- Commodities had a challenging year, but the outlook looks brighter

- Widely expected interest rate cuts are traditionally commodity price positive

- Chinese demand for commodities has not fallen as much as prices would indicate. Moreover the nation is likely to increase stimulus to stem the sentiment slump

- Enthusiam around the energy transition may have faded, but policy makers resolve remains strong. We could see commodity demand from this source surprise to the upside

- Related ProductsWisdomTree Broad Commodities UCITS ETF – USD Acc, WisdomTree Enhanced Commodity UCITS ETF – USD Acc, WisdomTree Enhanced Commodity ex-Agriculture UCITS ETF – USD Acc

Commodities had been under pressure in the past year, but we believe there are several reasons to be cautiously optimistic about the asset class in 2024 – the Chinese ‘Year of the Dragon’.

The key drivers of negative commodity performance in the past year were:

- Rising interest rates in many developed countries

- China’s economy stalling under the pressure of a real estate blow up

- Sentiment around the energy transition losing momentum

We believe all three will reverse course this year.

Interest rates to fall

Consensus strongly believes that we will see interest rate cuts this year. While we thought that markets were getting a little ahead themselves in terms of the timing and scale of the cuts at the beginning of the year, markets have recalibrated their views and are pricing in the first cuts for Federal Reserve and European Central Bank around the middle of the year.

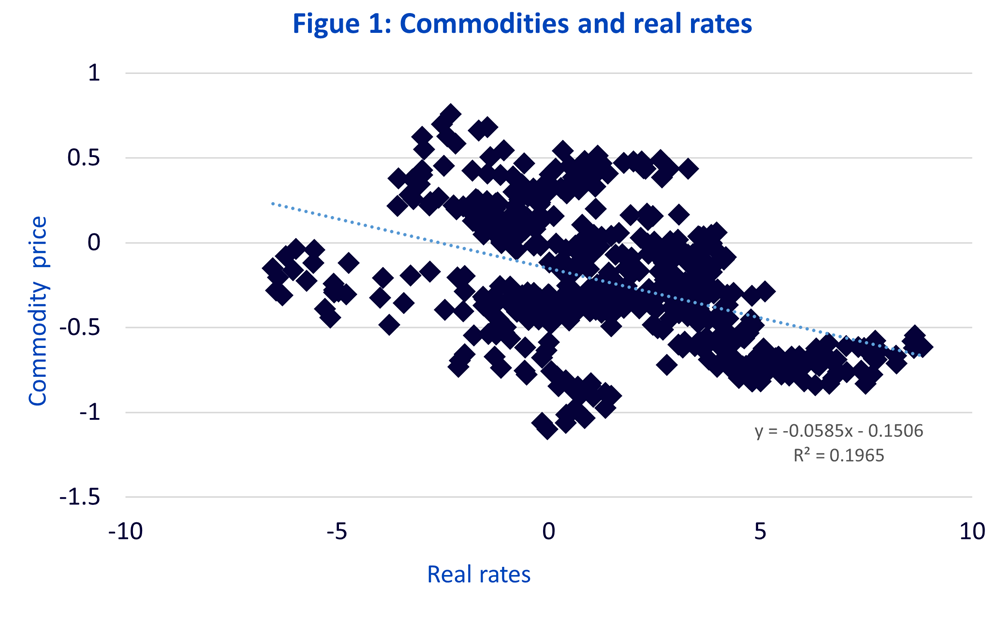

We believe that rate cuts will be positive for most cyclical asset classes, including commodities. Our observation is that lower real interest rates are price positive for commodities (Figure 1). The line of best fit indicates that the 1% decline in real rates would be consistent with a 6% increase in broad commodity prices.

Source: Bloomberg, WisdomTree. June 1976 to January 2024. Commodity price is the log of Bloomberg Commodity Index – log US Consumer Price Index. Real rates are the US two-year nominal Treasury yields – US CPI inflation. Historical performance is not an indication of future performance and any investments may go down in value.

Chinese ‘Year of the Dragon’ may breathe fire back into commodity markets

Noting China’s disappointment in 2023, will the country step up a gear in 2024? China will announce its economic growth targets in March 2024. In its December 2023 Central Economic Work Conference, a mixed message of “pursue progress while ensuring stability, consolidate stability through progress and establish the new before abolishing the old”1 was given. It’s hard to decipher a call to bold action from this.

China’s property slump has simply gone on too long for policy makers to continue with the 2023 piecemeal stimulus approach. Sentiment has already been damaged severely and the market needs support. In response to the broader sentiment slump, Chinese authorities have been relying on the so-called ‘national team’ – a group of state-run funds to buy equities in February 2024. That has certainly led to an upswing in equity markets since markets reopened after the Chinese New Year celebrations. To strike at the heart of the problem, policy makers could focus on the real estate sector itself.

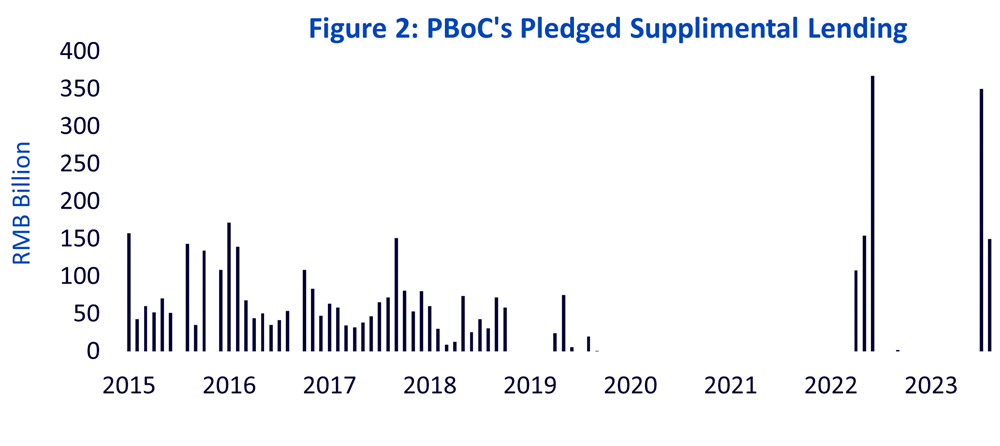

Policymakers have turned to ‘three major projects’: affordable housing, urban village renovation and emergency public facilities. A boost to funding for the People’s Bank of China (PBoC)’s Pledged

Supplemental Lending (PSL)2 program seems to indicate spending on these projects will rise (Figure 2). Support via this channel does not involve a broad-based rate cut.

Source: Bloomberg, WisdomTree. June 2015 – January 2024. Monthly data. Historical performance is not an indication of future performance and any investments may go down in value.

The PBoC additionally cut key mortgage interest rates by the most since 2019 in February 2024. Reluctance to cut interest rates in a broader fashion stems from fears of currency depreciation. But as other countries cut their interest rates (see section above), then China will feel less restraint.

We should also note that China’s demand for commodities has not been dented severely. Commodity price weakness seems to stem from perception that a weak economy will drive commodity demand lower.

For example, we believe that China had been increasing its grid spending during a period of relatively low copper prices, as it aims to opportunistically accelerate its transition to a lower carbon economy. Copper is essential for renewable technologies and the grid infrastructure improvements needed to accommodate an increasing number of electric vehicles on the road.

Xin san yang

Apparently, a new buzz word is circulating among Chinese officials and state media – Xin san yang – the “new three”, referring to solar cells, lithium-ion batteries and electric vehicles (EVs). China is a leader in the production and exports of these goods. While the “old three” – household appliances, furniture, and clothing – had a negative contribution to export growth in 2023, the new three were positive.

Solar cells, lithium-ion batteries and electric vehicles are metal-intensive industries and a widening international market for them could go some way to replace the slowing metal demand from the domestic real estate sector. Moreover, while property is more steel/iron ore intensive, the new three are more base metal intensive.

Energy transition

Our long-term outlook for commodities is conditioned on an energy transition taking place: the migration away from fossil fuels and greater reliance on renewables in an effort to reduce green-house gases.

After strong momentum behind the energy transition in 2021 and 2022, investor interest began to fray in 2023. 2022 marked a high-water mark given the sheer scale of the US Inflation Reduction Act (IRA) that was signed into law (despite its name, the act was a piece of legislation designed to spur investment in green technology). However, in 2023 the European Union adopted its Fit for 55 legislation (aimed to reduce greenhouse gas emissions by 55% by 2030 relative to 1990 levels). It is also on the cusp of signing Critical Raw Materials Act (CRMA) into law. The CRMA is similar to the US IRA – providing tax credits to those on-shoring the supply chain of electric vehicles, wind turbines and other green goods (but on a smaller scale).

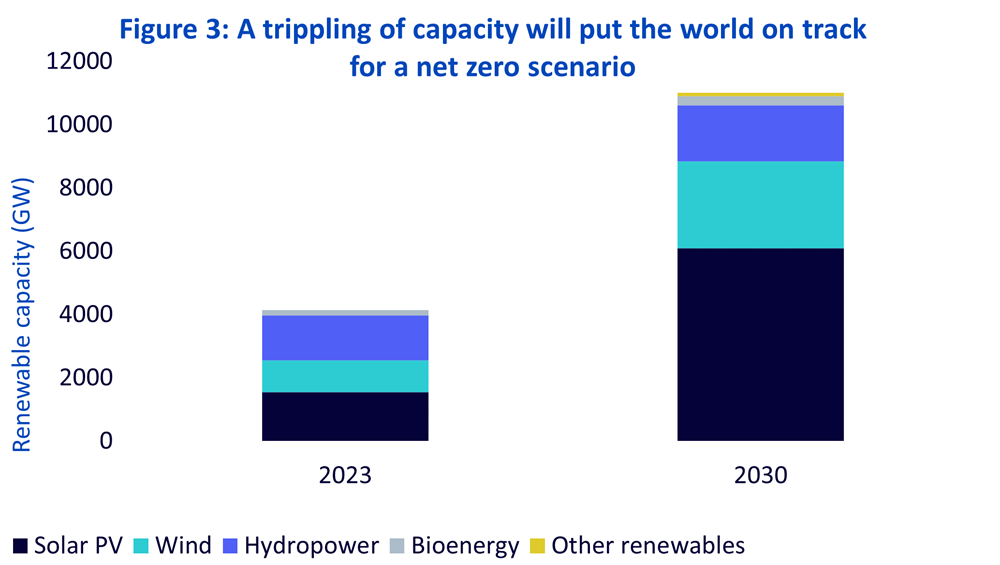

The COP28 in December 2023 concluded with a roadmap for “transitioning away from fossil fuels” – a first for a UN climate conference. That could potentially galvanise the energy transition once again. Although the extended discussions failed to agree on a “phase out”, the avoidance of stalemate allows planning and resources to be devoted to the “phase down” strategy. At the COP28 more than 130 national governments, including the European Union, agreed to work together to triple the world’s installed renewable energy capacity to at least 11 000 GW by 2030. That would be in line with the International Energy Agency’s Net Zero Emissions by 2050 scenario (if coupled with the doubling of the annual rate of energy efficiency improvements every year to 2030), see Figure 3.

Source: WisdomTree, International Energy Agency Renewables 2023, January 2024. 2030 forecasts refer to a Net Zero Scenario, which are higher than its base case forecasts. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

Conclusions

After a challenging 2023, commodities appear poised for a breakout as rate cuts come to the fore. The late December 2023 rally provides a glimpse of what could happen when the cuts are delivered.

While the largest consumer of commodities – China – remains in a tough spot in terms of its economy, we recognise that its demand for commodities remains resilient as it modifies it ‘business model’. That may mean that some commodities will do better than others though. We believe China will continue to stimulate and its ability to do so may improve as other countries around the world loosen monetary policy (as the country is worried about currency depreciation).

While investor attention to the energy transition could be fading, policy makers are intensifying their resolve. Breakthrough agreements at COP28 are a case in point. Our long-term outlook for commodities is conditioned on the energy transition and we believe that the potential for medium-long term supply deficits in metals will generate a commodity Supercycle.

The full outlook can be viewed here.

Investing in broad commodity strategies

WisdomTree has a comprehensive range of broad commodity UCITS Exchange-Traded Funds (ETFs) that can help diversify a traditional portfolio and cater for different investor needs and objectives. We believe the diversified nature of our broad baskets will be beneficial in a soft landing scenario as defensive commodities like gold are mixed with cyclical commodities like oil.

WisdomTree Broad Commodities UCITS ETF

The WisdomTree Broad Commodities UCITS ETF closely tracks the benchmark Bloomberg Commodity Index (BCOM) but, unlike other BCOM-trackers, it uses an innovative replication method that includes direct exposure to spot prices for the precious metals portion of the index rather than synthetic. The direct exposure to physical precious metals allows the ETF to reduce roll cost on the precious metals portion of the BCOM index, potentially improving performance versus full swap-based replication, while maintaining a low tracking error versus the benchmark.

- USD Accumulating: WisdomTree Broad Commodities UCITS ETF – USD Acc (IE00BKY4W127)

WisdomTree Enhanced Commodity UCITS ETF

The WisdomTree Enhanced Commodity UCITS ETF is a core commodity alternative to the Bloomberg Commodity Index (BCOM). It invests in the same commodities and rebalances yearly to the same weights as the BCOM, but seeks to systematically enhance the risk return profile by using the shape of individual commodity futures curves to optimise returns. The algorithm in the methodology finds the point on the futures curve where the roll yield (the yield from transitioning from a shorter dated contract to a longer dated one) is maximised. This can be a substantial source of return. The strategy also tends to have a much lower level of volatility compared to the benchmark, BCOM. A soft landing (as opposed to a continued recovery) may entail more volatility in a front-month contract-following commodity strategy, when softening demand may drive more commodity futures curves into a state of contango. The enhanced strategy we believe could mitigate some of that volatility.

- USD Accumulating: WisdomTree Enhanced Commodity UCITS ETF – USD Acc (IE00BYMLZY74)

- USD Distributing: WisdomTree Enhanced Commodity UCITS ETF – USD (IE00BZ1GHD37)

- EUR Hedged Accumulating: WisdomTree Enhanced Commodity UCITS ETF – EUR Hedged Acc (IE00BG88WG77)

- GBP Hedged Accumulating: WisdomTree Enhanced Commodity UCITS ETF – GBP Hedged Acc (IE00BG88WH84)

- CHF Hedged Accumulating: WisdomTree Enhanced Commodity UCITS ETF – CHF Hedged Acc (IE00BG88WL21)

WisdomTree Enhanced Commodity ex-Agriculture UCITS ETF

The WisdomTree Enhanced Commodity ex-Agriculture UCITS ETF provides broad commodity ex-agriculture and livestock exposure, while also aiming to systematically enhance the risk-return profile by selecting optimal maturities along the futures curves to improve carry and broaden the commodity set by including platinum and palladium. The strategy is designed for investors who don’t want to have exposure to the agricultural markets.

- USD Accumulating: WisdomTree Enhanced Commodity ex-Agriculture UCITS ETF – USD Acc (IE00BDVPNS35)

- EUR Hedged Accumulating: WisdomTree Enhanced Commodity ex-Agriculture UCITS ETF – EUR Hedged Acc (IE00BDVPNV63)

Sources

1 https://english.www.gov.cn/news/202312/12/content_WS657860aec6d0868f4e8e21c2.html

2 The PSL programme, initiated in 2014, was originally designed to help support any property downturn by funding urban redevelopment, pushing up property prices in the process. China relied heavily on PSL loans to support its shanty-town renovation during 2015-2018.