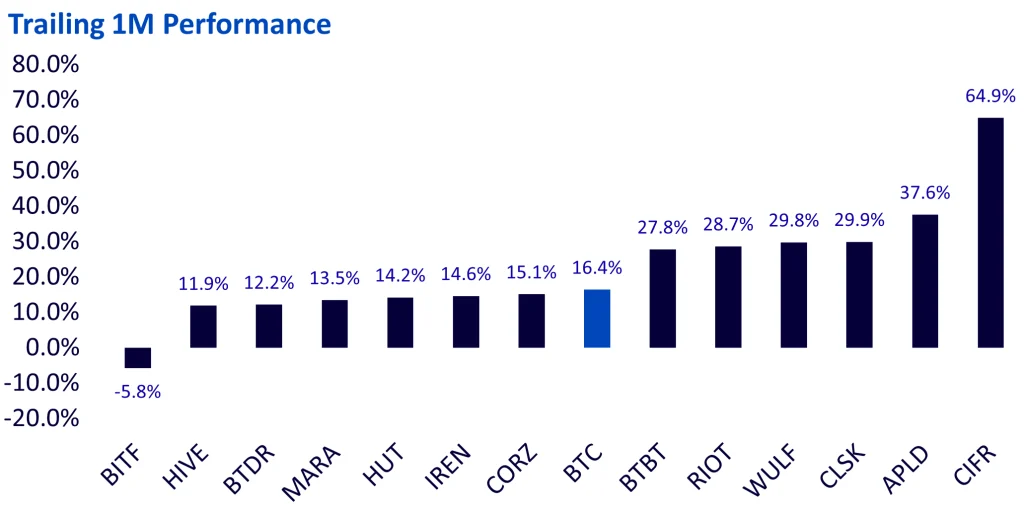

It’s been nearly a month since the US Federal Reserve’s interest rate cut in September, and risk assets have responded positively since. Digital assets, particularly bitcoin, have surged over 15% in that time, and bitcoin miners have followed suit—many even outperforming bitcoin itself, as shown in Figure 1. This price momentum, driven by favourable macroeconomic and political factors, along with improving miner efficiency, sets the stage for potential earnings surprises from miners in Q4 and a possible cyclical breakout for bitcoin to reach new highs in the months ahead.

Key Takeaways

- Bitcoin and bitcoin miners have recently performed strongly, benefiting from lower interest rates and rising profitability metrics like revenue per exahash.

- Q3 earnings being reported in the weeks ahead may be mixed given summertime bitcoin price volatility, but if profitability metrics continue to improve and price momentum continues, Q4 and early 2025 could show stronger results.

- Broader macro and political factors, driven by US elections, including budget deficits and tariffs, may drive bitcoin prices above key levels of resistance near previous cyclical highs.

- Related ProductsWisdomTree Physical Bitcoin, WisdomTree Blockchain UCITS ETF – USD Acc

Find out more

It’s been nearly a month since the US Federal Reserve’s interest rate cut in September, and risk assets have responded positively since. Digital assets, particularly bitcoin, have surged over 15% in that time, and bitcoin miners have followed suit—many even outperforming bitcoin itself, as shown in Figure 1. This price momentum, driven by favourable macroeconomic and political factors, along with improving miner efficiency, sets the stage for potential earnings surprises from miners in Q4 and a possible cyclical breakout for bitcoin to reach new highs in the months ahead.

Figure 1: Performance of bitcoin and bitcoin mining equities

Source: Koyfin as of 17 October, 2024. Historical performance is not an indication of future performance and any investment may go down in value.

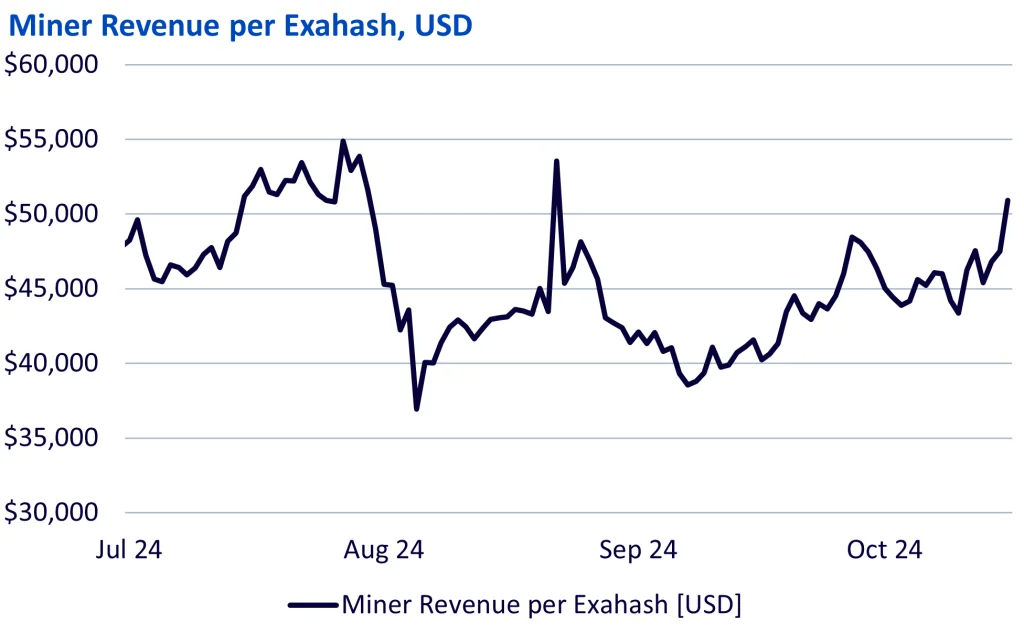

Lower central bank policy rates are just one factor driving the recent surge in bitcoin and miner prices. Another key development has been the rise in miner profitability, viewed through the lens of revenue per exahash. Bitcoin miners use energy to perform computations and ‘mine blocks’ on the blockchain in exchange for bitcoin rewards. The profitability of these firms depends on cheap energy and efficient computing equipment. When miner revenue per exahash rises, it indicates increasing profitability, as miners are able to source cheaper electricity, run more efficient hardware, and sell the bitcoin rewards at a price higher than their production costs.

As seen in Figure 2, the rising miner revenue per exahash indicates that miners are well-positioned for the fourth quarter. Additionally, the temporary shutdown of operations by firms like CleanSpark1, due to hurricanes in the USA, reduced competition on the network. This decrease in network competition has the potential to benefit miners who remained operational, further enhancing their profitability.

Figure 2: Rising Bitcoin Hashprice Boosts Miner Profitability

Source: Glassnode as of October 17, 2024. Historical performance is not an indication of future performance and any investment may go down in value.

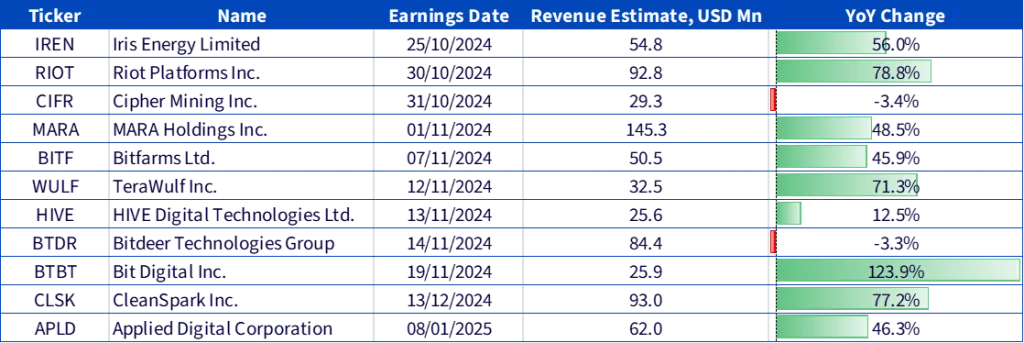

As Q3 earnings season begins, many publicly traded Bitcoin miners are expected to show strong year-over-year revenue growth, driven largely by Bitcoin’s price being more than double what it was last summer. However, the recent Bitcoin ‘halving’ has reduced miners’ block rewards by half, making operational efficiency and energy cost management even more critical to maintaining profitability. Miners have responded by optimizing their operations, with some diversifying revenue streams by allocating computing resources to areas like AI model training and inference.

While Q3 earnings expectations are high, it’s important to recognize that the volatility in bitcoin’s price over the past few months could lead to mixed earnings results. Nevertheless, the recent improvement in miner profitability—if the trend continues—could set the stage for a strong Q4, with results reported at the start of 2025. We are already seeing some of these expectations reflected in current prices.

For those who have secured cheap energy and efficient computing equipment, the growth prospects remain strong heading into Q4. Combined with a positive outlook for bitcoin prices, the next few months could look very promising for miners.

Figure 3: Upcoming Bitcoin Miner Earnings for Q3

Source: Koyfin as of 17 October, 2024. Historical performance is not an indication of future performance and any investment may go down in value. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

Shifting focus to bitcoin, price has been relatively range-bound in recent months, particularly after a strong start to the year driven by major inflows into US ETFs and global approval of regulated products. Summertime momentum stalled, awaiting a positive catalyst, but September brought a key trigger in the form of interest rate cuts. The upcoming US election could provide another catalyst, with bitcoin sitting near all-time highs and flirting with a breakout. Long term momentum is positive with short-term indicators pointing to a potential reversal to the upside.

Historically, post-election periods tend to bring reduced volatility as market and policy uncertainty subsides. Additionally, depending on the election outcome, we may see regulatory shifts that are more supportive of digital assets. Other broader policies, such as continued budget deficits or tariffs, could lead to longer-term structural inflation, driving up bitcoin prices alongside gold as a long term store of value.

If Trump’s supportive stance on domestic energy production and bitcoin mining were to translate into policy, US-based miners could benefit significantly. As a result, miners could be set to maintain this strong momentum into 2025.

Figure 4: Bitcoin Meets Technical Resistance Near Previous Cycle Highs

Source: Glassnode, as of October 15, 2024. 90D MA represents 90 day moving average price and 200D MA represents 200 day moving average price. Historical performance is not an indication of future performance and any investment may go down in value.

As we look ahead, bitcoin miners remain positioned to capitalize on favourable market conditions, rising profitability, and strong momentum. With bitcoin flirting near all-time highs and potential catalysts on the horizon, this sector is set up for continued growth. For investors seeking exposure to this space, the WisdomTree Blockchain UCITS Equity ETF (WBLK)—which invests in bitcoin miners and other blockchain-focused firms—and the WisdomTree Physical Bitcoin ETP (BTCW) offer targeted opportunities which aim to capture this momentum. With miners outperforming and bitcoin poised for a potential breakout, these provide timely exposure to the digital asset ecosystem.

Footnote:

Exahash: An exahash (EH/s) is a unit of measurement for computational power. It represents the scale of a miner’s computing capability, with higher exahash rates giving miners a greater chance of validating blocks and earning Bitcoin rewards.

Hashrate: Hashrate refers to the total computational power used in the Bitcoin network, measured in exahashes per second (EH/s). The higher the hashrate, the more competitive and secure the network becomes. For individual miners, a higher share of the total network hashrate increases their probability of generating new Bitcoin block rewards.

Hashprice: Hashprice is the revenue that miners earn per unit of computational power (measured in dollars per exahashes). It is influenced by Bitcoin’s price, network difficulty, and block rewards. Miners who use more efficient equipment and have access to cheaper energy can optimize their hashprice and overall profitability.

Bitcoin Halving: Bitcoin halving refers to the event that occurs approximately every four years, where the reward miners receive for validating transactions (mining) is cut in half. This reduces the rate at which new Bitcoin is created, increasing its scarcity. The most recent halving occurred in April 2024, reducing the reward from 6.25 to 3.125 Bitcoin per block. Despite the reduction in rewards, miners who improve efficiency and lower costs can continue to remain profitable.

Ticker Map:

- BITF: Bitfarms

- HIVE: HIVE Blockchain Technologies

- BTDR: Bitdeer Technologies

- MARA: Marathon Digital Holdings

- HUT: Hut 8 Mining

- IREN: Iris Energy

- CORZ: Core Scientific

- BTC: Bitcoin

- BTBT: Bit Digital

- RIOT: Riot Platforms

- WULF: TeraWulf

- CLSK: CleanSpark

- APLD: Applied Digital

- CIFR: Cipher Mining