The front December European Union Allowance (EUA) futures contract has fallen from a peak of €105/tonne on 27/02/2023 to €56/tonne on 27/02/2024. As much as the resilience of EUA prices through the COVID and energy crisis from 2020 to 2022 had surprised to the upside, the recent decline has surprised to the downside.

Admittedly given the state of the European economy and the mild winter it is hard to be bullish on EUA price in the short-term, but the extent of the decline appears overstretched and ripe for a short-covering rally.

Manufacturing recession

European Union industrial activity has been slowing for the past year. Industrial production data has trended down, there has not been a manufacturing PMI1 reading above 502 since June 2022, GDP3 growth across the union was negative in Q3 2023 and barely scraped into positive territory Q4 2023 (based on the preliminary release). Because of less economic activity, green-house gas (GHG) producing activity also slowed. That reduces the need for European Union Allowances (EUAs) by compliant entities and hence its price decline over the past year.

Front-loaded EUA auctions

In addition, to fund the European Commission’s RePowerEU Plan4, allowances auctions were front-loaded at the end of 2023. However, there are no net new allowances issued for that purpose across the current phase (that lasts to 2030) and hence auctions towards the end of the current phase will be commensurately smaller.

Mild winter and heating demand

A very mild winter in 2023/24 has reduced the need for energy for heating purposes. It feels like a déjà vu of 2022/23, when a mild winter reduced heating demand and sent European gas prices – benchmarked through the Title Transfer Facility (TTF) – lower. When Russian gas pipelines to the EU were shut off in 2022, there was fear that we will run out of the key energy source. Coal-fired power stations reopened at an alarming rate and new storage facilities for natural gas were built so that the EU could accommodate shipment of gas from elsewhere. Without a cold winter, there has been ample supply in storage and gas prices have fallen to way below the level when the Ukraine war commenced. Even disruptions to LNG shipments around the Red Sea have not been enough to turnaround the fall in TTF prices.

EUA-TTF unusually high

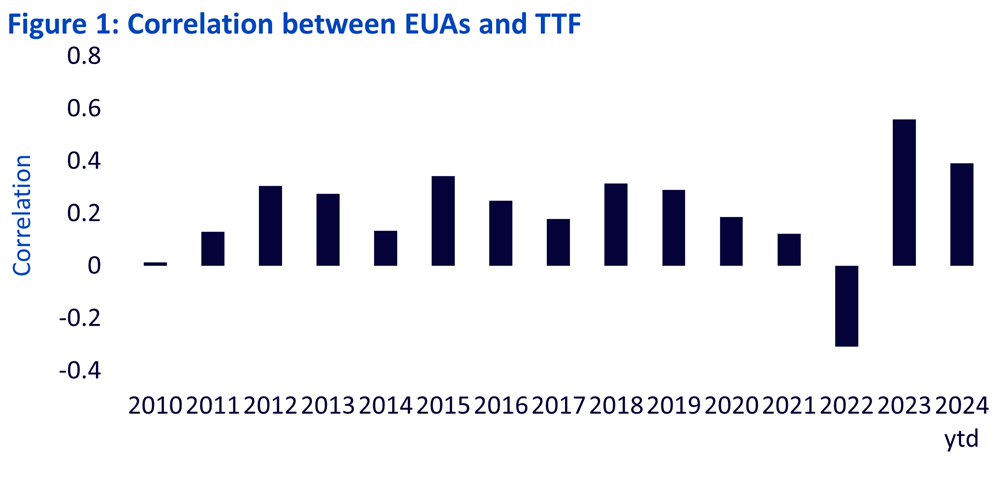

In theory there should be some relationship between EUA and TTF prices. Natural gas is a relatively low greenhouse gas emitting fossil fuel (when compared to coal or oil). When its price falls, power producers have more incentive to use natural gas. As a lower emitting source than the alternatives, the number of EUA’s power producers need to buy therefore declines. That is the theory, but in practice not every power producer can switch from one source to the other in a frictionless manner. Therefore, the relationship between EUA and TTF prices should only be loose. And that has been the case until recently. Figure 1 below shows that the correlation between TTF and EUAs was low until 2023 when it reached levels we have never seen before and in 2024 correlation remains excessively high. We believe the price correlation has strengthened to a level that is unjustified and is a clear break from the past. We believe EUA’s are being punished by poor sentiment rather than fundamentals.

Source: Bloomberg, WisdomTree. Based on weekly price growth correlations between front EUA and TTF futures contracts. January 2010 to February 2024. Historical performance is not an indication of future performance and any investments may go down in value.

Excessive bears on the rampage

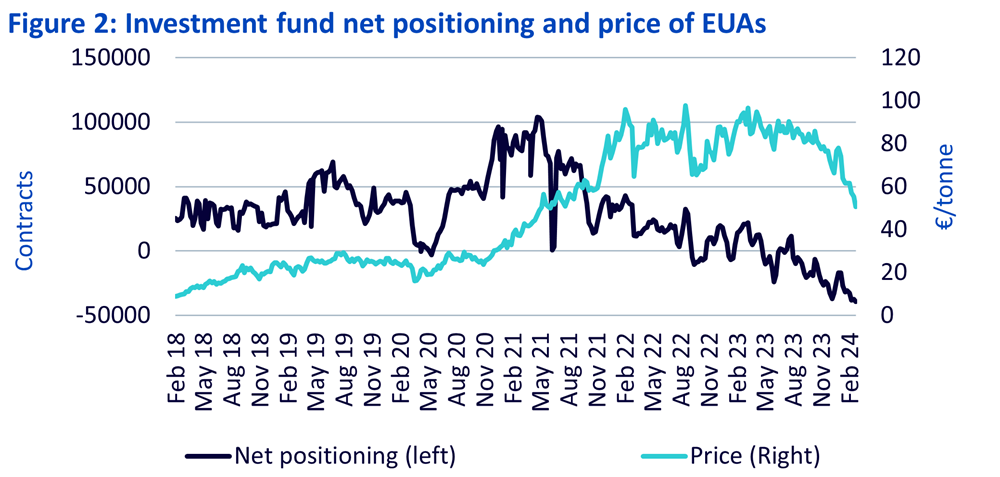

Net speculative positioning in EUA futures by investment funds has fallen to record lows (Figure 2). We believe the bearish speculative activity is the reason for the price decline and prices have thus sunk way below fundamentals.

Source: Bloomberg, WisdomTree. February 2018 – February 2024. Weekly data. Historical performance is not an indication of future performance and any investments may go down in value.

Structurally bullish

We remain structurally bullish on the EUA market over the current phase that lasts until 2030 and expect the EUA price to rise up to €150/tonne. In order to make the technologies needed to decarbonise (a target of at least 55% reduction by 2030 relative to 1990 levels) economically viable, an EUA price of that level will be needed.

Shipping added to the ETS

2024 is the first year that maritime shipping will be included in the EU Emissions Trading System (ETS). It will be phased in (40% of emissions in 2024, 70% in 2025 and 100% in 2026). That will provide a new source of demand for EUAs this year. Given the longer geopolitical tensions in the Red Sea and longer routes taken by ships to avert that region, shipping emissions are likely to be rising and thus be a stronger source of demand for EUAs than originally anticipated. Although the full effect will not be realised given the phasing-in programme.

The economy, however, will probably only splutter along until meaningful stimulus is offered.

Carbon Border Adjustment Mechanism

During the energy crisis of 2022, many high energy consuming companies shut their doors. Once the Carbon Border Adjustment Mechanism (CBAM) comes into operation, that could level the playing field for companies in the EU in these industries to reopen. CBAM will also drive the demand for EUAs higher as free allowances will be phased out. We believe these developments will be positive for EUA prices once the CBAM is implemented. On 1 October 2023, the CBAM entered into application in its transitional phase, with the first reporting period for importers ending 31 January 2024. Once the permanent system enters into force on 1 January 2026, importers will need to declare each year the quantity of goods imported into the EU in the preceding year and their embedded GHG. They will then surrender the corresponding number of CBAM certificates. The price of the certificates will be calculated depending on the weekly average auction price of EU ETS allowances expressed in €/tonne of CO2 emitted. Some foreign companies could start to hedge their future obligations with EUA futures in the run up to full implementation. With EUA prices as low as they are today, it is surprising that this process has not yet started.

Conclusion

In summary, despite the weak economy and mild winter we believe the decline in EUA price has been excessive and driven by speculation. The market is ripe for a short-covering rally. The longer-term policy path is extremely supportive for tightening the market, widening demand and, therefore, we believe prices will rise past previous highs in coming years. As EUAs are bankable, without expiry it is surprising that more EU corporates have not opportunistically purchased more EUAs for future use. It is equally surprising that foreign companies are not buying the futures to hedge their future CBAM obligations.

Sources

1 Purchasing Managers Index

2 A reading below 50 demarks contraction

3 Chain-linked volumes across 27 nations

4 Measures to limit EU dependence on Russian fossil fuels