Fixed income investors can now make a valuable contribution to the building of a sustainable economy. But it’s not as simple as just buying a green bond.

From mitigating climate change to creating a fairer and more equitable society, the private sector has a key part to play in the building of sustainable economy. Yet with governments unable to fund the transformation on their own, and investors increasingly keen to make a positive impact with their money, capital markets will need to adapt.

Encouragingly, the fixed income market is doing just that.

The past few years have seen a boom in bonds that explicitly embed environmental, social and governance (ESG) targets. In a study conducted for Pictet Asset Management, the Institute of International Finance estimates that the issuance of ESG-labelled sovereign and corporate bonds could reach USD4.5 trillion per year by 2025 – a significant jump from the USD863 billion issued in 2022.1 The same report says that corporate issuers will dominate the market as businesses continue to ramp up their net-zero commitments. Demand, meanwhile, should also build as asset owners have their own sustainability targets to meet.

While we welcome this trend, we prefer to take a much broader view of what constitutes as sustainable fixed income investment. The investment landscape is, we believe, richer than most investors realise.

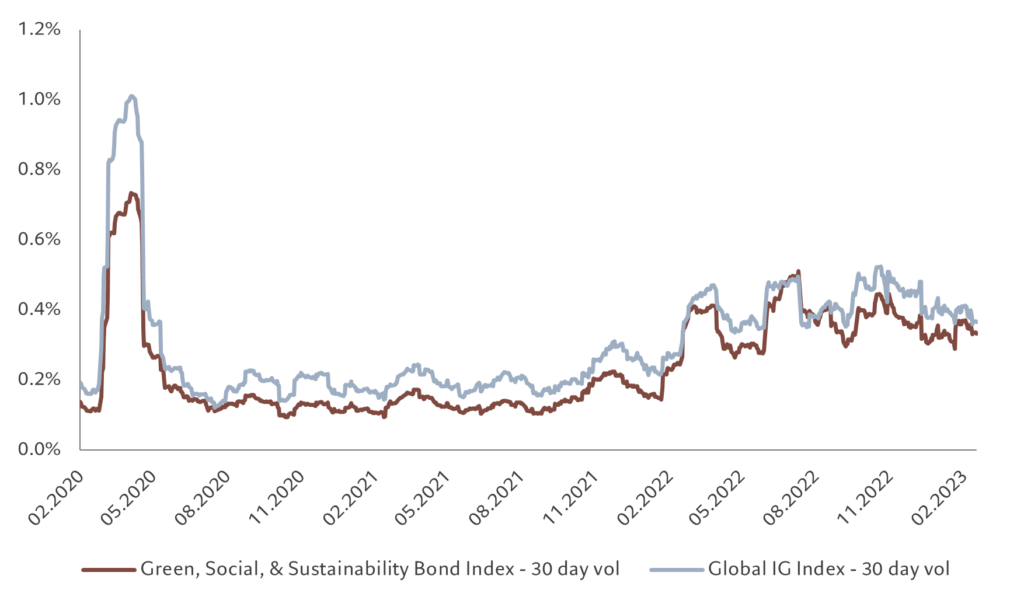

For us, sustainable corporate bonds are those issued by businesses with strong and improving ESG credentials. These could, in many cases, include ESG-labelled bonds. And, indeed, such securities do bring some advantages. They have historically suffered smaller drawdowns and lower volatility than conventional bonds in times of market turbulence. For example, in March 2020, when the world came to a near standstill due to the Covid pandemic, ESG-labelled BBB-rated corporate bonds lost just 6 per cent, compared to 10 per cent for non-labelled peers.2 They have also been quicker to recover their value.

Fig. 1 – More sustainable, less volatile

30-day rolling volatility, %

Yet for all this, what makes a corporate bond sustainable isn’t necessarily a label. Not all ESG labelled bonds are genuinely sustainable. And by the same token, there are numerous corporate bonds without ESG labels but whose sustainability credentials are beyond satisfactory. Much depends on the debt issuer and the industry in which it operates.

A closer examination of sustainable bonds reveals that such debt tends to be issued by companies operating in sectors that are already making a strong contribution to sustainable transition. Examples include clean energy, education and wastewater treatment.

And as governments accelerate efforts to fight climate change, companies in these industries should thrive. Our economists expect the US Inflation Reduction Act to trigger the mobilisation of USD1.5 trillion of capital across power grids, renewables and grants. Europe’s green initiatives, meanwhile, could mobilise an additional USD4 trillion in capital.

Increasingly, regulation is rewarding sustainable companies and punishing less sustainable ones.

Many shades of green

The growing popularity of sustainable corporate debt brings new complexities, however. For a start, there is no official definition of what constitutes ‘sustainable’ corporate activities; regulators have yet to reach a consensus. That puts the onus on investors to set their own guidelines and do their own due diligence, which requires time, resources and experience.

Green bonds may at first glance appear to solve these problems.

They are designed to raise money for specific environmental projects. Yet there are few controls to ensure the money raised is used as intended. And almost any business can issue such debt, including companies whose main revenue sources are far from sustainable. Companies that manufacture oil tankers or generating electricity from coal can access the green bond market as easily as solar energy firm.

To their credit, regulators are alert to such problems.

Earlier this year, the EU approved a new set of green bond standards that will require companies that issue such debt to provide more detailed information on how such funds are used. The rulebook also contains provisions that will force firms to demonstrate how the projects funded by green bonds feed into broader company-wide transition plans.

These measures are an important step in the right direction, potentially setting a template for other regions to follow.

Even so, consistent and clear regulation across jurisdictions is lacking.

Another disadvantage is the size of the market. Although green bonds are growing rapidly, the market has yet to reach critical mass. The universe of issuers is currently limited, spanning just a few industries. Which means investors who focus exclusively on green bonds will find it difficult to diversify their portfolios.

The same can be said of social bonds, those that embed social objectives. Over the past two years, social bonds accounted for only around 10 per cent of global ESG-labelled issuance, although we do expect this share to increase.3

To avoid the pitfalls and maximise our positive impact, we have developed our own proprietary financial and ESG scorecards to assess how sustainable a company’s business model is. So we will invest in a green bond but only if our analysis suggests the issuer’s claims are justified – and if it passes our financial assessment on the health of the business and the valuation of the instrument.

“By focusing on labels, investors risk missing out on a large number of opportunities to make a positive impact and generate attractive returns. We prefer to take a much broader view of what’s sustainable. “

It is worth noting that conventional corporate bonds can in fact have stronger ESG credentials than green bonds. It all depends on the profile of the issuer.

A large proportion of our portfolio is invested in unlabelled bonds issued by companies who derive their revenues from environmentally-friendly activities, such as the recycling used oil and cleaning solvent or treating waste water so it can be reused. Taking inspiration from the EU’s green taxonomy, our sustainable investment universe consists of companies operating in water resources, pollution prevention and biodiversity protection and climate change mitigation.

Following this approach means we often decide against investing in green bonds. That has been the case with bonds issued by banks that we believe have poor ESG credentials. But our investment process also uncovers companies whose transitions have not fully been appreciated by the market. For example, we have invested in bonds issued by a utility company which we believe is making strong progress in improving its ESG scores and which – due to the nature of its business – has the potential to make a significant impact on the clean energy transition.

Sustainable society

But there is more to sustainable investing than the environment. In our view, a sustainable future also requires a more equitable society (which, in turn, should put us in a strong position to respect the planet). For this reason, around a third of our portfolio is invested in businesses seeking to make a positive social contribution.4 That could be through promoting education, securing sources of safe drinking water or even building telecom infrastructure to enable better access to information and connectivity (improving social cohesion and integration).

Whatever the underlying theme, our priority is to have a positive social and environmental impact. As a responsible investor, we aim to be a long-term lender and engage regularly with the companies we invest in. Maintaining a good relationship with company management is crucial in helping businesses transition towards a more sustainable future.

To limit risk, we invest in quality issuers and take a “pure corporate credit” approach, avoiding securitised credit such as asset-backed securities. Such instruments have been popular in recent years but are likely to prove more vulnerable as the global economy stutters.

Ultimately, we believe fixed income investors have a key part to play in funding a sustainable future – not just by buying ESG-labelled assets but also by focusing on businesses that can make a significant contribution to the building of a greener, fairer and more productive economy.

[2] ICE, Bloomberg, Pictet Asset Management

[3] BI ESG Bloomberg, Pictet AM, 31.03.2023

[4] As of 23.04.2023