In November 2022, did you know ChatGPT was about to launch? Did you know it was going to become the fastest application ever to reach 100 million users?

Not many people—including the OpenAI team that built it—predicted this outcome. It’s a great example of exciting breakthrough technologies that can influence thematic equity strategies.

In our opinion, building a thematic equity exposure that tracks the growth of a megatrend over more than ten years involves an important balancing act:

- On one hand, you want significant exposure to potentially ‘world-changing’ technology. If the technology is sound and widely adopted, a larger exposure equates with a bigger benefit.

- On the other, very few can predict which technologies will be developed and go viral, supporting the case for spreading equity exposure across different technologies to increase chances of ensnaring the biggest winners.

What, if anything, do you look for in an AI strategy?

47.82% said diversity of exposure to relevant business models (that is, not all software, not all semiconductors, not all giant companies).

Getting this response halfway through 2023 was comforting, given one could have said ‘buy into the Magnificent 7.’ Even if they didn’t, they could easily have responded ‘buy into the Nasdaq 100.’ 2023 was a strange year when many, including WisdomTree, were ready for a revival of the value investment style after many years of growth-oriented tech companies leading the way. With higher interest rates we thought that valuation multiples, particularly of growth stocks, needed to come down, making way for value’s outperformance.

Instead, the largest tech companies in the world dominated. If they can translate AI’s potential into revenue and earnings generation, it’s possible they could set up for further, multi-year equity market leadership. In a sense, this is historic, because it hasn’t been the case that from decade to decade the same or substantially similar companies hold leading positions.

Even if this seems obvious, when we were writing about value strategies a year ago, that seemed obvious too. The importance of humility is the clear takeaway.

As the AI megatrend evolves, we believe that change and surprise will be the only constants. There’s also an interaction occurring between AI, what it can do, and the overall macroeconomic environment, with effects channelling in both directions. Maybe AI can enhance productivity and economic growth. Similarly, maybe higher interest rates are pulling down the valuation multiples of newer AI companies. We also know there’s a semiconductor cycle that’s impacted by AI, but that also has independent elements. 2023 was a year of the ‘AI-accelerator chip’, and Nvidia clearly benefitted, but maybe 2024 could see a broader semiconductor rally if more of us replace laptops and smartphones.

When WisdomTree collaborated with CTA on the Nasdaq CTA Artificial Intelligence Index, the AI value chain was split into three distinct groups:

- Engagers: These companies are pushing AI software forward, and in CTA’s view, AI is fundamental to how they earn revenues. They would account for a 50% exposure at each semi-annual rebalance.

- Enablers: These companies are providing the hardware that forms the backbone of AI, predominantly semiconductors. They would account for a 40% exposure at each semi-annual rebalance.

- Enhancers: These are larger, more diversified businesses that have done/are doing many different things. Some of the world’s largest companies sit in this group so it’s important to have lower weights because many investors can easily access these stocks and hold them in other strategies. They would account for a 10% exposure at each semi-annual rebalance.

You’ll notice ‘users’ of AI have been excluded. This was so investors in this strategy would have a clear focus on businesses pushing the AI ecosystem forward, rather than those simply using the technology.

Purity—everyone wants it in thematic equities, but what does it mean?

WisdomTree has consciously grown a platform of thematic equity strategies, with 10 at this time. In one word, what investors want across the board in thematics is purity.

In our recent AI survey, 44% of respondents did mention this—not quite the number 1 response, but a strong number 2.

Purity is a difficult concept within thematic equities. Think of revenue or net income. These terms are generally understood and there’s a means of calculation accepted by third parties. We can read disclosures and develop an understanding of what any company does when they calculate terms like this on their financial statements.

However, if we say, ‘what’s the exposure of a company to AI?’, is the answer to this question similarly ‘auditable’? In today’s world, it isn’t. Taiwan Semiconductor Manufacturing Co. (TSMC) is the world’s most advanced fabricator of AI accelerating semiconductors, and there’s no Nvidia H100 without it. However, TSMC also disclosed that it only makes about 6% of its total revenue from AI accelerating chips. Is the 6% more important, or is the overall understanding of the semiconductor ecosystem globally, more important?

WisdomTree’s answer has been to utilise expert partners within its thematic strategies. In the case of AI, we’ve been working with CTA for five years. There are many cases where one has to weigh quantitative metrics, like the percentage of revenues (if disclosed) coming from certain AI activities, and qualitative metrics, like the importance of a company to a given functional ecosystem.

In short, we view purity through the eyes of a topical expert.

WisdomTree Artificial Intelligence UCITS ETF

If we think about the WisdomTree Artificial Intelligence UCITS ETF (ticker WTAI), as the strategy marks five years, it makes sense to look at the performance picture. It’s our view that the overall AI megatrend will be playing out for far longer than five years, but we’re now starting to have enough of a track record to at least think about some analysis.

We can think along two dimensions.

- Performance relative to the MSCI ACWI Index: Many investors are building equity exposures benchmarked back to the MSCI ACWI Index. Making specific choices, such as AI or another thematic equity strategy, is aimed at generating better performance than this overall benchmark.

- Performance relative to other AI strategies: WisdomTree has developed a ‘Thematic Universe’ where any thematic topic can be grouped with other similarly focused strategies. We don’t see much value in comparing a fund focused on AI to a fund focused on sustainable energy—these are completely different topics. However, if there is a range of different AI funds, which one is the best (or worst) over different periods?

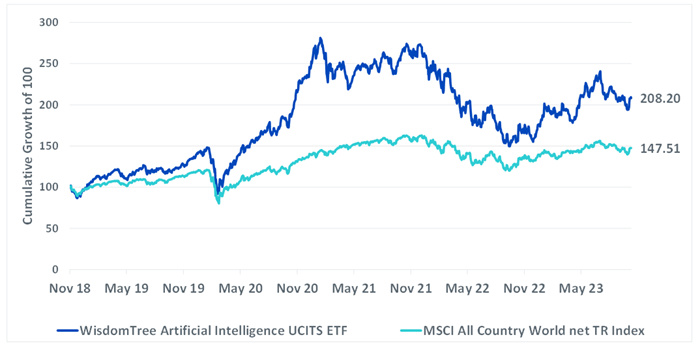

Figure 1 indicates the cumulative performance of WTAI relative to the MSCI ACWI Index. We do see a higher volatility which is to be expected as WTAI had a much bigger run up in value over 2020 and early 2021, and then a much bigger drawdown during late 2021 and early 2022. Similarly, in early 2023, it did indicate a bigger upward market response as AI was a very hot topic. For the overall period, it was able to outperform.

Figure 1: WTAI vs. MSCI ACWI Index, Since Fund Inception

Sources: WisdomTree, Bloomberg. Fund data is shown in NAV total return terms. Historical performance is not an indication of future performance and any investments may go down in value.

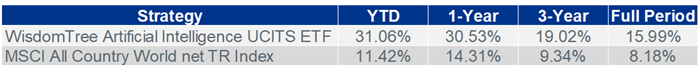

If we shift our focus to WisdomTree’s Thematic Universe, WTAI would fit within WisdomTree’s ‘Artificial Intelligence & Big Data’ category. The way to evaluate the data would be to take a given period, see the number of strategies with live history over that full period, and then note WTAI’s overall ranking. We see the following as of 7 November 2023:

- Year-to-date 2023 saw 17 different funds in this category, with WTAI ranked 4th.

- Over the 1-year period, there were 17 different funds in this category, with WTAI ranked 4th.

- Over the 3-year period, there were 13 different funds in this category, with WTAI ranked 5th.

- Over the full period, there were 7 different funds in this category, with WTAI ranked 2nd.

This is an exercise we can do for any of our different thematic funds—WTAI is just the first to reach a five-year track record of live performance.

Sources

1 WisdomTree, Censuswide. Pan-Europe Professional Investor Survey Research, Survey of 803 professional investors across Europe, conducted during August 2023.