Back in 2013, Ethereum was introduced to the world via whitepaper before going live in 2015. Since then, it has become one of the crypto mega cap names, sitting alongside Bitcoin. Ethereum’s cap is just under US $300 billion1 and bitcoin’s is nearly US $1.2 trillion2, making them the top two names in the crypto universe. Investors tend to refer to both as crypto mega cap names.

While Solana followed Ethereum in 2017, it remains an altcoin in the crypto universe with a market cap of just over US $60billion3, five times smaller than that of Ethereum. But how do these two blockchains compare?

Figure 1: Side-by-side comparison

Key Takeaways

- Ethereum and Solana are two layer-1 platforms used to power decentralised applications, and they compete with each other.

- Ethereum is ahead of Solana in terms of total value locked, while Solana is ahead of Ethereum in terms of daily transactions and active addresses.

- While Solana is fast and cheap, Ethereum remains the largest ‘economic centre’ in the decentralised blockchain world.

- As Solana and Ethereum appear relatively well-balanced, Solana’s price could benefit from a catch-up effect.

- Related ProductsWisdomTree Physical Ethereum, WisdomTree Physical Solana, WisdomTree Physical Bitcoin

Find out more

Back in 2013, Ethereum was introduced to the world via whitepaper before going live in 2015. Since then, it has become one of the crypto mega cap names, sitting alongside Bitcoin. Ethereum’s cap is just under US $300 billion1 and bitcoin’s is nearly US $1.2 trillion2, making them the top two names in the crypto universe. Investors tend to refer to both as crypto mega cap names.

While Solana followed Ethereum in 2017, it remains an altcoin in the crypto universe with a market cap of just over US $60billion3, five times smaller than that of Ethereum. But how do these two blockchains compare?

Figure 1: Side-by-side comparison

As shown in the Figure 1 (above), Ethereum is ahead of Solana in terms of total value locked (TVL), and Solana is in front of Ethereum in terms of daily transactions and daily active addresses. On the face of it, these two layer-1 platforms, which are used to power decentralised applications (dApps) and that compete with each other, appear relatively well balanced. As such, there is scope for Solana’s price to benefit from a catch-up effect.

Speed

Both Ethereum and Solana use Proof-of-Stake (PoS) consensus mechanisms where new blocks are generated through validators based on staking. Even though they use the same consensus mechanisms, there is a big difference with respect to the number of transactions that they can accommodate per second4:

- Ethereum: ~30

- Solana: ~4,000

This difference is primarily because Ethereum did not completely abandon the Proof-of-Work (PoW) consensus mechanism when it transitioned from PoW to PoS in August 2022. Ethereum’s new blocks are still based on the PoW-based Nakamoto consensus that follows the ‘longest chain’ rule. PoW is a consensus mechanism used by bitcoin and known for requiring bitcoin miners to put in a lot of energy and resources to solve puzzles in order to validate transactions. In other words, PoW is slow and expensive.

Solana uses Proof-of-History (PoH) to support PoS. In this case, PoH acts as a network clock that arranges the order of blocks, transactions, and data. This is done through a timestamp verification, which allows Solana to achieve consensus without doing full block verification. In essence, using PoH to support PoS instead of PoW-based consensus logic allows Solana to accommodate more than 100 times more transactions per second than Ethereum.

Fees

In March 2024, Ethereum underwent a Dencun upgrade, which enabled layer-2 solutions to settle transactions faster and cheaper using the Ethereum blockchain. Layer-2 solutions are dApps built on Ethereum (or any other layer-1 blockchain), rely on the blockchain, and use the blockchain’s token for fees. The Dencun upgrade was a critical step in scaling Ethereum, which has been facing strong competition from other blockchains offering similar capabilities, particularly Solana.

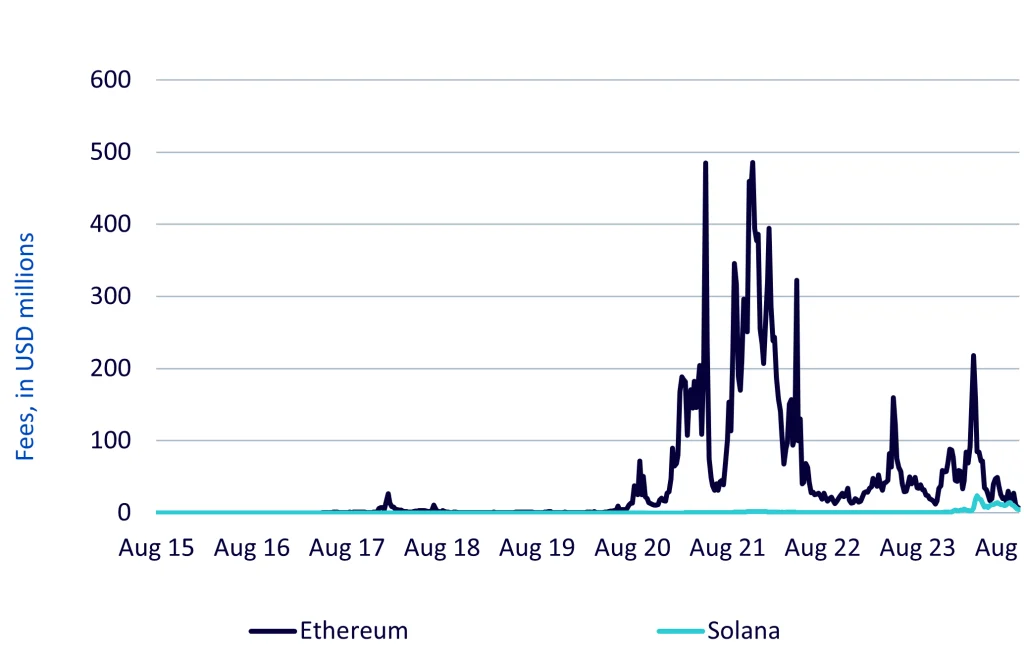

Figure 2: Weekly aggregation of fees, in USD millions

Figure 2 (above) clearly illustrates that Dencun upgrade resulted in lower fees collected by Ethereum and brought Ethereum to broadly the same ballpark where Solana has been playing for a while.

Activity

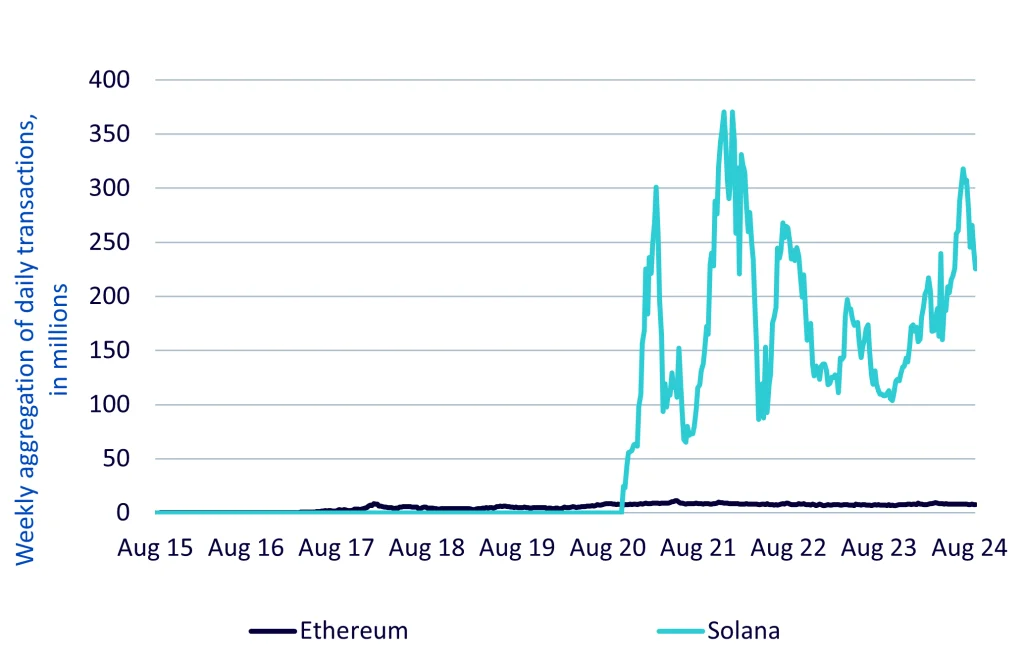

Compared to Ethereum, Solana can accommodate more transactions per second and has had lower fees. So, it is unsurprising that Solana has significantly higher daily activity than Ethereum.

It is interesting to note in Figure 3 (below) that, with respect to the number of daily transactions, Ethereum has been relatively steady since it went live in 2015. While the number of daily transactions on Solana has varied over time, it has exceeded Ethereum’s since October 2020.

Figure 3: Weekly aggregation of daily transactions, in millions

Source: Artemis Terminal. 2 September 2024. Historical performance is not an indication of future performance and any investment may go down in value.

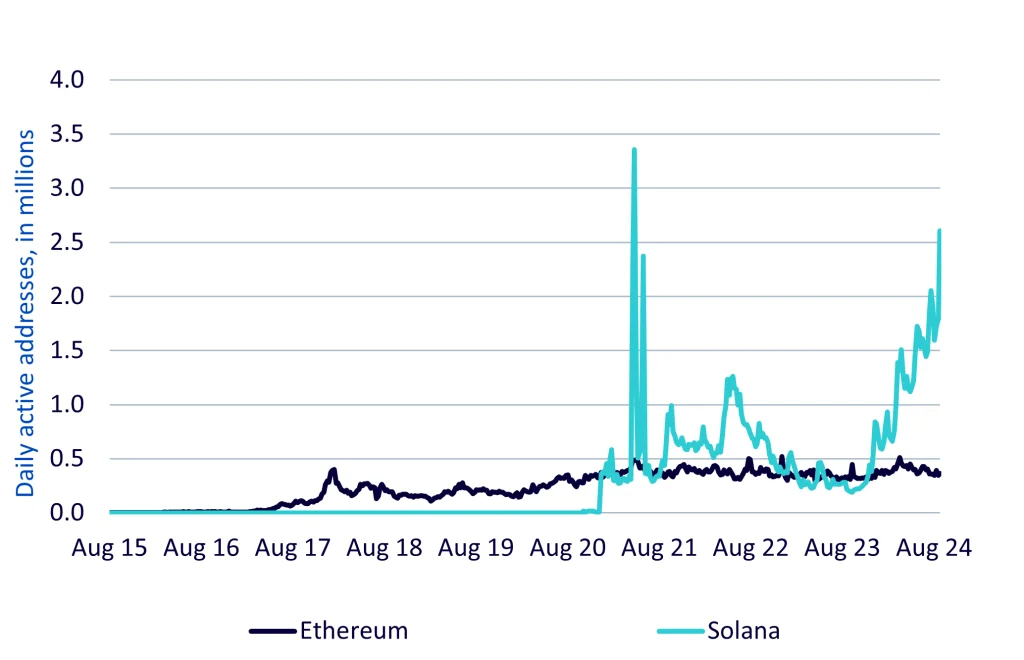

The number of daily transactions measures the number of unique on-chain interactions with the protocol. The other way to explore activity is to look at the number of daily active addresses, which measures the number of unique on-chain wallets that interact with the protocol. In Figure 4 (below), we see more variability as Solana exceeds Ethereum in some periods and Ethereum exceeds Solana in others.

Figure: 4: Weekly aggregation of daily active addresses, in millions

Value

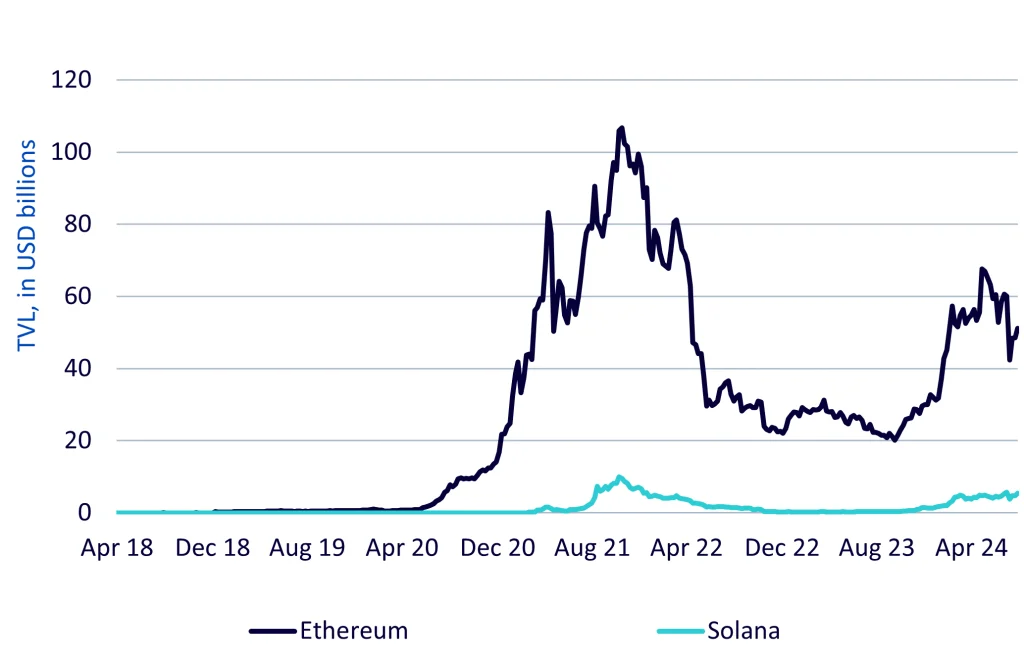

While Solana is cheap and fast, Ethereum remains the largest ‘economic centre’ in the decentralised blockchain world. This is well illustrated by Figure 5 (below), as it clearly shows that the TVL is more than nine times larger on Ethereum than on Solana.

Figure 5: TVL, in USD billions

Source: Artemis Terminal. 02 September 2024. Historical performance is not an indication of future performance and any investment may go down in value.

TVL is an important metric in crypto space as it measures the total USD value of crypto locked (i.e. staked) on a blockchain. Each dApp on Ethereum or Solana has a certain TVL. The higher the TVL, the more valuable and secure the dApp is viewed to be.

Conclusion

Solana is fast and cheap, whereas Ethereum has significantly higher TVL. While both are layer-1 blockchains, Ethereum is a crypto mega-cap, while Solana remains a crypto altcoin that is quickly catching up. Over the coming months, Solana’s price could benefit from this catch-up effect.

WisdomTree: an established ETP provider to access cryptocurrencies

WisdomTree offers a curated range of eight physical crypto ETPs with an institutional-grade structure and provides spot price exposure to single coins and diversified crypto baskets. Please see the WisdomTree Crypto ETP centre and for further detail.

1 Source: Messari, 12 September 2024.

2 Source: Messari, 12 September 2024.

3 Source: Messari, 12 September 2024.

4 Source: solana.com/developers/evm-to-svm/consensus