In our latest round-up of developments in financial markets and economies, we consider what to make of an improving growth outlook, but worsening debt picture.

As geopolitical risk escalated in the Middle East and elsewhere, volatility hit financial markets last week, despite an improving global growth outlook.

Risk assets were particularly impacted; in the US, the S&P 500 slumped 3% while the Nasdaq was down 5.5%. Japan’s Nikkei index fared even worse, sliding 6.2%. Credit markets were not immune, with US high-yield option-adjusted spreads widening 14 basis points (bps) to 339bps, although triple-B corporate bonds held relatively firm, widening just 4bps over the week.1

Inflationary politics

On April 12, the UK and US announced an extension of their ban on metal-trading exchanges accepting new aluminium, copper and nickel produced by Russia, while also barring imports of the metals.2 That news led to a strong week for industrial metals, with the price of aluminium rising almost 5%.3 The US and European Union are also preparing new sanctions on Iran in response to its missile and drone programme.4

Meanwhile, the trade war between the US and China continues with US President Joe Biden calling for a tripling of tariffs on Chinese steel and aluminium imports, which he says will protect the US steel and shipbuilding industries from China’s “unfair practices”.5 In contrast, when meeting German Chancellor Olaf Scholz in Beijing last week, President Xi Jinping claimed Chinese exports were helping cool global inflation and supporting the energy transition.6

Springtime in Washington

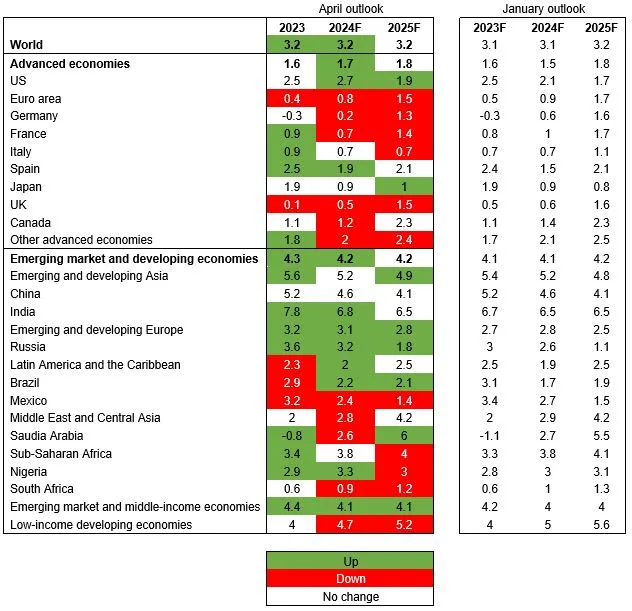

Growth was a major focus last week at the World Bank and International Monetary Fund’s (IMF) annual Spring Meeting in Washington DC. During the event, the IMF released revisions to its World Economic Outlook,7 generally on the upside, with a few notable exceptions (see Chart of the Week).

Global growth was upgraded by 0.1% to 3.2% for 2024. Advanced economies are now expected to grow 1.7%, with the US upgraded by 0.6% to 2.7%. The IMF stated most indicators point to a soft landing in the US, although its projections for the euro zone were more downbeat, lowering its 2024 growth forecast to 0.8% from 0.9%.

The prospects for emerging markets (EM) look more favourable, with EM and developing economies expected to grow 4.2% this year. An improving growth picture in India and Brazil has contributed to the revision. Asia is expected to account for 60% of global growth this year, led by India.

Estimated growth in China was unchanged at 4.6%, although given better-than-anticipated economic data, a revision in the IMF’s next economic outlook can’t be discounted. In Q1, China’s economy grew 5.3% year-on-year, well above the 4.6% consensus of economists polled by Reuters.8 This suggests the Chinese economy is continuing the momentum from Q4, 2023, when its economy expanded 5.2%.

Fiscal largesse

The IMF has abandoned its concerns of an imminent recession, and said it was positively surprised at the resilience of banking systems and EM countries. Inflation and debt are the big concerns. Although still expecting inflation objectives to be achieved by central banks in advanced economies, the IMF warned recent headline and core inflation figures call for continued vigilance.

The IMF’s long-term concern is fiscal largesse. Global government debt is projected to rise to 98.8% of GDP by 2029, an upward revision from 93.2% in 2023, with the IMF urging the US and China to act.9 China’s government debt is expected to rise from 83.6% of GDP at the end of 2023 to 110.1% in 2029, with US government debt expected to rise to 133.9% from 122.1% over the same period. Left unchecked, the IMF warns China’s debt could double over the next 30 years, while US debt could increase by 70%.

Expectations for US rate cuts have been dialled back in recent weeks, which the IMF attributes to fiscal slippage. “Loose US fiscal policy could make the last mile of disinflation harder to achieve while exacerbating the debt burden,” it stated.

There was a significant pick-up in communication last week by US Federal Open Market Committee (FOMC) members, as the recent trend of upside inflation surprises continued, this time concerning retail sales. Excluding auto-related receipts, retail sales increased 1.1% month-on-month, the highest reading since January 2023 and well above expectations of 0.4%.10

The FOMC’s base case remains that it will start the removal of restrictive policy this year. However, given how ‘hot’ economic data is, it may take longer for the committee to have confidence in achieving its inflation objective, with restrictive policy needed for longer. The overnight interest rate swap market is now only pricing in one 25bps cut in policy rates this year, in November.

As we noted in last week’s Market Comment, the European Central Bank (ECB) is in a different position. Last week, Robert Holzmann, Austria’s central bank governor and one of the ECB Council’s most prominent hawks, conceded: “If inflation develops as expected and, above all, the geopolitical problems don’t worsen, there will likely be a majority for an interest rate cut in June.11

Chart of the week

Figure 1: IMF updates GDP growth forecasts (annual change, per cent)

Forecasts mentioned are not a reliable indicator of future results.

Source: IMF, as of April 16, 2024. For illustrative purposes only.

References

1.Ice Index Platform, as of April 19, 2024

2.UK Government, ‘UK and US to clamp down harder on trade of Russian metals,’ as of April 12, 2024

3.London Metal Exchange, as of April 19, 2024

4.Financial Times, ‘US and EU prepare fresh sanctions against Iran after Israel attack,’ as of April 17, 2024

5.The White House: ‘Biden-Harris Administration Announces Actions to Protect U.S. Steel and Shipbuilding Industry from China’s Unfair Practices’, as of April 17, 2024

6.Bloomberg, ‘Xi Rebuffs Scholz Pressure to Rein In Chinese Manufacturing’, as of April 16, 2024

7.IMF, World Economic Outlook, as of April 16, 2024

8.Reuters, ‘China’s economy grew faster than expected in Q1’, as of April 16, 2024

9.IMF, Fiscal Monitor, as of April 17, 2024

10.US Census Bureau, as of April 15, 2024

11.Bloomberg, ‘Fed Rate-Cut Reluctance Will Limit ECB Leeway, Holzmann Says’, as of April 18, 2024

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co. are as of April 22, 2024, and may change without notice. All data figures are from Bloomberg, as of April 19, 2024, unless otherwise stated.