We recently wrote a blog highlighting the main differences, in issuance mechanism, between Bitcoin and Ethereum. The key takeaways are that Ethereum’s mechanism is not predetermined, has been evolving through time, and will continue to do so in the future. The Ethereum community regularly implements changes to tackle challenges faced by the network, such as high or volatile fees. Two main upcoming changes to the protocol will impact the issuance mechanism: Ethereum Improvement Proposal (EIP) 1559, also called the London Fork, and the transition to a proof-of-stake consensus mechanism. They are respectively planned for summer 2021 and for the beginning of 2022. In this blog, we detail the former, EIP 1559.

The Problem: Network Congestion and High Gas Price

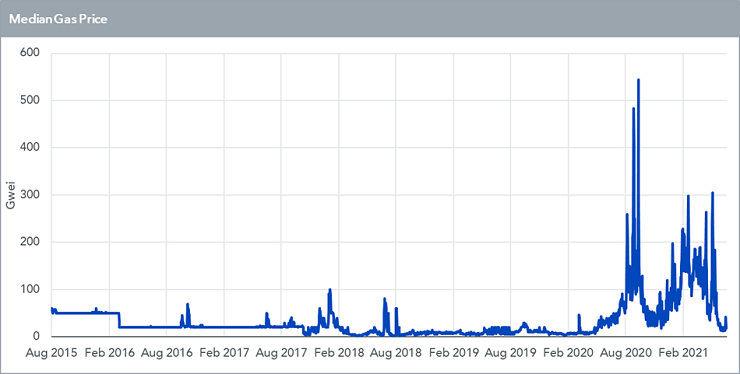

Ethereum has been experiencing a high level of growth in activity, especially over the past year with the advent of Decentralised Finance (DeFi). As more and more people used the network, the cost skyrocketed, making it prohibitively expensive to use for some participants. To understand why this happened, we need to investigate Ethereum’s fee system.

When you use your computer for any type of operations, you’re using computing power. And it varies with applications. Using the calculator application will not require nearly as much computing power as playing the latest video game or running advanced machine learning algorithms would.

Similarly, when you use the Ethereum network, operations are being run on the Ethereum Virtual Machine, which runs on each computer node participating in the network. Different amounts of work are required from the nodes depending on the smart contracts you trigger.

A smart contract is made of multiple operations. Each operation is associated with a number of gas, which represents the computing power required for that operation. For example, an addition will cost 3 gas, while an ether transfer (a more complex operation) will cost 21,000 gas. Each user can set the price they are willing to pay per gas. This is measured in gwei (1 gwei = 0.000000001 ether).

To illustrate, when sending one ether, you can say you are willing to pay 100 Gwei1 per gas, which means you are willing to pay 21,000 x 100 = 2,100,000 Gwei, which amounts to 0.0021 ether worth of fee for that transaction.

One very important element is that each block on the Ethereum blockchain has a block gas limit, i.e., a limit to the aggregated amount of gas required by the operations included in a block. You may start to see where a competition arises here. Assume bus tickets are a market. If there are 20 seats in the bus, and 20 people are looking for a ride, each might be willing to pay around $1 for it. Now if there are a 100 people waiting, 20 of them might be willing to pay $5 and more to take this ride.

Ethereum by design has a limited number of blocks per day as well as a limit on gas per block. Hence, if you want your operation to be executed faster, you need to offer a gas price high enough so miners will include your operation into their block.

With the rise of DeFi and non-fungible token (NFTs), gas price has been elevated most of the time over the past year, making it difficult for smaller users to use the network. Furthermore, gas price has been quite unstable, causing the fee market to be less predictable. Note that the recent market pullback has had the benefit of reducing activity on the network and consequently brought the gas price down.

Source: Glassnode, as of February 2021.

Historical performance is not an indication of future performance and any investments may go down in value.

The London Fork and EIP 1559: A Significant Change to the Fee Market

EIP 1559 is one the EIPs to be implemented when the London fork occurs later this summer. The London fork follows the Berlin fork, which occurred back in April 2021, and increased the block gas limit from 12.5 million to 15 million, amongst other changes.

EIP 1559 will implement significant changes to the fee market. The first one is the introduction of a “base fee”, which is a variable minimum gas price. That base fee will be dynamically changed based on the level of activity on the Ethereum blockchain. Furthermore, the base fee will be burned, i.e., destroyed, reducing the outstanding supply of ether. In addition to the base fee, users will be able to pay an “inclusion fee” to get their transactions executed faster, which will be earned by the miners.

The normal level of gas in a block is set at 15 million, but it will be allowed to go up to 30 million in times of congestion. When a block contains more than 15 million gas, the base fee will be raised by 12.5%. On the other hand, when there is spare capacity in a block, the base fee will be reduced by 12.5%, with a lower bound close to 0.2

Implications and Risks

The main implication – and the reason why EIP 1559 is probably the most widely expected event for Ethereum in 2021 – is that it will implement a deflationary element to ether’s supply. The current rate of new supply is 2 ether per block, with no cap. Theoretically, the supply could grow indefinitely. But with the introduction of the fee burning, some of the supply will be destroyed. In times of network congestion, it could lead the rate of the new supply to decrease significantly, and even turn negative at times. Furthermore, as more network activity reduces the rate of new supply, the change is expected to better tie the value of ether to the level of activity on the network.

Coming back to the issue of high and volatile fees, it is important to note that the objective of this new system is not directly to reduce fees, but rather to make them more stable and predictable. Fee uncertainty is an issue for users and developers of decentralised applications. EIP 1559 should essentially swap volatility in gas price for volatility in block gas limit, and help alleviate issues linked to gas price volatility, like fee estimation, long wait time for transaction inclusion in a block etc…

This update comes with several risks. First, as with any update, there is technology risk, i.e., the risk of unforeseen bugs, the risk of introducing weaknesses that can be exploited by malicious actors. Secondly, there is a risk that the proposed change might not have the desired effects in practice. Finally, some of the fee is now burnt and does not go to miners. This can reduce profitability for miners, who could potentially be reluctant to accept the change. But it currently seems that the mining community is ready to accept the change.

Conclusion

EIP 1559 is a widely anticipated event, from both the developer and investor communities. It should help address issues linked to gas price volatility and introduce a deflationary pressure on the supply of ether. Furthermore, the change is expected to better tie the value of ether to the level of activity in Decentralized applications (dApps) built on the Ethereum blockchain. EIP 1559 will be implemented in the London fork, which is currently being deployed on Ethereum’s test nets, and is currently planned for launch on the 4th of August 2021.

For more, some interesting resources can be found here and here.

Sources

1 Gwei is a denomination of the cryptocurrency ether (ETH), which is used on the Ethereum network

2 https://static.coindesk.com/wp-content/uploads/2021/06/EIP-1559-Ethereum-Fee-Market-Upgrade-Explained-1.pdf