Thematic strategies offer investors exposure to companies that will be the driving force behind the structural shifts shaping our future, be it the energy transition in our fight against climate change or the generative AI revolution fuelled by the release of ChatGPT. The associated growth potential created by those structural shifts is one of the key value propositions of thematic investing.

By choosing to invest in a multi-thematic strategy instead of single theme strategies, investors can benefit from a simplified investment experience, deferring decisions around theme selection, capital allocation between themes, and individual stock selection. Multi-thematic strategies can therefore offer a one-stop solution to participate in long-term equity growth across different megatrends as they develop.

WisdomTree is a leading thematic exchange-traded fund (ETF) provider with deep thematic research expertise. Since 2018, we have developed world class research around the construction of single thematic strategies and thematic portfolios. We have also launched multiple successful, expert-driven thematic strategies. All this research has culminated in a unique multi-thematic ETF called the WisdomTree Megatrends UCITS ETF (WMGT). With its unique investment approach, WMGT offers investors an opportunity to invest in the world’s future.

WisdomTree Megatrends UCITS ETF: A one-stop solution to capture the world's future growth potential

WMGT tracks the WisdomTree Global Megatrends Equity Index. The strategy relies on an expert-driven, top-down portfolio construction approach. This allows control of the balance between diversification and increased exposure to high-growth stocks. The ETF can therefore benefit from three layers of alpha generation.

- The Strategic Thematic Asset Allocation

The first layer provides investors with a curated exposure to the most promising themes at a given point in time, whilst maximising diversification between themes.

Once every April around 15 themes are selected based on qualitative and quantitative indicators, focusing on 3 main criteria:

- Conviction: high-conviction themes have greater market size, growth potential and investable universes.

- Diversification potential: themes are assessed through a combination of hierarchical clustering calculated on the excess returns (vs. global equity benchmark) of each of the themes to assess their diversification potential. The portfolio of themes aims to maximise diversification.

- Alignment with the UN Sustainable Development Goals (SDGs): themes are assessed by looking at the proportion of revenues aligned to the different SDGs for all the stocks in each theme. Themes with differentiated SDG exposure and higher revenue exposure to SDGs are prioritised.

The 3 relevant megatrends are weighted on rebalancing as follows:

- 50% for Technological Shifts

- 40% for Environmental Pressures

- 10% for Demographic and Social Shifts

The themes are then equally weighted within each megatrend.

- Tactical Thematic Asset Allocation

The second layer allows the strategy to lean in and overweight themes when a combination of positive factors creates a virtuous cycle for a given theme. This was the case for Cloud during COVID in 2020, or AI in 2023. Each theme’s weight in the portfolio would depend on the different themes’ absolute and relative strengths.

In effect, the tactical allocation is based every quarter on a proprietary momentum score calculated independently for each theme. Depending on the momentum scores, the weighting of each theme is modified by a multiplier ranging from 0.5 to 1.5. The final weight of each theme at the quarterly rebalancing is its strategic weight multiplied by the theme’s tactical multiplier.

- Thematic Stock Selection

The third layer brings together different theme experts to pick the most relevant and up-and-coming companies for each theme. It aims to create a diversified portfolio of stocks that best represent each theme, its underlying story, and its long-term growth potential. The objective is to ensure the portfolio invests in the future winner for each selected theme while maintaining liquidity and tradability.

The portfolio for each theme is built independently so that each theme basket is a diversified portfolio of expert-picked, pure-play, up-and-coming companies that are highly relevant to the theme.

The final step in the process aims to apply momentum at stock level to reduce the number of stocks in the portfolio and increase its timeliness. Every quarter, at the end of the process, the portfolio is reduced to around 600 stocks by removing those with the lowest momentum in each theme basket. The process is applied so that the weight of the different themes remains unchanged.

A closer look at the WisdomTree Global Megatrends equity strategy

The portfolio currently holds 593 stocks. However, this is a portfolio design for growth aiming to exhibit low overlap with classic market cap indices. The overlap with the MSCI All Country World Index is only 15.3% as of 30 November 2023.

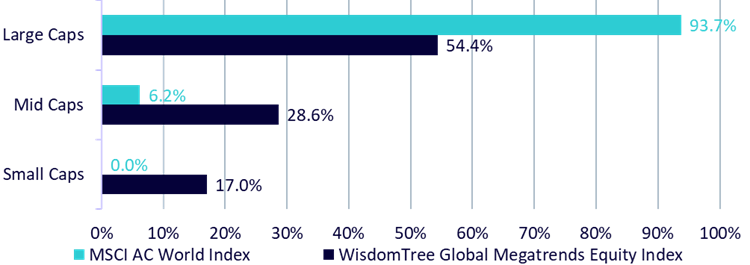

Figure 1 shows that the strategy invest 17% in small caps and 28.6% in mid caps while market cap weighted indices, like the MSCI AC World, have a very high proportion of large caps.

Figure 1: WisdomTree Global Megatrends equity strategy – portfolio distribution by company size

Source: WisdomTree, Factset. As of 30 November 2023. Small caps have a market cap below $2billion; large caps’ market cap are above $10 billion.

Historical performance is not an indication of future performance and any investments may go down in value.

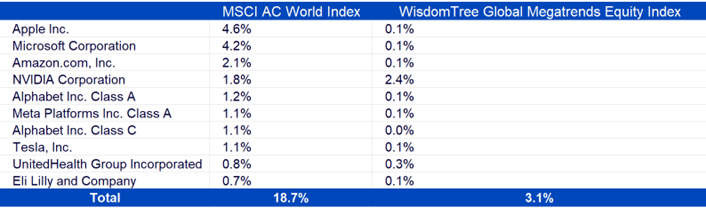

Looking specifically at the biggest companies in the world, they represent 18.7% of the MSCI All Country World. In our strategy, they only represent 3.1% with Nvidia being the bulk of it. This easily demonstrates that the strategy is focused on small and mid-sized companies with high growth potential and pure play exposure to the different megatrends that can change our world.

Figure 2: WisdomTree Global Megatrends equity strategy – low overlap with key megacaps

Source: WisdomTree, Factset. As of 30 November 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

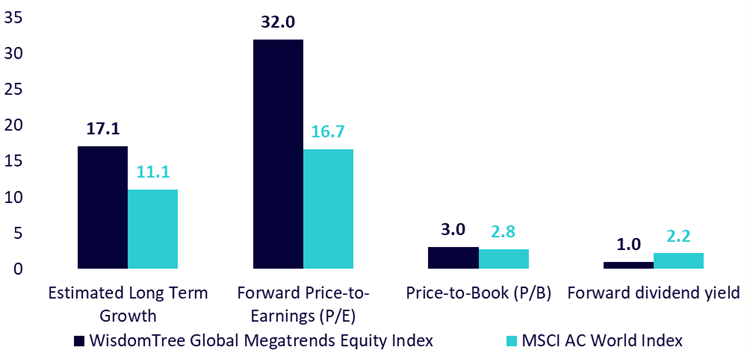

The portfolio that results from this process is highly geared toward high-growth stocks. The portfolio’s estimated long-term growth is 17.1% versus only 11% for the MSCI AC World. This comes at the expense of more expensive stocks as would be expected.

Figure 3: WisdomTree Global Megatrends equity strategy – key fundamentals

Source: WisdomTree, Factset. As of 30 November 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

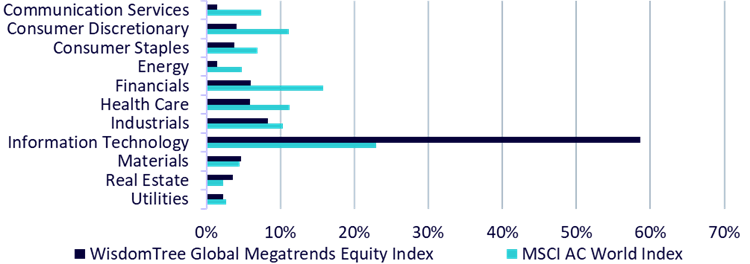

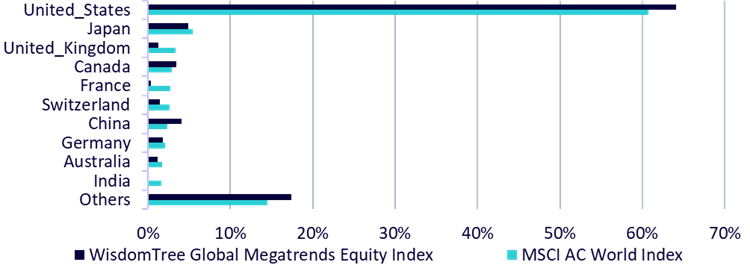

Sector-wise the portfolio tilts toward Information and Technology, of course. But it is still diversified across sectors. Country-wise the portfolio is invested around the world, in developed and emerging markets.

Figure 4: WisdomTree Global Megatrends equity strategy – sector and country weights

Source: WisdomTree, Factset. As of 30 November 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

Key takeaways

WMGT offers a unique approach that allows investors to get access to long-term growth through a curated portfolio of themes and expert-driven stock selection. Investors also benefit from tactical allocation to the different themes over time to adapt to current market environments. The WisdomTree Megatrends UCITS ETF is a strong alternative to other multi-thematic strategies or traditional growth funds as it delivers exposure to a diversified basket of growing, up-and-coming companies instead of established tech megacaps.

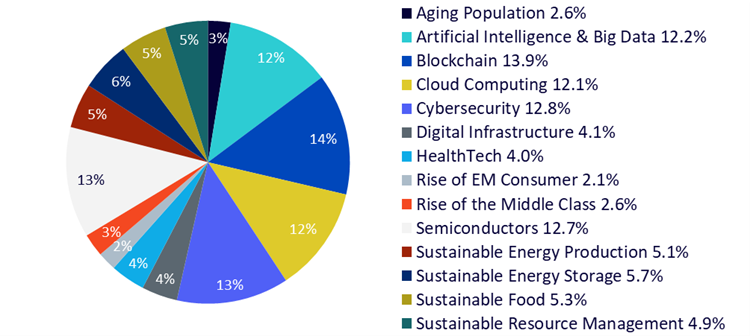

Figure 5: WisdomTree Global Megatrends Equity strategy – current theme allocation

Source: WisdomTree, Factset. As of 30 November 2023.