Key Takeaways

- More and more businesses have started to mention AI in their earnings calls since the release of ChatGPT

- Nasdaq CTA Artificial Intelligence is a systematic approach to capture the investment opportunities in the AI segment.

- The index’s most recent rebalance reveals the dynamics of AI investment and the potential it holds

- Related ProductsWisdomTree Artificial Intelligence UCITS ETF – USD AccFind out more

NVIDIA was probably the most captivating company in the tech industry in Q1. Its earnings call in February attracted widespread attention from investors, who held their breaths in anticipation. This resulted in various sentiments, including a slight dip before the call.

However, NVIDIA’s staggering 265% year-over-year (YoY) revenue growth reinvigorated market sentiment. Subsequently, the unveiling of the new Blackwell chips, B200 and GB200, once again thrust Nvidia into the headlines.

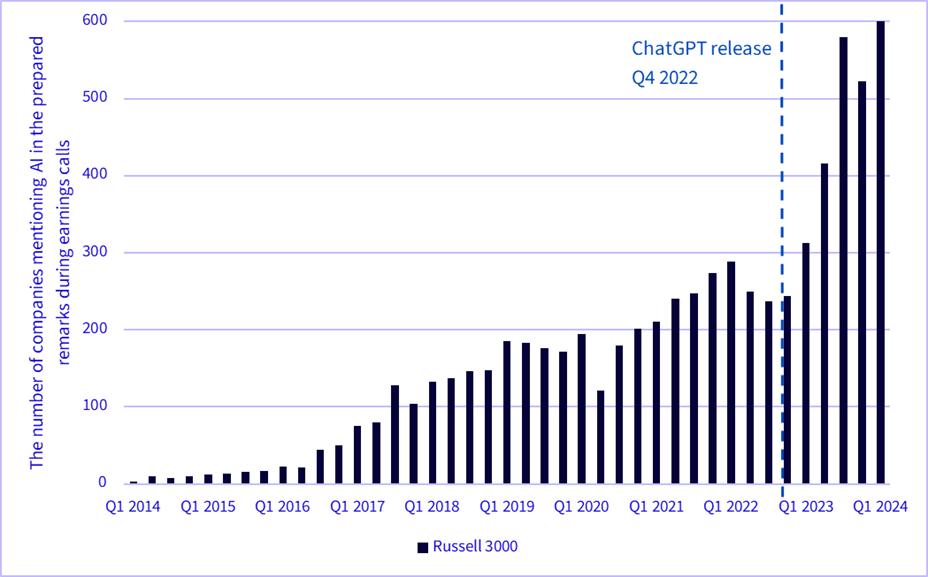

NVIDIA’s revenue wasn’t the only one to experience a rally last year. Many companies have begun discussing AI during their earnings calls thanks to the artificial intelligence (AI) boom, led by ChatGPT. Compared to Q1 2023, the number of companies mentioning AI in their prepared remarks during earnings calls in Q1 2024 surged by 94% among Russell 3000 constituents1. Clearly, AI is a hot topic not only for investors but also for corporates.

Figure 1: The number of companies mentioning AI in the prepared remarks during earnings calls

Source: Bloomberg. As of 31 March 2024.

A systematic way to capture the pure AI megatrend

While an increasing number of companies discuss how AI has shaped or will shape their business, distinguishing AI-focused companies from mere users of AI technologies and identifying investment potential among companies that interact with AI in distinct ways can be a challenging task.

The Nasdaq CTA Artificial Intelligence Index (NQINTEL) offers a systematic approach to capture the potential gains in the AI segment. Companies within the eligible universe are categorised into three groups based on their position in the AI value chain and their estimated revenue exposure to AI. The categories are:

- Engagers: Engagers are at the forefront of AI-powered services and products. Their customers are directly utilising and benefitting from AI.

- Enablers: Enablers supply the components that can support the real-time complex processes required by AI solutions.

- Enhancers: Enhancers are large, diversified companies operating on scales that few others can imagine and tend to push more and more towards AI, platforms and data as they continue forward.

Recent additions: A glimpse into the index

Based on updated classification and AI intensity scores, the NQINTEL undergoes rebalancing every March and September. In March 2024, the index welcomed five new constituents and moved an existing constituent from Enhancer to Engager after the rebalance. Analysing these changes provides us with a glimpse into the index’s reconstitution.

Ocado Group (shifted from Enhancer to Engager): Ocado was an existing holding before the rebalance, but its classification has been changed from Enhancer to Enabler this time. This company is well known for its online retail business, but it also provides AI-powered technology solutions like warehouse automation and robotic fulfilment.

The company was moved to enabler because of its technology solutions’ remarkable profitability and substantial growth. Notably, Ocado’s technology solutions’ revenue surged by 44% last year compared to 2022. Moreover, Ocado is expanding its technology business globally. It has secured its first deal outside grocery retail to provide its robotic warehouse solution to a site drug distributor McKesson’s Canada unit. It also opened three robotic fulfilment centres – in the UK, Japan and Canada. Given the increasing importance of AI-powered solutions to Ocado’s business, Ocado was shifted from Enhancer to Engager.

Palantir Technologies (new addition to Engager): Palantir Technologies is a software company specialising in building enterprise data platforms. They launched an AI solution, AIP, last year, offering a comprehensive solution. This allows customers to leverage Palantir’s AI and machine learning tools, including the latest large language models (LLMs), within their data platforms. Customers can deploy LLMs on their private networks, maximising data security and improving efficiency by minimising data transfer and storage costs.

Benefitting from its AI solutions, Palantir’s Q4 revenue increased by 20% YoY, and it anticipates full-year revenue growth of 19% over the previous year in 2024. The share price has surged by more than 40% since the Q4 financial results were released.

The company increased transparency regarding its clients and partnerships. This has revealed robust sales growth not only among government clients but also within the commercial sector. This transparency underscores the company’s genuine AI capability and convinced our index provider to add them to the index.

The company AI intensity score became high over the last year and met the financial eligibility criteria. Consequently, Exscientia was added to the index this time.

Darktrace (new addition to Engager): Darktrace Plc specialises in developing and selling AI-powered cybersecurity solutions for businesses. The company’s AI technology offers a dynamic view of cloud architectures and swiftly interrupts in-progress cyber attacks, including ransomware, email phishing, and threats to cloud environments and critical infrastructure.

Benefitting from the tailwind of AI, Darktrace reported 27.4% YoY revenue growth and 24.4% YoY ARR growth. Additionally, they have raised their expectations for revenue and EBITDA margin for the current year. This company’s AI intensity score is on the rise, and its AI solution has been demonstrated to gain customers and generate revenue.

CEVA Inc (new addition to Enabler): CEVA, Inc. specialises in licensing signal processing platforms and AI processors to chip manufacturers. Their offerings include Digital Signal Processors, AI processors, wireless platforms, and complementary software for sensor fusion, image enhancement, computer vision, voice input, and AI.

The company has developed a powerful NPU IP (Neural Processing Unit Intellectual Property) known as NeuPro-M NPU. This specialised hardware component is designed to accelerate neural network computations, reduce power consumption, enable real-time processing, and support edge AI applications.

Symbotic (new addition to Enhancer): Symbotic is an automation technology company specialising in robotics and automation-based product movement technology platforms. Its system manages various aspects of warehouse logistics.

Notably, the company has improved warehouses by deploying a fleet of autonomous robots powered by AI-powered software. Symbotic’s platform already serves some of the world’s largest retailers. Leveraging their AI-powered solution, the company achieved a 98% YoY revenue increase in Fiscal Year 2023.

All financials and share prices in this section are sourced from Bloomberg. As of 31 March 2024.

Conclusion

ChatGPT has been released for over a year and a half, and the rally in the AI megatrend that it initiated is gradually expanding into various segments. The most recent rebalance of the Nasdaq CTA Artificial Intelligence Index provides insight into various companies, spanning cybersecurity, cloud services, biotechnology, robotics, and supply chain.

By classifying companies based on their position in the AI value chain and applying an equal-weighting method within each group, the Nasdaq CTA Artificial Intelligence Index selects a well-rounded mix of companies interacting with and driving AI advancements in distinct ways. These companies are poised to benefit from the potential broadening of the AI megatrend in the near future.

Sources

1 Bloomberg. As of 31 March 2024.