In our latest round-up of developments in financial markets and economies, we consider what to make of a week of divergence in asset prices.

After several years where financial markets were largely driven by risk-on or risk-off sentiment, the current trend of divergence across asset classes might take some getting used to for many investors.

This week, the winners included gold. Spot prices were up over 3%, continuing the trend of the past six months where gold has risen almost 23%.1 Gold is often used as a hedge against escalating geopolitical risk or rising inflation, as investors fear fiat currencies could be debased.

The other big winner was the US dollar, which appreciated against other G10 currencies. Variables that typically cause the greenback to appreciate include its status as the global reserve currency; higher uncertainty can also result in inflows as US investors send money home and many non-US investors look to increase dollar exposures. Currently, interest-rate differentials favour the US versus many other markets, with global savers paid more on a relative basis to hold US assets.

Weaker yen

At first glance, we could conclude it was a risk-off week, but the details reveal a more nuanced picture. Putting the dollar under the microscope, its appreciation has been most notable against developed-market currencies, not higher-beta, emerging-market currencies. The Japanese yen, meanwhile, belied its usual “safe haven” status, depreciating and breaching 153 against the dollar. The last time the yen was at these levels was 1990.2 However, the underperformance of the euro was even starker, weakening against the US dollar by over 1.5%.

Equity indices in all regions were mostly range bound (+/- 1%), while corporate credit spreads were flat to slightly tighter for the week, with high yield outperforming. The largest divergence was in government bonds. For example, five-year US Treasury yields increased by 14 basis points (bps) versus German bund yields, which fell 3bps.

Diverging US and euro rate expectations

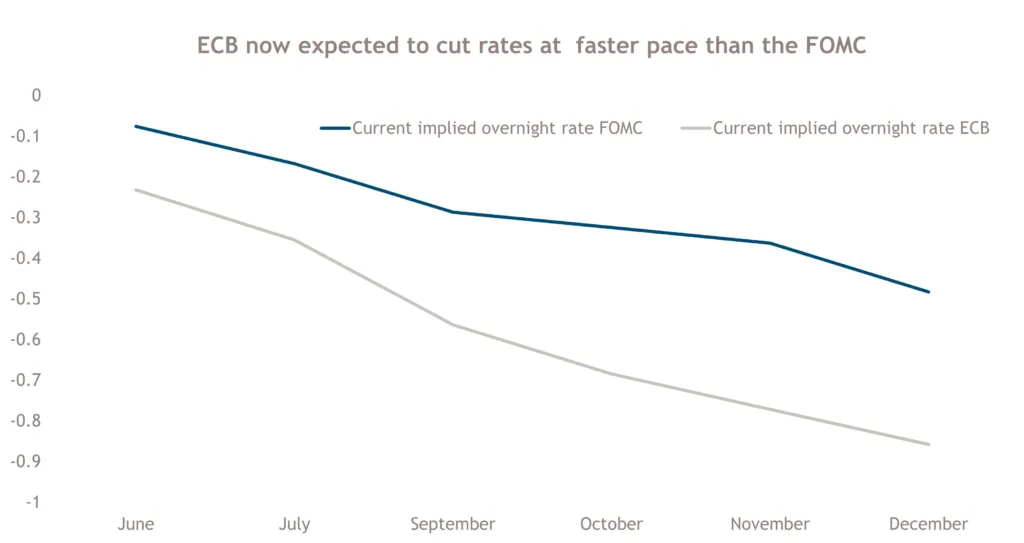

Of perhaps greater significance to investors, the overnight interest rate swap market is now pricing in just one 25bps cut in 2024 by the US Federal Reserve at September’s meeting of the Federal Open Market Committee (FOMC). The European Central Bank (ECB) is expected to initiate its first cut in over eight years at its June meeting, with three full 25bps cuts priced in for this year. [See Chart of the week.]

The Fed’s reluctance to move early on rates is down to inflation data. US headline and core consumer prices in March rose 0.4% against expectations of 0.3%.3 This edged headline inflation higher to 3.5% and core inflation to 3.8% over the past 12 months.

Two aspects from the data will be of particular concern to the FOMC. March was the third month in a row core inflation was above economists’ expectations, suggesting a loss of momentum to the disinflation trend. Additionally, the “super core” component of consumer prices — core service prices excluding rents — rose 0.65% month-on-month, with auto insurance, personal services and medical services respectively up 2.6%, 0.76% and 0.56%.

European inflation is heading in the opposite direction. Core inflation fell to 2.9% in March from 3.1% in February, its lowest level in two years.4 At the ECB meeting on April 11, investors sought confirmation policy restrictions will start to be removed in June. While the ECB kept policy rates unchanged as expected, it stated: “If the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission were to further increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction.”

Hotter for longer?

Putting the pieces together, the US economy has yet to land and may run hotter for longer. This should benefit risk assets, in our view, particularly those less sensitive to interest rates, including US and EM short-duration high yield. Conversely, Europe is already on the runway, which should benefit assets more sensitive to rates, such as full-duration European investment-grade credit.

At the same time, investors need to remain mindful of ongoing geopolitical uncertainty. This would support the case for additional portfolio diversification and holding capital in reserve in case of price dislocation.

Chart of the week

Figure 1: ECB expected to cut rates faster than the Fed

Forecasts mentioned are not a reliable indicator of future results.

Source: Bloomberg, as of April 11, 2024. For illustrative purposes only.

References

1.Goldprice.org, as of April 12, 2024

2.Nikkei Asia, ‘Japan lets yen slide past 153 without intervention,’ April 11, 2024

3.Bureau of Labor Statistics, as of April 10, 2024

4.European Commission, as of April 3, 2024

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co. are as of 15 April 2024 and may change without notice. All data figures are from Bloomberg as of 11 April 2024, unless otherwise stated.

Important Information

Muzinich & Co.”, “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above. United States:

This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC. Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2024-04-15-13340