Introduction

Higher interest rates and the spectre of recession mean the outlook for equities is uncertain. Such an environment is seen as particularly difficult for smaller companies, which are typically more economically sensitive. However, the small cap market offers exposure to quality global companies with diverse earnings drivers and potential for resilience. With a hugely concentrated large cap market and smaller companies trading at historically low prices, the asset class can provide a great opportunity for portfolio diversification at a compelling price.

A great asset class

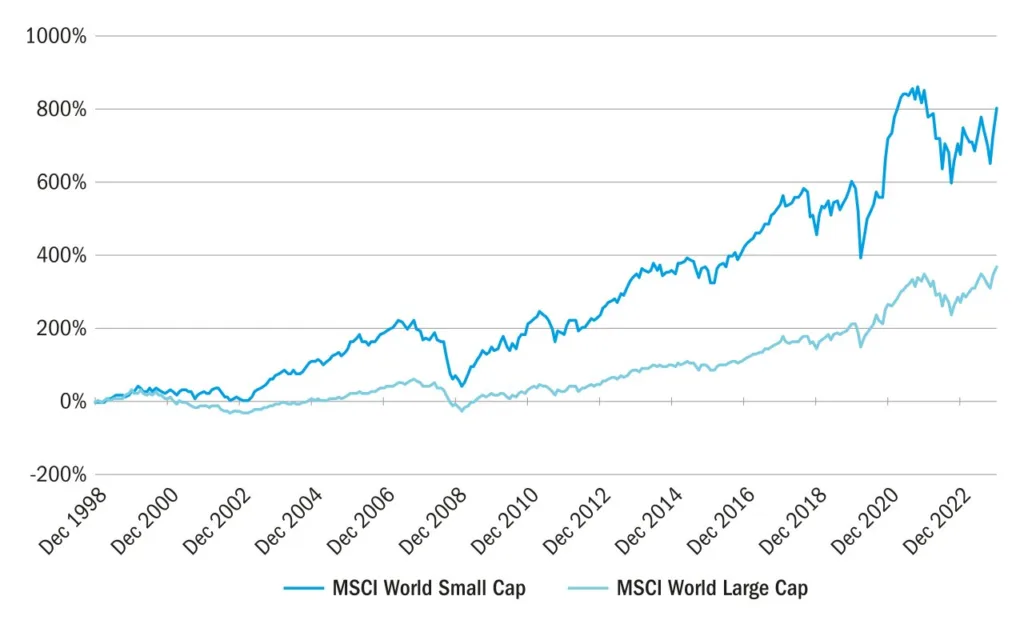

Small caps are inherently riskier than large caps. Their smaller size means limited liquidity. They are often more economically sensitive and may rely on borrowing to fund their growth. They can also be perceived as immature businesses, untested over economic cycles. All of which means they are more susceptible to price volatility. As a higher-beta asset class, small caps tend to decline further during periods of uncertainty but bounce back strongly out of downturns and typically surpass the recovery pace of large caps (Figure 1).

Figure 1: smaller company outperformance over the long term

Source: Bloomberg, MSCI World Large Cap Index and MSCI World Small Cap Index. Based on gross

total return indices in USD, 31 December 1998 to 31 December 2023.

Take the Covid-19 pandemic of 2020, for example. As lockdowns took hold, small companies were hit harder than their larger counterparts, dropping by around 40% in the depths of the drawdown compared to 33% for large caps. But as lockdown pressures eased and business and consumer spending increased, we saw renewed interest in the asset class and the rebound was more pronounced. Both asset classes closed 2020 up circa 16.5%.2

Going global

There is an assumption that small companies generally have a domestic focus. Any fluctuations in regional economic or political outlook will affect small caps to a greater extent. Even though a company’s domicile doesn’t dictate the quality of its business, nor does it convey where it makes its money, the share price can get swept up in the regional market sentiment.

Investing globally reduces your exposure to a single or narrow group of equity markets, allowing investors to capture the excess return potential of a broader set of small cap opportunities, many of which are global businesses. Indeed, over the past 25 years the risk-adjusted return from global smaller companies is higher than that from individual regions (Figure 2).

Figure 2: risk-adjusted returns by region

Source: Bloomberg, 31 December 2023. Data taken from MSCI World Small Cap, MSCI North America Small Cap, MSCI UK Small Cap, MSCI Europe ex UK Small Cap, MSCI Asia ex Japan Small Cap and MSCI Japan Small Cap. Based on gross total return indices in USD, 31 December 2003 to 31 December 2023. Risk-adjusted return = annualised return/volatility.

The valuation opportunity

In 2022, as concerns over inflation, interest rates and war gripped markets, the MSCI World Small Cap and MSCI World Large Cap indices were down by comparable amounts. Yet 2023’s recovery was much more pronounced towards the top of the market cap spectrum.

Investors often allocate to small caps when their outlook for growth becomes more positive. However, with persistently higher inflation, tighter global monetary policy and recession still a possibility, the asset class fell out of favour. In this environment managing a business will be tough, particularly a small one, and the average company’s earnings may come under pressure.

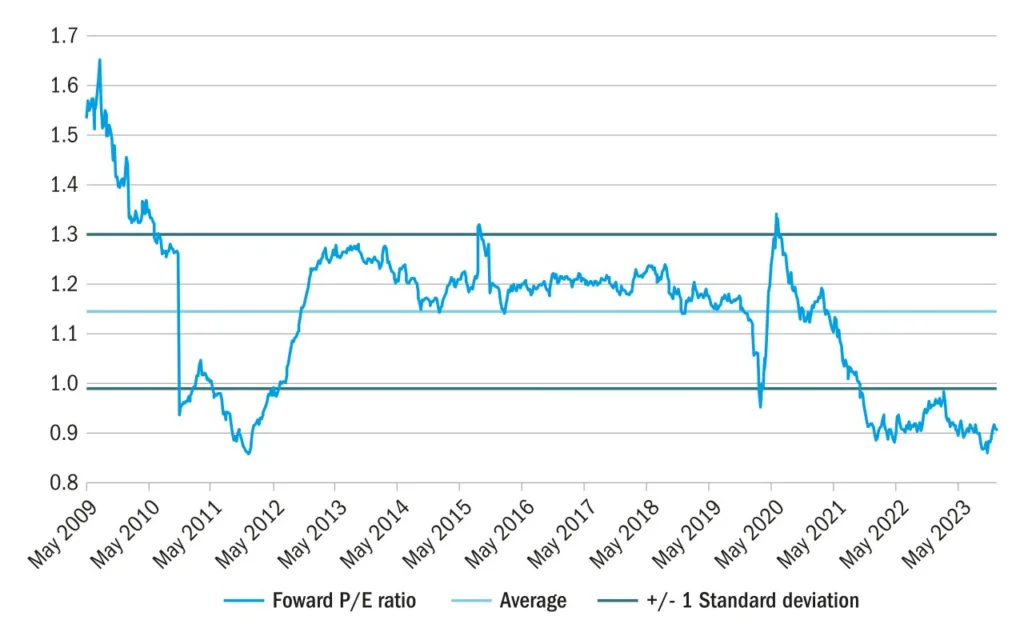

The outcome is that small caps currently trade at a discount to both their own history and their historical premium to large caps (Figure 3).

Figure 3: forward price/earnings, MSCI World Small Cap versus MSCI World

Source: Bloomberg. Forward P/E (MSCI World Small Cap versus MSCI World). February 2009 to December 2023.

There is a clear-cut valuation opportunity. The question is how best to take advantage of that discount?

Quality versus value

A cheap valuation should not be the only trigger for investment. Small companies often take advantage of shorter duration financing to support their growth – assuming they have access to credit. Following last year’s regional banking crisis in the US, small business lending has been contracting. And, of course, any deterioration in economic sentiment stands to have an impact. For many businesses it is quite possible that this discount is warranted.

For this reason, we believe the time for investing in quality small cap stocks is now. Quality companies tend to have relatively low gearing and strong balance sheets, so should be less affected by the need to refinance debt at higher rates. They are usually cash generative and should be better placed to ride out any downturn. This supported them during the early stages of the pandemic and should ensure they are better placed in an economic slowdown. Additionally, many have pricing power which provides resilience in inflationary times.

Many also stand to benefit from the same structural opportunities that are present in large cap. It could be the growth in AI, innovation in healthcare or addressing the climate crisis, both cause and impact. Small companies are often the enablers, providing the mission-critical products or services embedded in their customers’ processes.

It is in that quality cohort where some of the most compelling opportunities can be found. 2022’s valuation reset saw investors switch out of more expensive growth holdings in favour of cheaper stocks, energy-exposed companies or those perceived as defensive. Little attention was paid to the fundamental quality of companies. Those trading at a premium to the market – as high-quality companies typically do – were hit hardest during the valuation reset.

At first glance, some of these companies may not seem “cheap” compared to the broader market, for example based on a simple price-earnings multiple. However, the consistent, compounding nature of their earnings means they remain cheap relative to their intrinsic value. They are proven businesses with strong cash flows and should be able to support a higher interest rate environment.

For many of those quality companies that sold off, the investment opportunity is still intact. We now have a compelling entry point for active investors at prices cheaper than they previously were.

In a nutshell

Given the macroeconomic backdrop, quality is arguably the best way to get exposure to small cap companies. 2022’s valuation reset and the dominance of large cap in 2023 means many high-quality small caps are trading at cheaper prices. A global approach also makes sense in this environment, as it means less dependence on the strength of particular economies.

With the large cap market having been so concentrated in a handful of names, a small cap allocation provides useful diversification not only by market cap but also by region and sector. The global small cap universe is large and there is significant dispersion in the types and quality of businesses within it. For the well-resourced investor it offers an opportunity for truly differentiated returns.