What’s Hot: A volatile week in oil as security-driven supply concerns counter demand concerns

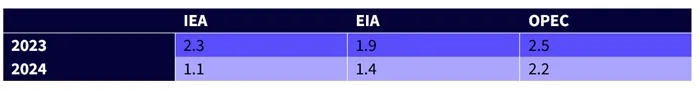

While the International Energy Agency (IEA) and Energy Information Administration (EIA) have been revising downward their oil demand forecasts for a number of months, the Organisation of Petroleum Exporting Countries (OPEC) has kept its forecasts at a rather optimistic level for some time (see Table 1).

Oil demand growth forecasts (million barrels per day)

Source: IEA Oil Market Report – December 2023, OPEC monthly Oil Report – December 2023, EIA Short-Term Energy Outlook, January 2024. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

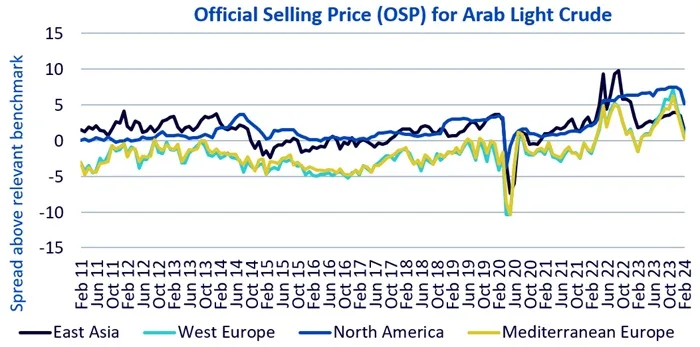

Reduction in Saudi OSPs

However, last Sunday (January 7th 2024), Saudi Arabia, the largest and most influential OPEC member, cut its selling prices across most regions. The Official Selling Price (OSP, as a spread above the Oman and Dubai benchmarks) of the flagship Arab Light Crude to East Asia for example fell to the lowest level since November 2021. Markets interpreted this as Saudi conceding that oil demand is indeed soft, and the price of Brent crude oil fell 4.5% between the open and late afternoon on Monday 8th January.

Source: WisdomTree, Bloomberg. Relates to prices in February 2024, expressed in US$/barrel above the relevant benchmark. Relevant benchmarks: East Asia – Oman and Dubai; West Europe and Mediterranean Europe – Brent; North America – Argus Sour Crude Index.

Historical performance is not an indication of future performance and any investments may go down in value.

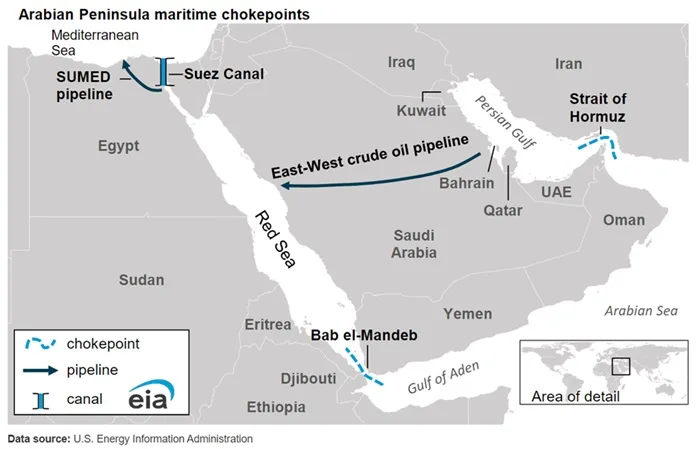

Middle East export disruption in focus

The price weakness in Brent was not sustained for long and by Wednesday 10th January, most of the losses were recovered. The chief driver has been market concern about oil export supply disruptions in the Middle East. Attacks on ships passing through the Red Sea by Houthi rebels had gathered pace in December 2023 and escalated into January 2024. On 10th January, a British warship in an operation with US forces, shot down seven drones launched by Houthis in the Red Sea to repel the largest drone and missile attack to date. Further US air strikes against Houthis on 12th January lifted oil prices to erase all loses from earlier in the week.

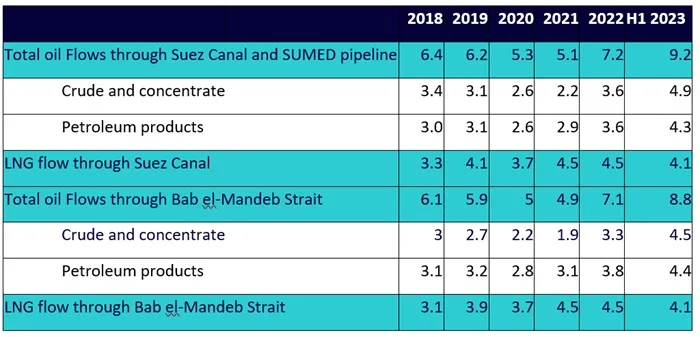

Around the Red Sea are the Suez Canal and Bab el-Mandeb Strait choke points. According to EIA analysis, in H1 2023, 9.2 million barrels per day of oil and petroleum products passed through the Suez Canal and SUMED pipeline and 8.8 million barrels per day of oil and petroleum products passed through the Bab el-Mandeb Strait.

Suez Canal, SUMED pipeline and Bab el-Mandeb Strait chokepoints

Source: EIA analysis based on Vortexa tanker tracking, December 2023. LNG=liquefied natural gas. Oil flows measured in millions of barrels per day and LNG measured in billion cubic feet per day.

Historical performance is not an indication of future performance and any investments may go down in value.

The region is critical for global oil transportation. Oil and fuel tanker traffic through the Red Sea has not fallen significantly yet, unlike Asia-Europe container ships, which have chosen to divert around the Cape of Good Hope in South Africa (adding an extra 14 days to shipments according to S&P Global). However, the few that have paused their Red Sea shipments, could become more numerous the longer the security concern in the area remains.

Could the Strait of Hormuz be next?

On Thursday 11th January security concerns in the Middle East were further escalated when Iranian state media reported that Iran’s elite Revolutionary Guards seized a tanker with Iraqi crude destined for Turkey. The seizure was in retaliation for the confiscation last year of the same vessel and its oil by the US. Last year the US stopped the vessel as part of its enforcement of Iranian sanctions. Markets are getting fearful that Iran and it proxies could disrupt oil moving out of the Strait of Hormuz, which is the world’s most important oil chokepoint. The Strait of Hormuz lies to the north of point where the tanker was taken. More than 20 million barrels of oil per day move through the Strait of Hormuz, which could be more than a third of all seaborn oil , eclipsing both the Bab el-Mandeb Strait and Suez Canal.

Will OPEC adjust its forecasts?

At the end of a volatile week, it appears security related supply concerns overwhelmed demand concerns to drive oil prices higher. However, should supply issues be resolved, market focus could return to the demand side of the equation. Crude oil is an unusual market in that OPEC and partners control more than 50% of production. Their supply decisions can drive market balance and ultimately price. OPEC will publish its next Monthly Report on 17th January. OPEC and its partner countries are restraining production with voluntary cuts of 2.2 million barrels per day until March 2024. Should demand forecasts be revised lower in the January report, that could build the groundwork for a deeper cut.

WisdomTree Solutions

WisdomTree has a large number of products providing exposure to oil price movements. These can help hedge against the geopolitical and security concerns continuing to drive prices higher. WisdomTree Brent Crude Oil (BRNT) and WisdomTree Bloomberg WTI Crude Oil (WTID) for example provide delta-one exposure to Brent and WTI futures respectively around the front end of the curve. WisdomTree WTI Crude Oil (CRUD) offers a multi-tenor approach, giving exposure to several contract prices near the front of the curve. Should you have a bearish view – for example believe that the demand weakness will ultimately dominate – you can express this through instruments designed to provide inverse exposure such as WisdomTree WTI Crude Oil 1x Daily Short (1OIS) or WisdomTree Brent Crude Oil 1x Daily Short (SBRT), but note these are designed with very short holding periods in mind.