It is widely acknowledged that the investment proposition underpinning the existence of thematic investing is the long-term growth potential. The performance of such investments relies on their intimate relationship with the impact of the theme on the world and our everyday lives. Candidly, if using artificial intelligence (AI) does not become an everyday occurrence for most of us, the performance of AI-related strategies won’t be as strong as hoped. Looking back, the incredible performance of e-commerce stocks, search stocks, or social media stocks is the direct result of how embedded in our lives those activities have become. Every day, a large part of the population buys items online, endlessly scrolls on their social media feed, and types questions into Google.

Can valuations or fundamentals predict when it is worth entering a given theme?

While investing in a given theme is a long-term endeavour, performance is not going to look like a straight line. Every theme is driven by theme-specific events (such as a technological breakthroughs) and theme-specific news leading to periods of intense outperformance and, sometimes, underperformance. The performance jump in AI in the first half of 2023 is the most recent example of this behaviour. Investors intuitively understand that such behaviour, if properly leveraged in their portfolio, could improve the overall risk-return profile.

This leads to in-depth discussions with our clients around entry and exit points for thematic investment. Very often investors rely on their experience with other types of equity strategies to try to draw conclusions for the thematic space, leading to valuations and fundamentals being discussed as a way of timing thematics. However, this may not be the best approach and focusing on the valuations of a theme may be detrimental to the long-term potential as it could lead to missing those periods of strong outperformance.

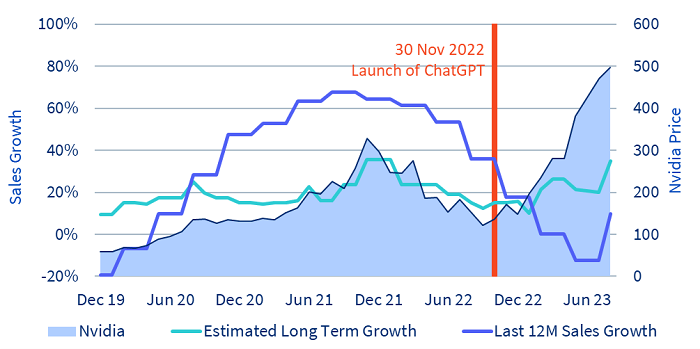

Artificial intelligence in 2023 offers us a case in point. Clearly, many stocks linked to AI benefitted from the launch of ChatGPT in November 2022 and have enjoyed stellar performance. Following that news, all AI stocks jumped up. Nvidia, for example, gained 168.7% from 30 November 2022 (ChatGPT launch date) to 13 October 2023. Looking at Figure 1, we tried to link the performance of Nvidia in 2023 to its fundamentals. Clearly, this performance was not ‘Nvidia-driven’, it was not the result of particularly attractive fundamentals. Many investors we met in the last few weeks have, in fact, repeatedly pointed out that Nvidia was quite unattractive from a valuation and growth point of view in late 2022. So, the question is, would it have been worth it not to be invested in AI on the launch date of ChatGPT because fundamentals were not attractive enough or because AI stocks were expensive? Or should fundamentals have been overlooked to benefit from the virtuous cycle created for those stocks by the launch of ChatGPT? To us, the answer is clear.

Figure 1: The impact of the launch of ChatGPT on Nvidia’s performance

Sources: WisdomTree, Bloomberg. From December 2023 to August 2023. Returns are calculated in US dollars.

Historical performance is not an indication of future performance and any investments may go down in value.

Key takeaways

When it comes to timing thematic investment, success hinges on understanding the theme and its drivers more than on valuations and fundamentals. Themes are driven by various factors over time, from regulatory changes to technological advances. Those factors have a significantly higher impact on performance than the fundamentals of companies relevant to that theme. Understanding those factors, and how they impact the themes, are the main drivers of performance. This is why expertise is the key to thematic investing.