As the crypto market continues to evolve, investors are keeping a close eye on macroeconomic factors that impact digital asset prices. One of the most significant developments recently has been the US Federal Reserve’s (Fed) interest rate cut, shifting investor sentiment to more ‘risk on’, particularly benefiting altcoins.

Key Takeaways

- Recent U.S. Federal Reserve rate cuts have bolstered digital assets prices, with altcoins outperforming bitcoin and ethereum as investors shift toward riskier assets

- Altcoins, with higher beta to bitcoin, could continue to benefit from a more accommodative interest rate environment ahead, as investor risk appetite grows

- Related ProductsWisdomTree Physical Crypto Altcoins, WisdomTree Physical Crypto Market, WisdomTree Physical Solana, WisdomTree Physical Cardano, WisdomTree Physical Polkadot

Find out more

As the crypto market continues to evolve, investors are keeping a close eye on macroeconomic factors that impact digital asset prices. One of the most significant developments recently has been the US Federal Reserve’s (Fed) interest rate cut, shifting investor sentiment to more ‘risk on’, particularly benefiting altcoins.

Recent interest rate cuts

The Federal Reserve’s recent decision to cut interest rates by 50 basis points (bps) has created a favorable environment for digital assets. Historically, lower interest rates have tended to stimulate risk assets like cryptocurrencies, as investors seek higher returns in a less restrictive financial landscape. Currently, markets are pricing in two more rate cuts by the end of the year, which could lower the target rate from the current 4.75%-5% range to 4.00%-4.25%1. Market projections also indicate further cuts could push U.S. policy rates down to 3.00%-3.25% by mid-next year1, approaching the Fed’s estimated neutral rate—where monetary policy no longer constrains the economy.

Price reactions

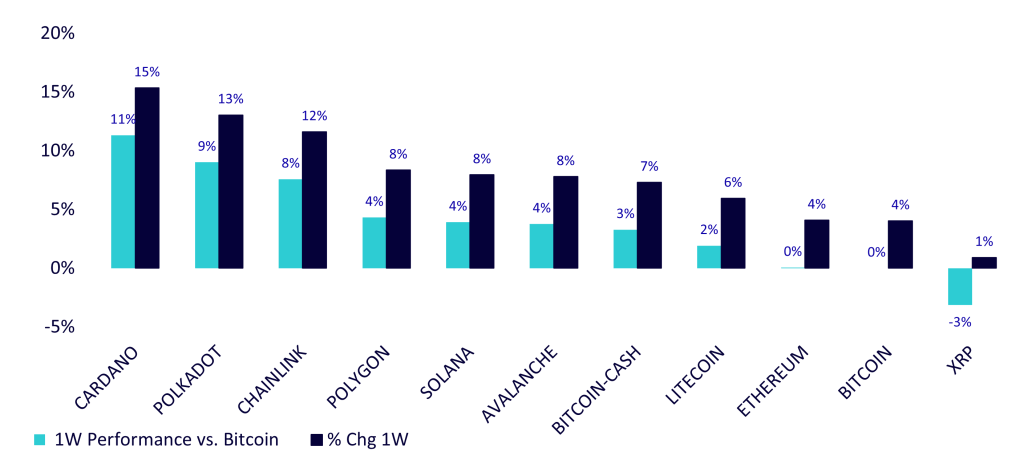

Immediately following the Fed’s announcement for a 50 bps cut on the 18th of September, digital asset prices surged higher. Bitcoin, for instance, jumped by a few thousand dollars within hours, ultimately settling around $63,000 the following day2. Bitcoin is trading above $65,000 as of writing on the 27th of September3, having trended higher in the week following the event, reflecting the broader bullish sentiment in the market. Ethereum followed a similar trajectory, rising 4% in the hours after the announcement2, and continued its positive trend thereafter. While ether’s performance has largely mirrored bitcoin’s in the most recent week, the strongest performers have been altcoins, having outperformed their mega cap crypto counterparts, shown in Figure 1 below.

Figure 1: Recent 1 week performance vs. bitcoin

Source: Messari, as of Sept. 27, 2024. Historical performance is not an indication of future performance and any investment may go down in value.

This outperformance marks a shift from the year-to-date trend, where bitcoin had been the dominant performer, outperforming the majority of other major cryptocurrencies. This came on the back of the launch of bitcoin exchange traded funds (ETFs) and greater institutional adoption across the globe. Bitcoin has appreciated 50% year to date3, whereas many altcoins are still in the red over this longer time period.

A bullish environment for altcoins ahead?

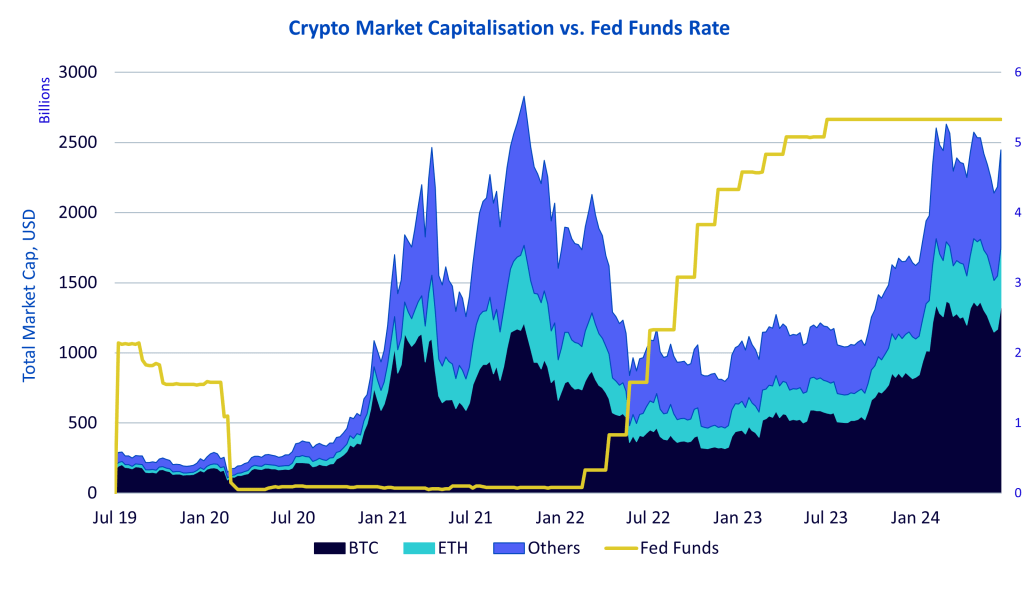

The recent outperformance by altcoins signals a possible shift in the market’s risk appetite. Historically, when interest rates are low and monetary policy is more accommodative, investors become more comfortable taking on riskier assets like altcoins. This was particularly evident during the COVID-19 period when digital assets flourished in a low-rate environment, and market value of the altcoin ecosystem expanded rapidly, shown in Figure 2.

Figure 2: Crypto market valuation (market capitalisation) vs. federal funds rate

Source: Coinmarketcap, Bloomberg, as of September 18, 2024. Historical performance is not an indication of future performance and any investment may go down in value.

As inflation concerns diminish and the economic outlook stabilizes, the market could be transitioning to a more ‘risk-on’ environment. This shift could continue to drive altcoin outperformance, especially as investors diversify their portfolios beyond bitcoin and ethereum.

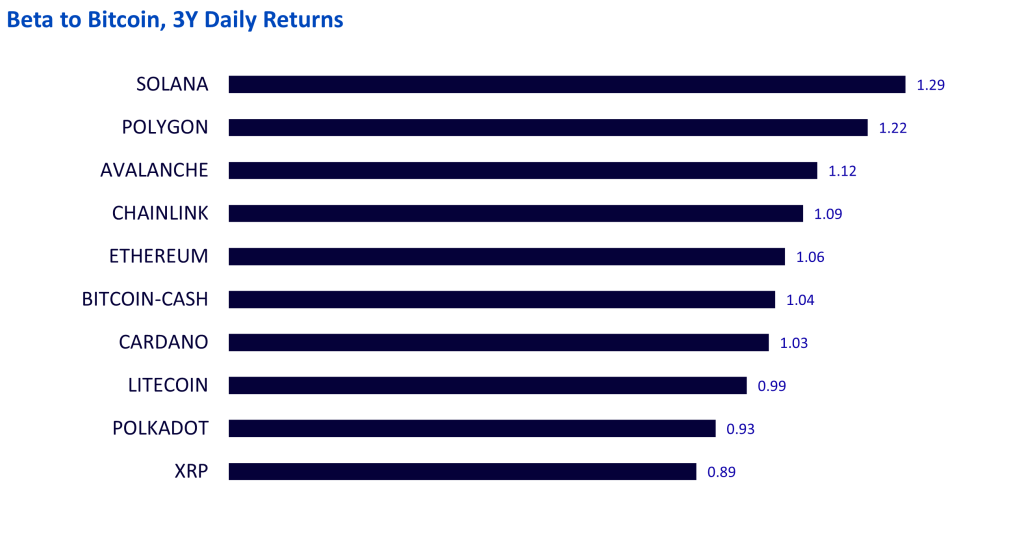

The high beta nature of altcoins

One reason altcoins may perform well in a risk-on market is their higher beta relative to bitcoin. To put it simply, historically when bitcoin price has risen, altcoins tended to rise more; when bitcoin price has fallen, they have often fallen harder. While individual cryptocurrencies can experience idiosyncratic movements, this relationship offers a helpful framework for understanding some of the key drivers of crypto asset prices. In Figure 3, we can observe the beta of major cryptocurrencies vs. bitcoin over the last 3 years.

Figure 3: Beta to bitcoin, major crypto assets

Source: Messari, Coingecko, Coinmarketcap for the period August 31, 2021 to August 31, 2024. Historical performance is not an indication of future performance and any investment may go down in value.

Leaning into the altcoin surge

As we move further into a more accommodative interest rate environment, the conditions may be ripe for altcoins to shine. Lower rates have historically led to increased risk appetite among investors, and as the Fed continues to adjust its policy, altcoins stand to benefit. For those willing to embrace the potential volatility, altcoins present a tactical opportunity as market sentiment shifts.

For investors looking to gain exposure to altcoins, market cap-weighted exchange-traded products (ETPs) offer a diversified way to tap into the altcoin market. Alternatively, single asset exposures may be another way for investors to position themselves to catch this tailwind while exercising their own views for any particular asset. As risk-on sentiment builds, these altcoin exposures could outperform a standard bitcoin and ethereum allocation.

1 CME Fedwatch Tool, as of September 27, 2024

2 Messari, for September 18th, 2024; data accessed September 27th, 2024

3 Messari, as of September 27th, 2024