Commodities: an immaculate asset for an immaculate disinflation?

A recent survey indicates that 21% of investors have no intention of investing in commodities1. We have argued that commodities are a strong strategic asset that offer great diversification benefits, inflation hedging and a long-term risk premium2. However, we acknowledge that many people see commodities as a short-term tactical instrument3. Looking down the barrel at a global economy that’s likely to continue decelerating in 2024, combined with the perception that commodities are a tactical asset, it’s unsurprising that close to a fifth of investors are refraining from the asset class. However, evidence points to real commodity prices generally rising in soft landings. Many investors could be missing an opportunity by sitting on the sidelines.

What is a soft landing?

Market consensus seems to be coalescing around a soft economic landing or an immaculate disinflation in 2024.

However, there are no official definitions of either term. The National Bureau of Economic Research (NBER), which dates recessions doesn’t have a definition for a soft landing. Many economists consider a recession with a small increase in unemployment as soft. The immaculate disinflation concept is similar in that inflation is subdued by an economic deceleration without a spike in unemployment. Such soft landings or immaculate disinflations are ideal from central bankers’ perspectives as they are associated with enough economic cooling to dampen price pressures without inflicting widespread economic pain.

Alan Greenspan, Federal Reserve (Fed) chairman between 1987 and 2005, is often accredited with creating a quintessential soft landing in the mid-1990s. In early 1994 the US economy was in its third year of recovery following the 1990-91 recession. By February 1994, the unemployment rate was falling rapidly, down from 7.8% to 6.6%. CPI inflation was 2.8%, and the federal funds rate was around 3%. With the economy growing and unemployment shrinking rapidly, the Fed was concerned about a potential pick-up of inflation and decided to raise rates pre-emptively. In 1994, the Fed raised rates seven times, doubling the federal funds rate from 3% to 6%. It then cut interest rates, three times in 1995 when it saw the economy softening more than required to keep inflation from rising.

Commodities in a soft landing

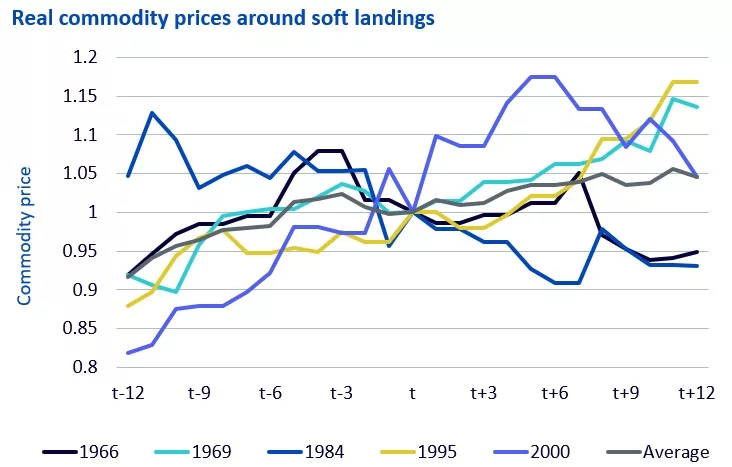

To analyse soft landings, we use the work of Princeton economist Alan Blinder4, a former Fed vice chair. He considers soft landings as a period when gross domestic product (GDP) declines by less than 1% and the NBER doesn’t declare a recession after at least a year of a Fed hiking cycle. We analyse the performance of commodity prices one year prior to and after the final Fed fund rate hike in each of these episodes.

In the chart below, we show real commodity prices (deflated by the US Consumer Price Index), indexed to 1 at the final rate hike in the soft landing period. What is clear is that not every soft landing is the same, but on average, commodity prices are soft for the 5 months prior to the last rate hike and then rise thereafter.

In 2000 and 1995 commodity prices rose prior to and after the last rate hike. And in 1984, commodity prices fell before and after the last rate hike. The two examples from the 1960s – 1966 and 1969 – fit the average profile of softening a few months before the last rate hike and rising after it.

The main takeaway is that in 4 out of the 5 soft landings, commodity prices were up 5 months after the last rate hike.

Source: Bloomberg, WisdomTree. November 1965 – July 2001. Monthly data. Commodity price (Bloomberg Commodity Total Return Index) deflated by the US Consumer Price Index, indexed to 1 on the month of the final rate hike in the cycle. Legend label indicates the year of last rate hike in the cycle. Historical performance is not an indication of future performance and any investments may go down in value.

Are we in a soft landing now?

As we argue in What Will “Higher for Longer” Actually Mean?, major central banks around the world are getting ready for the next stage of monetary policy. The Fed, which is arguably the leader of the pack, has left rates unchanged since August 2023. US inflation pressures appear to be declining in a meaningful way while US unemployment was very low at 3.7% in November 2023. In fact, while unemployment had been on a slow rising trend from 3.4% in January 2023 to 3.9% in October 2023, it surprisingly dipped in November. While the dip may be accounted for by idiosyncratic factors such as the resolution of strikes and extra hiring by government and healthcare, the University of Michigan survey of consumers also climbed to a four month high, pointing to positive sentiment that is inconsistent with the beginning of a hard landing. Moreover the survey showed inflation expectations cooling despite underlying strength in the labour market. While soft landings are difficult to achieve, current conditions appear supportive of one.

Investing in broad commodity strategies

WisdomTree has a comprehensive range of broad commodity UCITS exchange-traded funds (ETFs) that can help diversify a traditional portfolio and cater for different investor needs and objectives. We believe the diversified nature of our broad baskets will be beneficial in a soft landing scenario as defensive commodities like gold are mixed with cyclical commodities like oil.

WisdomTree Broad Commodities UCITS ETF

The WisdomTree Broad Commodities UCITS ETF closely tracks the benchmark Bloomberg Commodity Index (BCOM) but, unlike other BCOM trackers, it uses an innovative replication method which includes direct exposure to spot prices for the precious metals portion of the index rather than synthetic. The direct exposure to physical precious metals allows the ETF to reduce roll cost on the precious metals portion of the BCOM index, potentially improving performance versus full swap-based replication, while maintaining a low tracking error versus the benchmark.

USD Accumulating: WisdomTree Broad Commodities UCITS ETF – USD Acc (IE00BKY4W127)

WisdomTree Enhanced Commodity UCITS ETF

The WisdomTree Enhanced Commodity UCITS ETF is a core commodity alternative to the Bloomberg Commodity Index (BCOM). It invests in the same commodities and rebalances yearly to the same weights as the BCOM, but seeks to systematically enhance the risk return profile by using the shape of individual commodity futures curves to optimise returns. The algorithm in the methodology finds the point on the futures curve where the roll yield (the yield from transitioning from a shorter-dated contract to a longer-dated one) is maximised. This can be a substantial source of return. The strategy also tends to have a much lower level of volatility compared to the benchmark, BCOM. A soft landing (as apposed to a continued recovery) may entail more volatility in a front-month contract-following commodity strategy, when softening demand may drive more commodity futures curves into a state of contango. We believe the enhanced strategy could mitigate some of that volatility.

- USD Accumulating: WisdomTree Enhanced Commodity UCITS ETF – USD Acc (IE00BYMLZY74)

- USD Distributing: WisdomTree Enhanced Commodity UCITS ETF – USD (IE00BZ1GHD37)

- EUR Hedged Accumulating: WisdomTree Enhanced Commodity UCITS ETF – EUR Hedged Acc (IE00BG88WG77)

- GBP Hedged Accumulating: WisdomTree Enhanced Commodity UCITS ETF – GBP Hedged Acc (IE00BG88WH84)

- CHF Hedged Accumulating: WisdomTree Enhanced Commodity UCITS ETF – CHF Hedged Acc (IE00BG88WL21)

WisdomTree Enhanced Commodity ex-Agriculture UCITS ETF

The WisdomTree Enhanced Commodity ex-Agriculture UCITS ETF provides broad commodity ex-agriculture and livestock exposure, while also aiming to systematically enhance the risk-return profile by selecting optimal maturities along the futures curves to improve carry and broaden the commodity set by including platinum and palladium. The strategy is designed for investors who don’t want to have exposure to agricultural markets.

- USD Accumulating: WisdomTree Enhanced Commodity ex-Agriculture UCITS ETF – USD Acc (IE00BDVPNS35)

- EUR Hedged Accumulating: WisdomTree Enhanced Commodity ex-Agriculture UCITS ETF – EUR Hedged Acc (IE00BDVPNV63)

Sources

1 WisdomTree, Censuswide. Pan-Europe Professional Investor Survey Research, Survey of 803 professional investors across Europe, conducted during August 2023.

2 See The Case for Investing in Broad Commodities, November 2021

3 Although as we argue in Myth-busting: top 6 misconceptions about commodities, commodities aren’t just tactical instruments.

4 Landings, Soft and Hard: The Federal Reserve, 1965–2022, By Alan S. Binder, Journal of Economic Perspectives—Volume 37, Number 1—Winter 2023—Pages 101–120.