Data published this week in the US and eurozone suggests inflation may now be on a steady, downward glide path. Bond markets greeted the news with a rally, as did risky assets. Expectations that the US Federal Reserve and ECB may cut rates sooner than thought thus far were reinforced. Our fixed income team is sceptical, anticipating US inflationary pressures will not subside so smoothly.

Eurozone inflation falls significantly

Investors expecting that central banks will start cutting interest rates sooner rather than later were encouraged by data showing a further drop in eurozone inflation this week.

The harmonised index of consumer prices (HICP) in the 20 countries of the eurozone fell from 2.9% in October to 2.4% per cent in November. Lower core inflation was the main driver with both goods and services inflation down. The core rate, excluding energy and food, fell from 4.2% to 3.6%.

This sharper-than-expected decline in headline inflation takes it closer to the European Central Bank’s 2 % target and is generating excitement about how soon rate cuts will start.

The ECB only stopped raising rates in October, but investors are now anticipating it could start cutting as early as next April. ECB President Christine Lagarde said last week it was still too early to ‘start declaring victory’ in the push to tame inflation, warning price growth was set to reaccelerate ‘in the coming months’ as recent disinflationary forces start to fade.

Our macroeconomic team see an inflection in all measures of underlying inflation in the eurozone. They have revised down their core inflation forecasts and now expect this rate to be back at the 2% target in the eurozone by mid-2024. This revision is driven largely by prices of core goods. We expect disinflation in prices for services due to weaker domestic demand and a softer labour market.

On this basis, the ECB could theoretically start cutting policy rates in March/April 2024. But we think it more likely it will wait until June to have a full picture of the wage settlements next spring.

President Lagarde and other ECB council members have warned that they needed to see more evidence that wage growth was stalling before being sure that inflation was on track to drop to the ECB’s target. This caution will have only been reinforced by negotiated wage data the ECB published last week, showing it accelerated from 4.4% in the second quarter to 4.7% in the third quarter.

Fed’s inflation gauge shows an easier pricing environment

This final week in November saw the release of the Fed’s preferred inflation gauge, namely the core personal consumption expenditures measure. Core PCE, which excludes energy and food, rose by 0.2% from September when the month-on-month rate stood at 0.3%. Year-on-year, core PCE rose by 3.5% in October (after September’s 3.7% rise). At the Fed’s last meeting, policymakers forecast a rate of 3.5% for December.

ThIs data comes in the wake of news earlier this month that US consumer price inflation (CPI) fell by more than expected in October to 3.2 % year-on-year (after a 3.7% rise in the 12 months to September), marking the first decline in four months.

Market sentiment was also bolstered by a revision of US GDP data. This revealed that although GDP grew at an annual rate of 5.2 % in the third quarter (versus 4.9% in the advance estimate), inflation was slower than previously thought. The PCE price index — another measure of inflation closely followed by the Fed — was revised downwards by 0.1% to 2.8%.

After the cautious tone in the latest Federal Reserve meeting minutes, bond bulls were encouraged this week by comments from one of the Fed’s most hawkish policymakers, Christopher Waller, who said he was ‘increasingly confident’ that the Fed’s current policy was ‘well positioned’ to bring inflation back to the 2% target. This was seen as opening the way to a rate cut in the first half of 2024.

In a speech entitled “Something appears to be giving” Waller said that:

“If we see disinflation continuing for several more months — I don’t know how long that might be, three months, four months, five months . . . you could then start lowering the policy rate just because inflation’s lower.”

This rationale – cutting simply because inflation is coming down, rather than waiting until it gets all the way back to 2% – explains why markets have swung now to fully pricing in a quarter-point cut by the Fed’s meeting in May 2024, compared with expectations in mid-October that there was no chance of a cut by mid-2024.

This week’s rally in the US bond market has pushed down yields on 10-year Treasuries from a 16-year peak of 5.02% a month ago to a low of 4.25% this week. Markets are now pricing that the Fed will have cut policy rates by around 125bp by January 2025 (after discounting just 50bp of cuts in late October).

Higher for longer is our view

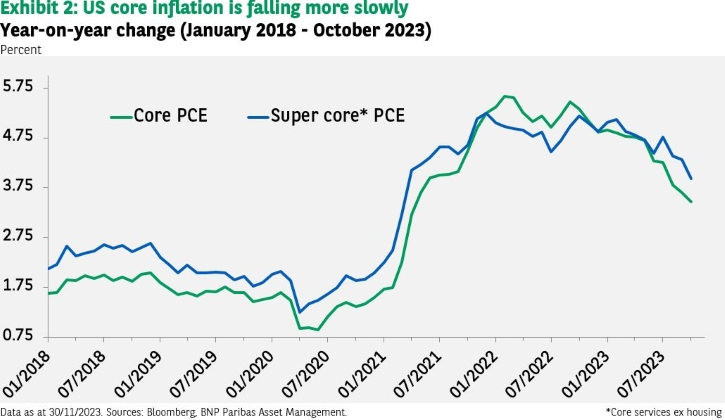

The view of our fixed income team is that by assuming a steady easing in inflation, the US bond market is getting ahead of itself and pricing in too many rate cuts in 2024.

While the latest data for the eurozone clearly suggests the period of high inflation is over, we do not expect US inflation to retreat so tamely. For this reason, we anticipate no more than 75bp of rate cuts from the Fed in 2024, with no easing of monetary policy until the second half of 2024.

Admittedly, each softer inflation report does increase the chance that inflation may convincingly return to 2% in the coming months without a deeper economic slowdown, but we see this as unlikely.

In the view of our bond team, US core inflationary pressures remain volatile. It thinks there is an underlying rigidity in the US labour market that means wages and prices of core services excluding shelter will not decline as quickly or smoothly as the market appears to anticipate.

Before the next meeting of the Federal Open Market Committee (FOMC), policymakers and markets will see data on job openings, a job market report and a supply managers’ survey for November. CPI inflation will be published on 12 December, the first day of the FOMC meeting.

This data will go some way in telling us whether inflation and aggregate demand are continuing to move in the right direction and whether inflation is on a glide path, or a rocky road toward the Fed’s 2% goal.

Disclaimer

![]()