Some investors have been increasing exposure to emerging market corporates this year, and it could be because these regions appear to be ahead of the cycle, with the outlook for interest rates, defaults and growth looking positive.

Taking the initiative

Emerging market governments can take some credit for this situation, having, in many cases, hiked interest rates early and aggressively. Past experiences of inflation in these parts of the world left most policymakers in little doubt about the need for decisive action.

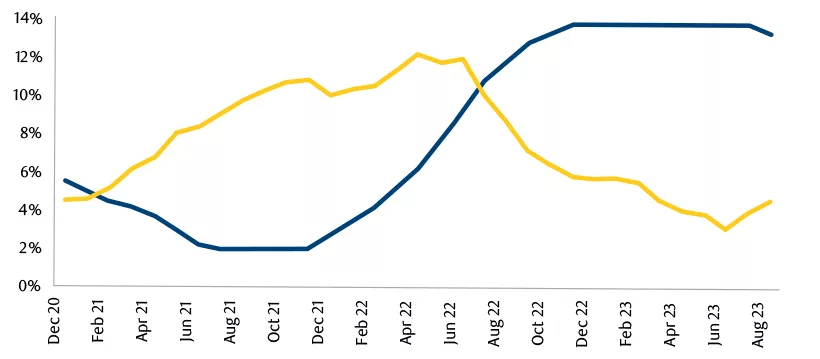

Brazil is a good example. It began raising rates from a low point of 2% in March 2021, reaching 13.75% by August 2022.1 Accordingly, inflation fell from 12.1% in May 2022 to just 3.2% in August this year.2

Interest rate and inflation in Brazil

Although this was painful during the period of rate hikes, the subsequent plateauing at higher rates and yields has created a fertile environment for fixed income investors.

Now, as we look forward, many emerging countries are actually starting to cut rates. For example, Brazil has been cutting in 50 basis point increments, while Chile recently cut by 100 basis points and then a further 75. This could provide a further tailwind as bond values rise and holders benefit from capital appreciation.

Default rates

To look at another important metric, we can speculate that corporate default rates may be similarly ahead of the curve, in the sense of being past their peak.

Certainly, high yield EM defaults have been much higher than in the developed world over recent years, running at 7% in 2021, 14% in 2022 and 7% in the year to date. There are some mitigating reasons for this – a lot of it has been driven by Chinese real estate and geopolitical events in Russia and Ukraine rather than serious weakness in the fundamentals – but we can nevertheless anticipate that a good deal of the pain is out of the way. Certainly, the most levered and most at risk companies have now fallen by the wayside.

This is mirrored in corporate funding costs. Taking Brazil as an example again, AA corporates have seen their funding yields rise from 3% three years ago to around 15-16%. At the same time, consumers have also been stretched by higher interest rates, affecting demand for goods and services. Now though, if interest rates are starting to fall, then we can anticipate that funding costs may come down too.

We can also take heart from the fact that the more prudent issuers took the opportunity to term out their maturity profiles during Covid. So many of those with debt due in the next one, two or three years issued, where they could, longer maturity bonds at what were in hindsight relatively low levels of yield.

Achieving the mythical soft landing?

When it comes to economic growth, we’ve seen something approximate to the “soft landing” that has been much talked about in the developed world. We’re not seeing many countries with a negative growth outturn at all – collectively, we’re expecting EM growth of around 3.8% this year and 3.6% next year.

For example, if we look at some of the countries in South America which have had weak growth outcomes this year, such as Chile, Peru, Argentina and Colombia, all except Argentina are expected to show sequential improvements as we move into 2024.

Regarding those countries discussed earlier as having a more challenging default situation, our view on the progress of the Russo-Ukrainian War is cautiously constructive. We see the potential for some sort of off-ramp or frozen conflict, and any reconstruction phase is likely to benefit economic growth.

On the downside, China is more of a concern. We’re seeing weakness in economic growth, and the stimulus coming through from government is fairly piecemeal. It doesn’t help that the country is continuing its substantial deleveraging programme, designed to control its debt-to-GDP ratio.

Indeed, we’re almost seeing deflation in China, and when you put that alongside weaker-than-expected growth, investors might prefer to skew to corporates or sovereigns which are more leveraged to the US and global growth cycle than the Chinese one.