seven, which rose over 8%. Nvidia and Meta took the spotlight after releasing standout fourth quarter earnings. However, Asia’s equity markets saw even better performance. Japan’s Nikkei 225 topped its previous high set in 1989, rising over 10% in February, while the Shanghai Stock Exchange appreciated by over 9%, its best monthly return since November 2022. Meanwhile, the Chinese regulator clamped down on disruptive quant activity and state-backed funds bought 410bn yuan ($57bn) of exchange-traded Chinese funds2.

Oil and gas diverge

Currency markets were broadly range bound for the month, possibly a sign of geopolitical tensions not escalating further. At the same time, the talk of commodity markets was the diverging fortunes of oil and gas. Oil prices finished the month 5% higher, as transportation costs and supply constraints from OPEC+ took effect.

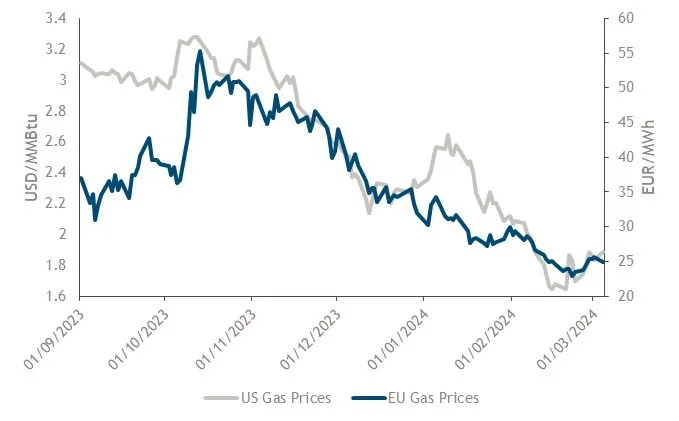

In contrast, gas prices in the US and Europe have fallen by over 40% and 50% respectively since October (see Chart of the Week). A mild winter and booming US production have led to a supply glut across the globe; US current stock is 498 billion cubic feet (BCF) above the five-year average of 1,876 BCF3, and European gas storage is 63% full versus the 5-year seasonal norm of 46% for this time of year4. This is good news for industrial activity and, along with an inventory rebuild, explains the expectations for global manufacturing to pick up in the coming months.

Chart of the Week—Since October Gas Prices have Collapsed: Europe -55%, US -44%

Source: Bloomberg, as of 1st March 2024. For illustrative purposes only.

References to specific companies is for illustrative purposes only and does not reflect the holdings of any specific past or current portfolio or account.

1.Bloomberg News, “BoJ’s Ueda Keeps Market Players Guessing Over Rate Hike Timing,” 1st March 2024

2.South China Morning Post, “After the best run in 16 months, investors see Chinese stocks maintaining momentum on policy tailwinds,” 1st March 2024

3. FX Empire, “Natural Gas Storage Draw Exceeds Estimates,” 29th February 2024

4. Bloomberg News, “European Gas market Fundamentals Snapshot March 1,” 1st March 2024

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co. are as of 1st March 2024 and may change without notice. All data figures are from Bloomberg as of 1st March 2024, unless otherwise stated.

Important Information

Muzinich & Co.”, “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above. United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC. Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom.